USD Fundamentals: Data Disappoints but Fed Still Expected to Hike 25bp on May 3

The dollar recorded another “red” weekly candle, reaching a new cycle low last Thursday before unexpectedly rebounding late on Friday. The extension of the USD fall came after a set of weaker economic data, primarily the CPI report, which showed US y/y inflation has already slowed to 5.0%.

The FOMC minutes released on the same day revealed Fed officials were worried about the negative impact the banking crisis stemming from SVB’s collapse could have on economic growth. This further intensified speculation that the Fed is ready to pause the hiking cycle at their next meeting on May 3. The dollar extended the fall as a result.

Given this environment, it’s hard to fight the trend of USD weakness at the moment. However, it’s also worth remembering that much of the USD weakness is also driven by investors’ optimism about other regions and currencies. At this stage, the USD direction will be determined just as much by what other central banks do as much as what the Fed does.

The US calendar is very light this week, featuring only 2nd tier data. But much attention will be on the scheduled Fed speakers, especially as we are just two weeks away from the May 3 meeting. The markets are positioned for a Fed pause and dovish guidance from here onward. Although not very likely, more hawkish comments from Fed speakers could lead to a USD rebound.

EUR Fundamentals: Some Dovish Voices Emerging Within the ECB Ahead of May 4 Meeting

The euro currency remains resilient, especially versus the dollar, with EURUSD last week hitting levels above 1.10 again. Much optimism is already embedded in this EUR rally, and perhaps this story is already reaching its limits.

Indeed, there are signs traders should be careful about when chasing EUR rallies from here. For instance, COT Fx positioning shows EUR longs are entering extended territory, with the net position the highest in two years at 163K contracts. This is close to both peaks from 2021 and 2018, which is also when EURUSD peaked in those cycles.

The EUR calendar was quiet last week, but there were ECB speakers. While the overall tone is still hawkish for more rate hikes (especially from the most hawkish members), there are now some clear dovish voices emerging within the ECB. The banking crisis has caused ECB hike expectations to fall in tandem with the Fed, and chances are it won’t take much more turmoil to convince the doves on the ECB board to favor a pause in the hiking cycle.

More ECB speakers are scheduled on this week’s EUR calendar, including President Lagarde. Much focus will also be on the business sentiment surveys, the German ZEW (Tue) and the set of manufacturing and services PMI reports (Friday).

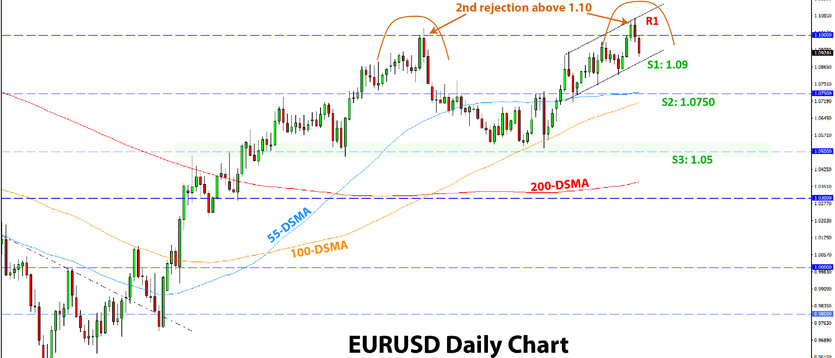

EURUSD Technical Analysis:

EURUSD is falling toward 1.09 after making a brief break above 1.10 last week. The rejection of levels above 1.10 has the potential to form a double top pattern with the previous peak here from early February (see daily chart below).

Similarly like in February, EURUSD could not hold onto gains above 1.10 for more than 1.10. This is a slight bearish sign by itself but is not enough to signal a full reversal. For that, EURUSD will need to break some support levels on the daily chart.

The first support zone on the daily chart is 1.09. A break below here should clear the road for the next support to be reached at 1.0750. The most important support in the longer-term context remains at 1.05.

GBP Fundamentals: Packed Calendar Promises a Volatile Trading Week

Sterling was generally a mild underperformer last week, while cable (GBPUSD) reversed late on Friday in tandem with all USD pairs. There was not much going on domestically in the UK last week, nor big data releases. GBP’s main drivers remain risk sentiment and BOE rate hike expectations.

With the former having hit at least a temporary ceiling, the BOE hiking trajectory could be the big factor that determines where GBP will trade. The markets continue to price one more BOE rate hike, but the dovish voices are getting louder within the UK central bank. The busy UK data calendar this week will certainly play a role in whether the Bank of England decides to hike or pause at the meeting on May 11.

The employment reports will be released tomorrow (Tue), followed by CPI inflation on Wednesday and retail sales on Friday. As in other countries, inflation will, of course, be in central focus for traders. 9.8% is expected for the headline y/y and 6.0% for the core CPI. Actual numbers lower or higher than this will likely result in a proportional GBP reaction (hotter CPI bullish and cooler CPI bearish GBP reaction).

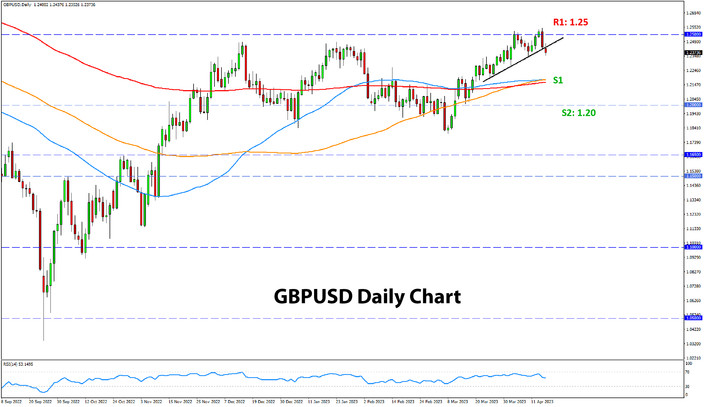

GBPUSD Technical Analysis:

Cable made it above 1.25 for the first time since June last year, only to reverse back below this key psychological level the next day. The pair is now already trading some 150 pips below 1.25, and the daily technical picture here is quickly turning increasingly bearish.

There is not much support until the 1.2150 - 1.22 zone on the daily chart. The more important and key support in this context, though, remains at the long-term 1.20 area.

Still, it doesn’t mean that we can expect a clear bounce or reaction even if GBPUSD reaches 1.20. At least, that was the case in the recent instances when GBPUSD was trading around 1.20, the reactions at this level on the daily chart were not particularly clear.

JPY Fundamentals: No Imminent Shift from the BOJ to Exert a Slight Bearish Bias

The yen has continued to underperform since the new Governor Ueda took office two weeks ago. The reason is that, unlike many had expected, Ueda said the current YCC policy is appropriate for Japan, and there is no need for changes at the BOJ for now. This stance from the new BOJ Governor should keep a slight bearish bias on the JPY in the very near term.

Longer-term, however, there is still potential for the JPY to strengthen. If the BOJ goes ahead with abandoning the YCC policy, even if it comes much later than most expected, will result in a new big wave of JPY strength.

In the meantime, JPY pairs will continue to be driven by US Treasury and other Government bond yields. The combination of the recent renewed upward moves in bond yields and the dovish surprise by BOJ Ueda can lead JPY pairs a tad higher still.

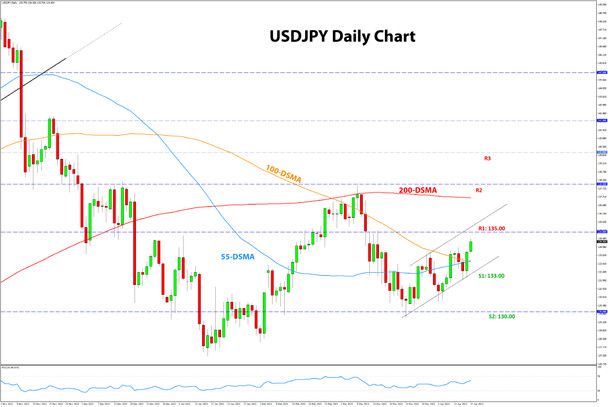

USDJPY Technical Analysis:

USDJPY touched 130.00 in late March and reversed higher from here. It has been gradually climbing since then and is now moving toward the 130.00 level. Resistance is likely to be found here both from the previous highs and lows here, and the gap down that occurred in March on the SVB banking turmoils.

Further higher, resistance remains located at 138.00, where the 200-day moving average (red) concurs with the previous cycle top here. Above 138.00, the next resistance zones are 140.00 and 142.00.

To the downside, support is at 133.00 and then at 130.00.