USD Fundamentals: Pressing the Lows a Week Ahead of Fed Meeting

The dollar is stabilizing this week near the lows, a week ahead of the next Fed meeting on February 1 and the Nonfarm payrolls release two days after (Feb 3). In addition, several other central banks meet next week (including the ECB and BOE), which could add to the overall mood of sideways action as traders cut back positions ahead of a volatile trading week.

With that in mind, the dollar is continuing to trade near the cycle lows, and further losses remain a real possibility. However, the scale of the decline is already quite sharp, and the major bull trend of 2022 has now retraced substantially. These USD losses were and continue to be mainly driven by the markets’ speculation that inflation will fall rapidly and the Fed will soon need to turn dovish.

However, the high speculations for a dovish Fed are already well into the price of USD at these levels (EURUSD touched 1.09 this week). While in the near term, the USD trend is certainly down, It’s questionable if further large USD losses can happen from here.

On this week’s calendar, the focus is on advanced GDP and the PCE index. Lower figures than the forecasts could make a further push lower to the beaten-down USD.

EUR Fundamentals: EUR-Optimism Not Fading, ECB Hawks Remain Stubborn

Like the Fed, the ECB meets next week, which means the overall Fx market has likely entered a quiet period of “lull” ahead of the big events. The euro is pressing on its highs across several Fx pairs as it continues to benefit from the hawkish ECB pivot (for now) and the less severe economic damage to Europe from the energy and electricity crisis.

The markets’ EUR-Optimism narrative now goes so far that it indicates the Eurozone will completely avoid a recession this year (most economists expected a recession till recently). For now, this is the trend, and it’s usually not wise to fight a trend until it has been proven to be over. Nonetheless, the euro gains are already substantial. EURCHF is back above 1.00, and EURUSD has erased all the losses since Russia attacked Ukraine in February last year.

The Eurozone calendar saw the release of the manufacturing and the services PMI reports, which printed largely mixed. There is nothing in them to change the market’s overall bias toward the euro, and range trading seems like a plausible scenario for the remainder of this week.

EURUSD Technical Analysis:

EURUSD continues to march higher, with the trend on the daily timeframe firmly bullish, as indicated by momentum indicators and the upward channel formation. EURUSD is now trading in the upper end of this channel while the RSI is close to overbought levels. This is often a warning sign that the bullish trend is getting tired. However, it is not a signal for a reversal by itself.

The nearest firmer resistance now stands at the 1.10 zone (see chart). There are now decent probabilities that this zone will be reached. However, some reaction seems very likely at that point, considering the overall picture and higher timeframes. Potentially attractive opportunities to go short could exist around 1.10.

To the downside, the nearest resistance is located at 1.06, ahead of the stronger one at 1.05.

GBP Fundamentals: Quiet Week for Sterling traders

The pound continues to mainly track the movements of its bigger cousin - the euro - and is benefiting from the recent switch to optimism about the global economy. Risky assets like stocks have also been climbing gradually higher recently, as an indication that risk sentiment remains positive.

As long as this positive global environment lasts, GBP will be supported too. These global factors remain the dominant driver of GBP moves, with the UK economic calendar remaining in the back seat as a driver.

In the wider spectrum, some UK-specific developments have also moved in a positive direction, especially since the election of Rishi Sunak, which has provided an additional boost for the pound.

The GBP calendar is rather light this week, so traders may already start to focus on the Bank of England meeting next Thursday.

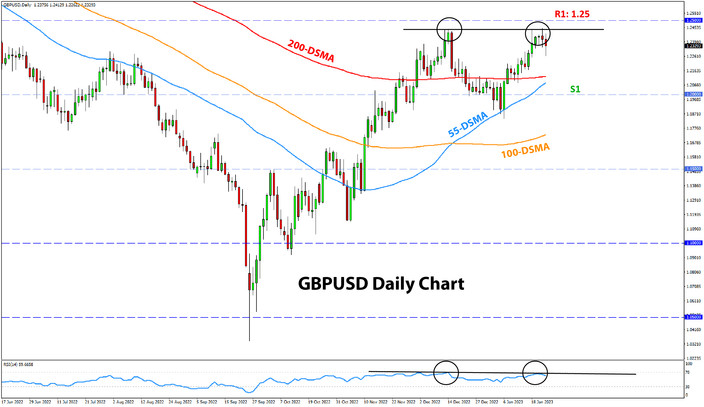

GBPUSD Technical Analysis:

GBPUSD is pushing on the highs this week, reaching the previous peak from December near 1.2430. This could be viewed as part of the wider 1.25 zone, which is an important resistance area for the pair. Some reaction here seems likely.

The RSI indicator is showing bearish divergence already exists when we compare the peak from December to the current one (see chart). While there is no reversal signal yet, further bullish action is likely to come much harder from here.

To the downside, there is moderate support at 1.22. But the more important support is at the 1.20 area.

JPY Fundamentals: BOJ Makes a Dovish Surprise This Time

Last week’s BOJ meeting was interesting as it provided a dovish decision following the hawkish surprise a month earlier. Most economists forecasted that the BOJ would make a further hawkish adjustment to their YCC policy (from 0.5% to 1.00%. Instead, they held the limit to a lower 0.50%, which effectively keeps Japanese yields capped at 0.5%.

The market reaction was even more interesting. The yen plunged weaker initially (JPY pairs higher) but then retraced almost all the losses by the close of the trading day. This is a clear indication that the markets aren’t believing the BOJ’s dovish decision.

Instead, the sentiment remains bullish JPY as investors believe the BOJ will still have to make the hawkish adjustment at some of the future meetings. This narrative can certainly continue to drive the JPY stronger (meaning lower JPY pairs). USDJPY moving toward 125.00 now looks like the probable scenario.

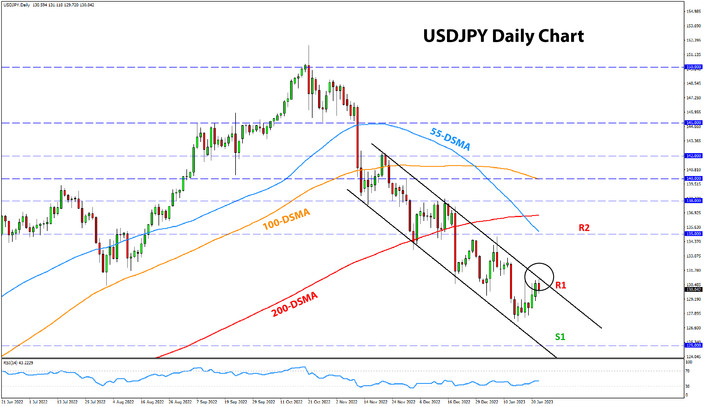

USDJPY Technical Analysis:

A clear downward channel is in force on USDJPY, pointing to the 125.00 area as the next destination for the pair. The price is currently testing the upper line of the channel, which means the start of a new bearish leg could be close.

However, equally – an upside breakout above the trendline (130.00 zone) would constitute a bullish breakout. In this case, the charts will turn bullish and a move toward 135.00 will become the likely scenario.