USD Fundamentals: Blowout NFP and ISM Services PMI Boost Dollar

The busy past week injected some new dynamics in the Fx market, which saw the US dollar staging a much-needed rebound in the end. The volatility was expected, but the big surprise was the direction, as most did not foresee the USD could rebound so sharply.

The 1st big event - the Fed meeting - was largely dovish and as expected. The dollar indeed fell on the Fed meeting and during Powell’s speech. The massive surprises were the Nonfarm Payrolls and the ISM services PMI reports which boosted the dollar late Friday.

Namely, the NFP printed a giant 517K jobs figure vs forecasts of only 193K. The unemployment rate fell to the lowest in 54 years at 3.4%, while wage growth also surprised higher. The ISM Services PMI also delivered a massive surprise late on Friday, coming in at 55.2 compared to forecasts of 50.5.

Obviously, the US economy is still far from encountering any big setbacks or slowdown in activity. All of this was a massive surprise for the Fx market, which has been lately positioning for a weakening dollar. It looks like a squeeze on those short USD positions has now been triggered, which means the dollar can rebound further in the near term.

EUR Fundamentals: Dovish ECB Surprise Knocks Euro Lower

The surprises in the Fx market last week started with the ECB. They delivered the expected 50bp rate hike they had long ago signalled, but then the overall communication during the meeting indicated that the next rate hike in March could be their last one in this cycle. This was the big dovish surprise that knocked the euro lower since, as soon as December, the ECB had communicated something very different - that they would keep delivering at least several more rate hikes this year.

The market was not prepared for such a dovish tilt by the ECB so soon after they committed to “many rate hikes” in December. It seems our analysis was correct throughout the autumn as EURUSD and other EUR pairs were rising. Even if the ECB was turning hawkish, it wasn’t going to last since the Eurozone economy remains much weaker than the US and other peers.

The Russia-Ukraine war and the subsequent energy crisis in Europe will remain a long-term issue that delivers a sustained hit to the economy. The ECB is in no position to out-hawk the Fed, and the market is likely to soon realize this. When that happens, the path of least resistance for EURUSD should again be lower. Levels below 1.05 suddenly look realistic again.

EURUSD Technical Analysis:

EURUSD reached the 1.10 level last week and was soon rejected and pushed down sharply. A bearish shooting star candlestick pattern (or bearish hammer) has formed on the weekly chart. In technical analysis, this is a clear bearish sign appearing at a key resistance zone. The control has changed hands from the bulls to the bears here, and further downside action should be likely.

EURUSD has already reached the first support at the 1.07 zone. The next one is at 1.05, but the more important one is 1.03. It will be no surprise if EURUSD soon trades toward the 1.03 area.

To the upside, 1.10 is now hard resistance that stopped the bull trend. It’s unlikely it will be tested again soon, but even if it is, we can expect strong bearish pressures to emerge.

GBP Fundamentals: BOE Joins the Dovish Pivot Camp of Central Banks

In a busy central bank schedule over the past week, it feels like the same message was communicated from all three major central banks. The Bank of England, like the Fed and the ECB, hiked interest rates but used the opportunity in the forward guidance communication to express their delight with the improved inflation outlook and that they are thinking about pausing the rate hikes soon.

Essentially all three currencies (USD, EUR, GBP) fell on their central bank announcements last week as all were read as dovish. For the pound individually, there are no major implications as it remains in its ranges on most crosses, with the exception of GBPUSD, which fell due to USD strength.

The GBP economic calendar this week sees the release of the q/q GDP report and some 2nd tier data like industrial production and goods trade balance. Several BOE speakers are on the agenda this week, but given it’s only one week after the bank’s meeting, any comments will likely have a much smaller impact on GBP than usual.

GBPUSD Technical Analysis:

In what was a mirror image of the action on EURUSD, GBPUSD also fell sharply and is now already trading near the major 1.2000 level. The near 350 pips drop on Thursday, and Friday created a tall bearish engulfing candle on the weekly GBPUSD chart.

As noted in the previous weekly Fx last Monday, the pair was approaching the monthly resistance trendline at the 1.25 zone. GBPUSD didn’t actually reach 1.25, but the sharp rejection of these levels is now a strong bearish signal on the weekly chart. Cable falling below 1.20 next is the likely scenario here.

Further support zones to the downside are 1.18 and the more important one at 1.15.

JPY Fundamentals: Big Jump in US Yields Lifts USDJPY; Fx Traders Also Watching BOJ Governor Announcement

The strong economic data from the US late last week, such as the blowout NFP and strong ISM service PMIs, lifted US Treasury yields across all durations (2-year to 30-year bonds). USDJPY immediately jumped higher in synchrony with the moves in the bond market, which is a sign that this historical correlation is still working.

The broad rebound in the US dollar also helps as a bullish factor for all USD pairs, including USDJPY. Interestingly the yen also weakened on other crosses last week (for example, EURJPY, CADJPY), which shows the big jump in yields also has a broad impact on the Japanese currency.

Given the ongoing rebound in the dollar and correction to its bear move of the past 3-4 months, some correction in the JPY looks likely too. While the outlook for other JPY crosses is likely to remain mixed, USDJPY now looks poised to test the 135.00 area again.

On the domestic front, Fx traders will watch the news about the candidates for the new BOJ Governor. The current Governor, Kuroda, will leave office in April, and who succeeds him is an important question for the Fx market. Rumours are that the name could be announced as soon as this week, although there is no set date by Japanese law when this should be done at the latest.

For where the yen will move, the key will be whether the new BOJ Governor will be a hawk or a dove. That could trigger the next major move in JPY exchange rates later this year.

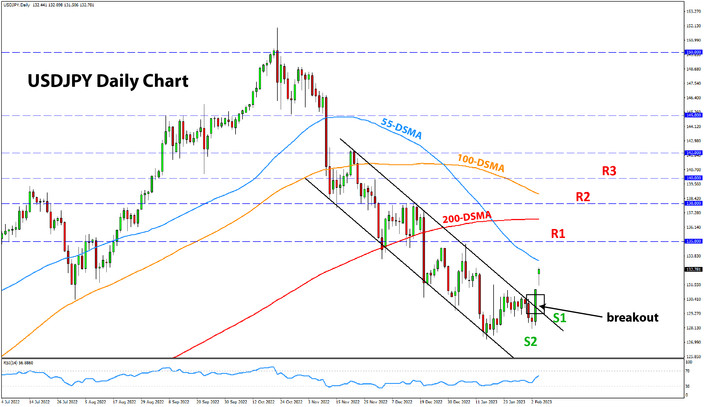

USDJPY Technical Analysis:

We showed the weekly charts for EURUSD and GBPUSD, but for USDJPY, the more interesting action is on the daily timeframe. Namely, USDJPY broke the 3-month descending channel last week. The breakout marks an important inflexion point for the pair as the technicals now shift clearly bullish here.

To the upside, the first resistance is at the 135.00 zone and looks likely to be reached as there are no big hurdles between it and the current levels near 133.00. Further higher, 138.00 and 140.00 are the next resistance zones.

To the downside, the first support is at 130.00, and the next one lower is at the lows around 128.00.