USD Fundamentals: Friday PCE Inflation the Only Report Ahead of May 3 Fed Meeting

The Fx market remains quiet and range-bound during the second half of April amid a light calendar schedule and in anticipation of the eventful calendar in early May. The dollar pairs and the broader Fx market traded in a narrow range last week, and the same mood is likely to extend into this week, given there are very few events that could move the market.

The key events are lined up for the following week, starting on May 1. The Fed meeting on May 3 and the Nonfarm Payrolls report on May 5 will obviously be the key focus again. But ISM services and manufacturing PMIs, as well as PCE inflation this Friday (April 28), will also gain a lot of attention. The near-term direction of the US dollar will be determined by those events. The broader Fx market will trade accordingly as well, either in line with a stronger USD trend or a weaker USD trend.

In the meantime, price action is likely to remain contained in the current week. The volatile events that lie ahead will discourage traders from taking any large positions. Be careful trading breakouts, as many of those may prove fake in a low volatility and low volume environment this week.

EUR Fundamentals: PMI Reports Show the Eurozone Economy Remains Weak

EUR pairs were also largely contained last week, reflecting the broader environment of range-bound markets. And while the euro currency continues to trade resiliently, especially with EURUSD staying around 1.10, the case for further appreciation has weakened.

Namely, last week’s PMI sentiment reports showed the contraction in the manufacturing sector is deepening to the lowest levels since May 2020, which was during the initial stages of the Covid pandemic shock. And while the services sector has been more resilient in recent months, the fact that the recession in the European manufacturing sector is worsening again does not bode well for the economy. The ECB may soon be forced to turn dovish and stop its hiking cycle.

Positioning is another factor that is likely to limit further EUR appreciation from here if not even contribute to a sharp reversal. Commitments of traders (COT) data shows that EUR longs remain at elevated levels, around 150K contracts net long. The market was long euros to this extent in 2018 and 2021, just before EURUSD reversed and embarked on sustained downtrends both times.

Preliminary (flash) CPI inflation figures from Germany, France, and Spain will be watched on the Eurozone calendar this week. Those are expected to decelerate further, and a bigger than forecasted fall is likely to result in a bearish EUR reaction. Conversely, if the CPI reports surprise higher, then a bullish EUR reaction could take EUR pairs to new cycle highs.

EURUSD Technical Analysis:

EURUSD traded narrowly last week in what was almost entirely sideways market action between 1.10 and 1.09. Nonetheless, the pair has traced out an ascending channel formation on the daily timeframe (chart shown below).

Thus, the first support zone to the downside is 1.0950 – 1.0970, where the support line of this channel is located. A break below this zone will open the way for a deeper move down toward the support at 1.0750. The 1.05 zone is the next support zone lower and the key one at the current juncture.

To the upside, resistance is at the highs around 1.1050. But if that doesn’t hold, then the next resistance higher is at the 1.12 zone.

GBP Fundamentals: UK Inflation Surprises Higher Again, but Damage from BOE Rate Hikes Also Showing Up

The pound traded relatively higher in the broader Fx market over the past week, except for against its younger cousin, the euro, which remains an outperformer. Last week’s busy GBP calendar provided a mixed message about the UK economy. Inflation was again higher than the forecasts, while the employment data and retail sales report showed the UK economy has weakened.

It seems the bad cocktail of high inflation and low growth has not gone away in the UK, even after a dozen of rate hikes from the Bank of England. The high CPI inflation figures last week pushed expectations for additional two BOE rate hikes, up from the one 0.25% priced before the CPI report.

The Bank of England meets on May 11, and no big UK events are scheduled on the calendar until then. This means risk sentiment and the global market environment are more likely to be the dominant driver of GBP action than domestic factors. Of course, speeches from BOE officials will be closely watched, and any dovish comments from BOE committee members will likely take GBP sharply lower.

GBPUSD Technical Analysis:

Like most European currencies, GBPUSD remains near the highs. So far, the trading range in April is around 200 pips, between 1.2350 and 1.2550. This is clearly a development to keep an eye on, as either upside or downside breakout can lead to continuation.

To the downside, notable potential exists if the support line at 1.2350 - 1.23 is broken. The next support zone would be 1.22, where the 55-day and 100-day moving averages meet. The next support down would then be 1.20.

To the upside, a breakout above 1.2550 would have traders look at the 1.27 and 1.28 zones as the next resistance zones higher.

JPY Fundamentals: BOJ Meeting in Focus, Will They Tweak YCC Again?

The yen continues with lackluster (under)performance despite the bullish market positioning and expectations by most Fx analysts that it will continue to strengthen. The reason is that the new Governor Ueda struck a rather dovish tone when he took office in early April and said no policy changes are needed for now. This disappointed many JPY bulls who had hoped for a further widening of the YYC band or a complete removal of the YCC policy.

Nonetheless, the markets remain on edge and will closely watch the BOJ communication. Should the BOJ surprises with a hawkish decision on the YCC policy, the yen will likely surge. USDJPY could quickly plunge below 130.00 in this scenario.

In the other scenario, the BOJ will make no decision and could provide either hawkish or dovish guidance. In this case, the JPY reaction will depend on the forward guidance. Hawkish guidance would be if the BOJ announce a further hawkish adjustment of the YCC policy (for example, at the next meeting in June). In contrast, if the forward guidance is “we don’t plan to adjust YCC anymore”, that would be very dovish. Although this is a rather unlikely scenario, expect the yen to sell off hard in this case, with USDJPY probably quickly rising above 138.00.

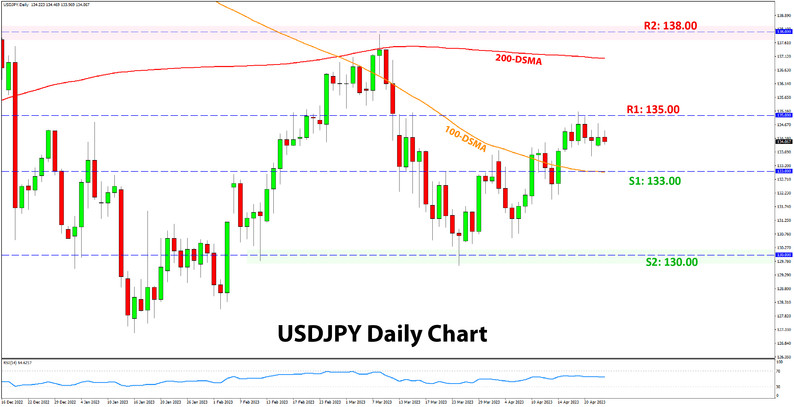

USDJPY Technical Analysis:

Not much is going on for USDJPY ahead of that pivotal BOJ meeting later this week (more about that in the above section). The charts indicate the 130.00 zone as support, and the 138.00 zone as resistance are the key ones to watch.

In between those, the 133.00 support and the 135.00 resistance are also worth paying attention to. Potentially, if the BOJ moves the market by a surprise decision, USDJPY will likely reach 130.00 or 138.00, depending on the outcome (whether bullish or bearish).

If, however, the BOJ meeting passes without much fuss, then USDJPY will likely stay inside the current ranges.