USD Fundamentals: Fed Meeting, Nonfarm Payrolls, ISM PMIs; A Packed Calendar to Kick Off the New Month

This week’s pivotal events include the Fed meeting and the release of the Nonfarm Payrolls data on Friday. In April, the US dollar depreciated against its major Fx peer currencies, like EUR, GBP, and CHF. Aside from the baked-in 25bp rate hike, the markets are eagerly awaiting any indication of a potential pause from the Fed on Wednesday. This means that the bar is high for the USD to experience a significant decline even if the Fed announced a pause (most of this scenario is already priced in).

Skepticism remains that the US dollar’s current resurgence will endure. If the FOMC meeting unfolds as described above, the NFP report on Friday may serve as the catalyst for market movement this week. As the labor market shows signs of weakening, a deceleration in nonfarm payrolls and wage growth could be observed. Consequently, growth is poised to deteriorate further, indicating that the dollar’s upward trajectory may lose momentum in the near future.

The other calendar events worth watching are the ISM manufacturing and services PMI reports. The markets will react to those, particularly if there are large deviations from the “low” consensus expectations. But upside surprises in this week’s economic reports could as well prove bullish USD stimulants.

EUR Fundamentals: ECB Meeting; 25bp or 50bp Hike?

The primary risk event on the EUR calendar this week will be the ECB’s monetary policy meeting. Most traders don’t anticipate that the outcome of this ECB meeting will prompt a reversal of the EUR’s current upward trend. The EUR has benefited from the upward adjustment in Eurozone yields since the summer of last year. For this meeting on Thursday, investors (as priced in by futures markets) predict a 25bp rate hike from the ECB. The markets then expect the ECB to deliver two more 25bp rate hikes throughout the year, to a peak of 3.75% by September.

Thus, a 50bp rate hike this Thursday would be a hawkish surprise. It’s unlikely but not impossible. Fx traders should take note of the risks of such an outcome. The ECB’s aggressive rate hiking cycle since last summer has led to a significant narrowing of yield spreads between the Eurozone and the rest of the world, especially the US. This is one of the main reasons why EURUSD has rebounded significantly.

Today’s Eurozone CPI inflation data for April printed somewhat lower numbers than the forecasts. This supports the case for a smaller 25bp rate hike on Thursday, and we see the euro falling today as a result. Still, the ECB may deliver a neutral message, which could cause a range-bound, sideways reaction in EUR pairs.

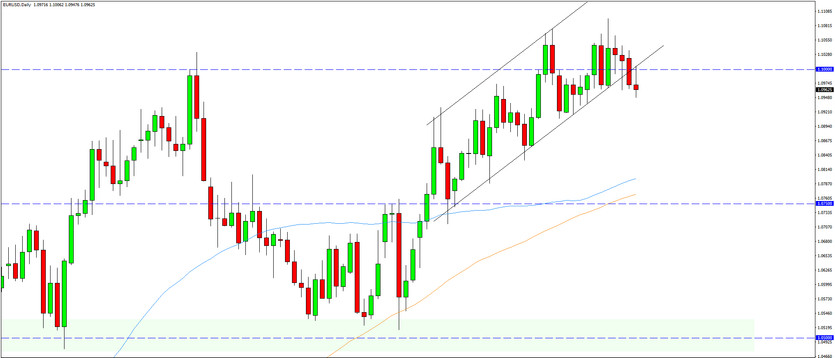

EURUSD Technical Analysis:

The EUR/USD currency pair exhibited a pattern resembling a bearish shooting star (inverted hammer), concluding the week slightly in the green.

The technical outlook presents a somewhat mixed picture. The main bullish factors continue to be based on the valid long-term bullish trend and the weekly closing price reaching a 10-month high, which is also above the significant round number at $1.1000.

Nonetheless, the bullish case is somewhat weakened by the formidable resistance around 1.1050, which appears to be holding firm. Those with a bearish perspective can also argue that the previous three weekly candlesticks are nearly exhibiting a bearish pin bar/inside bar combination.

It’s also worth a reminder that a lot of the EURUSD action will depend on the Fed and ECB meetings (more about those in the previous sections on USD and EUR fundamentals).

GBP Fundamentals: Very Quiet UK Calendar This Week

GBP trading is likely to be overshadowed by the highly impactful events in the US and Eurozone this week. The market consensus expects a 25bp (basis point) Bank of England rate hike to 4.50% on May 11th.

The nearly empty UK economic calendar this week suggests there is little that can alter that market pricing for BOE rate hikes this week. Thus, the pound sterling will probably be influenced more by global events and risk sentiment than domestic factors during this week’s trading.

For specific GBP pairs, this also means the other currencies will be the bigger drivers. E.g., the Fed and NFP will likely dominate in the case of GBPUSD, and the ECB could be the main driver in the case of EURGBP.

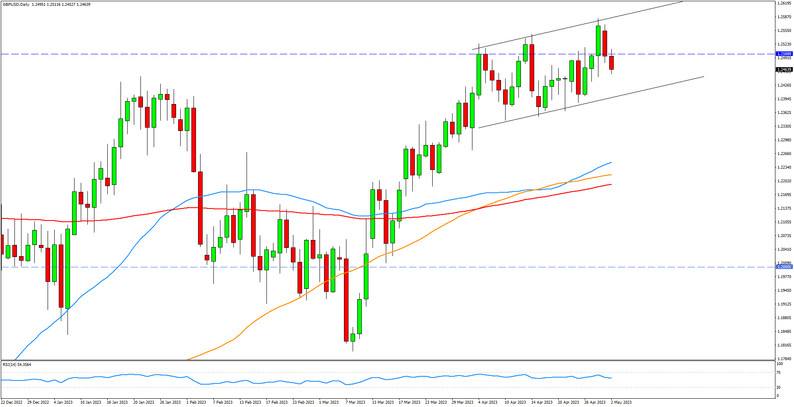

GBPUSD Technical Analysis:

The GBP/USD currency pair climbed to achieve an eighth consecutive higher weekly close and rose to a 10-month peak. However, it is difficult to envision GBP/USD deviating significantly from 1.2500 in the short term.

Indeed, 1.25 is proving a tough resistance area. GBPUSD is now back below it and has entered a short-term sideways trading range on the daily timeframe (see chart below).

To the downside, the first support is located at 1.24. It is a moderate technical zone, but nonetheless, important in the current context. A downside breakout could open the way for a steeper decline lower.

JPY Fundamentals: BOJ Surprises Dovish, Triggers Steep Yen Sell-Off

The yen has consistently weakened at the beginning of this week following the Bank of Japan’s dovish meeting last Friday. The yen has significantly weakened across the board after the BOJ disappointed expectations of an imminent shift away from the dovish YCC and QE policies. The yen has dropped to its lowest level against all the other major Fx currencies, with the weakness most pronounced against the euro and pound (EUR/JPY is now at levels last seen in 2008, and GBP/JPY is highest since 2016)

The biggest dovish surprise in the BOJ’s decision was the lengthy planned policy review, expected to take 12-18 months to complete. This has got markets to reprice the expectations that Abenomics’ loose YCC and QE policies will persist this year. This clearly implies a weaker yen as much of the strength since January was driven by the expectations for a further hawkish adjustment,

The BOJ’s dovish surprise clearly presents risks for a further extension of the yen weakness (bullish JPY pairs). This would especially be the case given the rebound in bond yields in other countries, like the US last week and the re-strengthening of the dollar last week and in this first week of May.

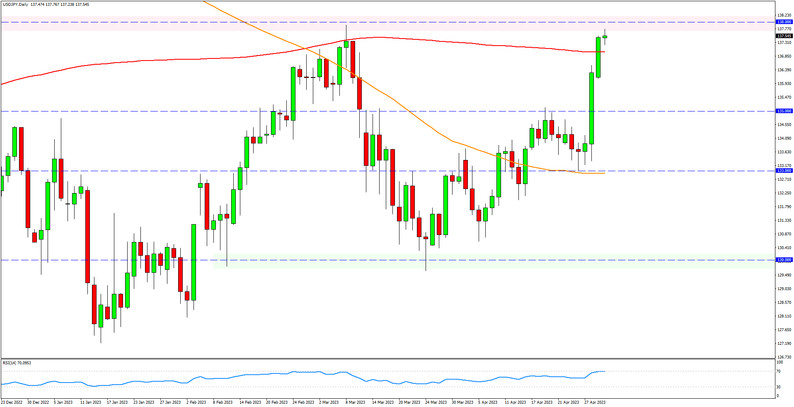

USDJPY Technical Analysis:

The big surge in USD/JPY above 135.00 last week triggered some stops, especially with the reduced holiday market activity. This has pushed USD/JPY back above resistance from the 200-day moving average, which is around the 137.00 level.

The pair is now testing the March high around 138.00, and a further move higher toward 140.00 this week is possible (especially if the calendar events yield more bullish outcomes). Above 130.00, traders will look at the 145.00 zone as the next resistance.

To the downside, 135.00 is now a solidified suppo