USD Fundamentals: Hawkish Fed Ignored By Markets Amid Another CPI Miss

These are interesting times in the Fx market. Last week we saw a fascinating theme, where we could say markets simply have stopped believing central banks. For instance, both the Fed and the ECB were hawkish, yet neither resulted in a stronger domestic currency.

The reason for the tepid USD reaction to the Fed was the CPI inflation report the day before. Inflation in the US again surprised lower, and the markets took this to mean that the battle against high inflation is already being won. Hence, risky assets (stocks) rallied, and the dollar was sold. Essentially, the market here is saying the Fed won’t deliver on their own forecasts for rate hikes because inflation will fall faster than the Fed is expecting.

So, who is right? The market or the Fed? This will be the key question that traders will be looking to answer over the following weeks and months, and that will also impact the Fx market to a great extent.

For the dollar, in the near term, the latest developments could mean more range trading. The USD has already corrected down a lot (to the point that markets are priced for no more Fed rate hikes), which means there is scope for some correction in the other direction (USD higher). Still, a resumption of the USD bull trend from earlier this year now seems less likely in the near future.

That being said, another key factor for the Fx market in the period ahead will undoubtedly remain risk sentiment. The Fed and most other central banks are continuing with rate hikes and more monetary tightening, which is usually not a positive environment for risk sentiment. By the same token, when all central banks are hiking together, the USD usually goes up as risk sentiment suffers. This is an important detail to keep in mind as we enter the new 2023 year, as it means that risk sentiment is still likely to be predominantly negative as long as central banks remain hawkish.

The US economic calendar is much lighter this week, with mostly 2nd tier reports like housing data and durable goods orders, though with a strong focus on PCE inflation on Friday. Remember, this is the inflation report the Fed uses to set policy, not the CPI, though both generally move in the same direction. So, lower PCE figures are expected on Friday, but potential surprises (either up or down) could still move the markets.

EUR Fundamentals: Massive Hawkish Surprise from the ECB; Yet EUR Is Not Much Stronger

The ECB delivered a big hawkish surprise last Thursday, stating, “significant further rate hikes are needed” in the months ahead. The surprise was not in the 50bp rate hike (that was fully expected), but in their economic forecasts and expectations for further monetary tightening.

This degree of ECB hawkishness surprised the markets, as everyone expected them to announce a slower pace of rate hikes (like the Fed). Instead, President Lagarde said they expect inflation to remain high throughout the next year (forecast core inflation of 4.2% end 2023), for which more 50bp hikes will be needed. The euro jumped on the announcement as this basically meant the ECB is preparing to raise rates to an unprecedented 4% in order to combat inflation.

Still, despite the very hawkish ECB meeting, the euro ended the week lower versus most other currencies than where it was before the ECB. And like in the case of the Fed, this is a gain a function of the markets not believing the ECB. The bond and Fx markets are simply not believing the ECB will raise rates above 4%, as the ECB has indicated. Hence, the euro jump was swiftly rejected by the end of the day.

This past Wednesday, we released a new short EURUSD trade idea based on the long-term factors and “newly created” EUR fundamentals amid the war in Ukraine. Thursday’s rejection of the hawkish ECB by the market is an indication that investors are shifting focus from the short term (ECB turning hawkish and lower gas prices due to warm weather) to the long term fundamentals (such as the big and long-lasting impact that the energy crisis will have on the Eurozone economies).

While the surprising hawkish shift at the ECB could keep the euro and the EURUSD pair elevated for a while longer, eventually, a resumption of the move lower still seems probable.

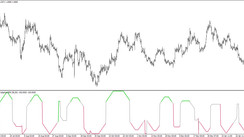

EURUSD Technical Analysis:

Last week, EURUSD tested well into the 0620 - 1.0750 Fibonacci confluence area, which we described as the key resistance in the long-term context. As would be expected with such important technical zones, the rally was stopped, and EURUSD backed off the highs only a few pips under 1.0750.

However, the bears are not out of the woods yet here. There is still some risk for further tests higher as EURUSD is yet to make a bearish break of some key support zones. The first such support in line is the 1.0580 – 1.0600 zone, which represents the most recent previous highs. It is a support of short-term importance, which if broken, should clear the road for a further move lower.

The next support would be the 1.0450 zone, ahead of the 1.03 area. Below it, there is no big support until the parity zone (1.00).

To the upside, a break above 1.0750 would threaten a major bullish breakout on the weekly chart. While it appears an unlikely scenario, in such a case, EURUSD could quickly run above 1.10.

Also, be sure to check out our latest short EURUSD trade idea, where we highlighted a bearish harmonic bat pattern on this same daily chart.

GBP Fundamentals: Bearish Reversal As Expected

The Bank of England also met last week and, like the Fed and ECB, also hiked rates by 50bp. However, their messaging was much more dovish. Firstly, the votes for the interest rate decision indicated a much more split BOE, with 2 dissenters voting to hold rates unchanged. Obviously, the BOE is near a pause of their hiking cycle, and this could soon be reflected in lower GBP exchange rates.

Indeed, the BOE has good reasons to be cautious about rate hikes. The economy is experiencing a major slowdown, and they know aggressive rate hikes are not a remedy for the energy inflation shock caused by the Russia-Ukraine war.

The UK’s large current account deficit, in addition to the big hit to GDP growth, is a bearish cocktail for the risk-sensitive British pound. As shown in our recent Fx analysis, a weaker pound via lower GBPUSD and also in other GBP pairs still looks like the “correct” outlook for the weeks ahead.

The GBP economic calendar is nearly empty in this final week ahead of the Christmas holiday period.

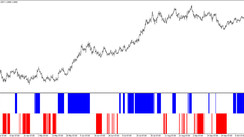

GBPUSD Technical Analysis:

GBPUSD got strongly rejected from levels above 1.24 last week week and is already trading under 1.2150. Some 50 pips lower, the 1.21 zone is the first key support in the current context, formed by the previous highs and the 200-day moving average (see chart below).

A break below the 1.2150 support would likely lead to a further drop lower. The 1.20 level is the psychological focus, but in the current environment on the daily chart, it’s less significant as a distinct level. Rather, it seems GBPUSD will likely proceed under 1.20 when 1.2150 breaks and move toward the 1.18 zone, which is the next support.

To the upside, the 1.24 high is the focus as resistance, ahead of 1.25.

JPY Fundamentals: BOJ Meeting Likely to Go Down Without Fireworks

The JPY remained rather contained over the past week, with USDJPY confined to a sideways horizontal range between 135 and 138. The moves in JPY pairs continue to reflect moves in global bond yields, and especially USDJPY remains correlated with US Treasury yields.

Long-duration bond yields (5 years and above) last week failed to make an upside breakout as the Fed and ECB delivered another hawkish surprise. The 10-year US Treasury yield is the most traded instrument in the bond market and is one which USDJPY is most closely correlated with. The 10-year Treasury yield is holding at its 3.5% support zone and is moving up gradually today. It is testing an important resistance trendline, where an upside breakout looks likely given the Fed’s hawkish resolve. If US Treasury yields break higher, USDJPY should follow suit.

On the calendar, the BOJ meeting tomorrow morning (Tue) is in focus. No big changes from the BOJ are likely, but it’s worth keeping in mind that Governor Kuroda’s term ends in April next year, and this will be one of the last BOJ meetings he leads. His successor may be announced at any time between now and the spring, and that news could cause volatility in JPY pairs, depending on who is selected for the job. Nonetheless, the key thing the markets care about is whether the new governor will continue the uber-dovish policy that the BOJ pursued under Kuroda?

USDJPY Technical Analysis:

Not much has happened on the USDJPY chart since we last analyzed it last Monday. A clear range has formed between 135.00 as support and 138.00 as resistance. A breakout in either direction should likely lead to further continuation in the breakout direction.

To the upside, there is resistance at 140.00 and 142.00 (see chart below). USDJPY is likely to react to each of these if or when it reaches them. A break above the nearest resistance at 138.00 should likely result in a quick continuation to the next one at 140.00.

To the downside, the 130.00 area is the next support down, which is also important in the longer-term context.