We are in for a wild ride after the quiet period over the past few weeks as a plethora of central bank meetings will rock the Fx market this week. It is the busiest central bank week of the year, with all four of the major currencies we regularly analyze here having a central bank meeting (see sections below).

US Dollar Fundamental Outlook: Fed to Amp Up the Hawkish Mode; USD Should Stay Supported

The dollar was generally stronger in the past week, though the Fx market was in broader consolidation and the modest USD appreciation was nothing but a part of this consolidation. However, the prospects for the dollar to extend the uptrend look good, and the last few weeks could be viewed as the consolidation before trend continuation.

The CPI Inflation reports on Friday were in line with consensus forecasts of 6.8% y/y for the headline and 4.9% for the core CPI. While fortunately, it wasn’t as hot as some feared (7% or higher), 6.8% is still a substantial spike above the 2% official target. This should keep the Fed on track to speed up the pace of QE tapering when they meet this Wednesday. The faster winding down of QE stimulus means the Fed’s shift to hawkish mode is not only fully in force but is also amping up by the day. This clearly sets the Fed apart as one of the more hawkish central banks and continues to be the main factor that should support the USD in the period ahead.

Possibly the FOMC could surprise hawkishly in the dot plot projections, the statement, or the press conference by giving more information about the specific timing when rate hikes may come (e.g., an indication for a March or May hike would be a big hawkish surprise). In this scenario, the DXY dollar index could break the highs around 97.00, with EURUSD moving toward the 1.12 lows.

On the other hand, Powell could deliver a slight disappointment for USD bulls if he emphasizes a more patient approach on inflation or the dot plot projections are not as high as expected. Under this scenario, the USD consolidation may extend for a while longer, though the uptrend would still remain intact.

On the calendar, retail sales are also due on Wednesday six hours before the Fed. On Thursday, traders will also watch the Philly Fed manufacturing index and Markit’s manufacturing and services PMIs. But all of those reports will be subordinated to the Fed and other central bank meetings throughout the week, which should dominate the price action in Fx.

Euro Fundamental Outlook: ECB to Reaffirm Uber-Dovish Position Relative to Other CBs

The ECB meeting is in central focus for the EUR currency this week. They should stay in the dovish camp and reaffirm that rate hikes in 2022 are definitely not on the table. The ECB’s dovish stance remains in stark contrast with the Fed and other central banks who are already pondering rate hikes.

But all that is not without backing from the economic reality. After all, Eurozone core CPI inflation is at only 2.6%, WAY lower than the 4.9% core CPI in the US. Moreover, Eurozone inflation is expected to turn markedly lower starting from next month (January 2022) due to the fading out of various base effects. Therefore, unlike the Fed, the ECB is under no pressure to tighten monetary policy. This is the main bearish factor that should keep the euro in a downtrend over the coming months in Fx pairs such as EURUSD, EURCAD, and EURNZD.

Thursday is a very busy day on the EUR Fx calendar. A few hours before the ECB, flash PMI data (preliminary reports) will be released. The PMIs will show the impact of the latest Covid lockdowns imposed across Europe this autumn. Negative surprises here, potentially coupled with an unambiguously dovish ECB, would be the most bearish EUR scenario on Thursday. In this case, the euro may be pushed to fresh yearly lows, and EURUSD could break the November 24 low around 1.1185. On Friday, traders will take note of the German ifo business climate report.

EURUSD Technical Analysis:

Consolidation is the name of the game here since that November 24/25 low, achieved a day before the Omicron news hit the markets. The consolidation has taken the shape of a bear flag pattern (see chart below), which is normally a trend continuation signal.

Thus, the long-term bearish trend channel that began in May/June this year remains fully intact. The 1.15 area remains the crucial resistance zone in the current context. EURUSD could perhaps test it on ECB/Fed volatility this week, but the downtrend will remain firmly intact as long as the price stays below this 1.15 resistance zone.

Ahead of 1.15, the 1.1375 – 1.14 area is moderate resistance, though a break above it won’t have any implications for the predominant bearish trend here whatsoever.

Initial support is found at the lower line of the flag pattern, currently around the 1.1250 level. The November 24 low at 1.1185 in the 1.12 zone is the next support down. A downside breakout of both these support areas would likely mean the continuation of the bearish trend is underway. This scenario will open the potential toward 1.11 and then toward the more important support area at 1.10.

British Pound Fundamental Outlook: High Volatility Alert – GBP to Swing Wildly Amid a Packed UK Calendar

If you think the EUR or USD calendar is busy this week, then check out the lineup of GBP events. The Bank of England meets on Thursday, a few hours before the ECB, making for a potentially very volatile day on the EURGBP pair. Moreover, the UK will also publish employment, CPI inflation, PMI, and retail sales data throughout the week. Thus, the pound will likely see a lot of two-way volatility this week, maybe even establishing a pivotal inflection point on some GBP pairs either in the bullish or bearish direction based on the outcome of this week’s events.

The market doesn’t expect a rate hike from the BOE for Thursday as it did for the November meeting. But the bank’s failure to deliver on the promise back in November is not the only reason rate hike probabilities are standing much lower today. This time, the Omicron variant is posing a threat to the economic outlook and has got BOE officials worried. Just this weekend, the UK announced stricter restrictions over as Omicron cases have started to surge in the UK. There are a lot of unknowns about the new variant, and authorities are acting by taking the safe road, using lockdowns to reduce the spreading rates of the virus. But this will hurt the economy, and in the BOE’s case, it could make them delay the rate hike again.

That being said, a hawkish surprise from the Bank of England is not completely out of the question. The UK economy is doing well, and most of the data in recent weeks was solid. If this week’s data is strong too, and especially the CPI inflation print, the BOE could opt for a hike. Such a hawkish surprise would likely cause a big bullish reaction in GBP (especially when we consider that GBP positioning is a bit extended to the short side).

On the other hand, a dovish surprise would be if BOE communicates that Omicron is a serious threat to the economic recovery and completely suspends plans for a February rate hike or beyond. The third and probably most likely scenario is for the BOE to deliver in line with market expectations (no hike on Thursday but on track for one in February). In this case, we should see a more muted GBP reaction.

GBPUSD Technical Analysis:

GBPUSD bounced in the final days of the past week, potentially opening up the potential for a further extension of the bounce to the upside. In this sense, the nearest resistance is around the 1.3370 - 1.34 zone. But the more important resistance is located toward the 55-day moving average at the 1.35 area. Further up, the most important support in the current context is around the 100-day moving average, which is in the 1.36 area (see chart below).

Daily chart support is firmly pinned at the lows around 1.3170 - 1.32, although this could stretch down below the 1.31 mark on volatile price swings. Remember, this 1.31 – 1.33 area is an important weekly/monthly support zone for GBPUSD. So, potentially big price swings on the daily chart may not mean that this support is breaking in the larger context on the weekly timeframe.

Japanese Yen Fundamental Outlook: BOJ Meeting - The Only Event Traders Don’t Care About

While the JPY also sees a central bank meeting of its own, it’s probably no big surprise that the Bank of Japan meeting will be the least impactful of all central bank events this week. That’s because the BOJ dovish stance is firmly engraved in market expectations, and no one sees big changes in their policy stance any time soon. Indeed, Japan’s inflation continues to run below target and well below western countries at the moment.

On balance, the BOJ meeting on Friday is likely to be another non-event. Thus for the yen, the usual drivers like global risk sentiment and movements in US Treasury yields will remain the dominant factors to determine its direction. In this regard, the Fed meeting will have a direct impact on US yields and global risk sentiment, and hence, rather ironically, the Fed could end up having a bigger impact on JPY pairs than the BOJ this week.

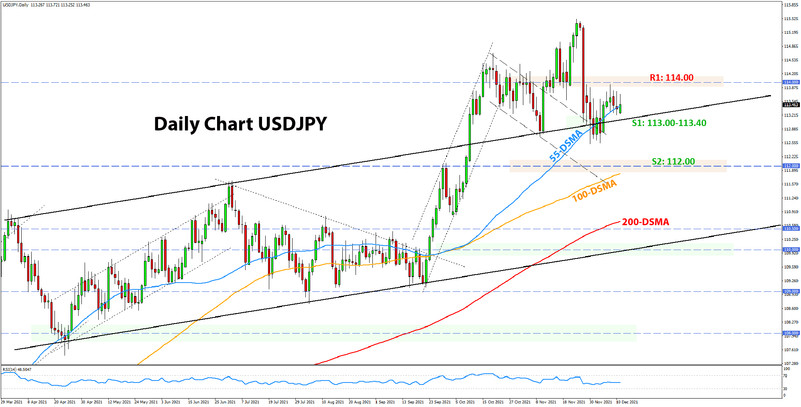

USDJPY Technical Analysis:

The daily chart is quite a mess here, though there are some distinct support/resistance levels that we need to pay attention to. Most eye-catching are perhaps the 55-day (blue) and 100-day (orange) moving averages, which appear to be the two immediate support zones to the downside.

The 55 DMA is at 113.44 and seems to be acting as support, with the price unable to close below it in the recent few session. While even if it does, it wouldn’t be a very strong bearish signal, the 55 DMA could be an important factor to watch simply because it already held on several occasions.

Other factors providing support here are past highs/lows and that broken upper trendline of the rising channel around the 113.00 level (see chart). So, it could also be said that the whole 113.00 – 113.40 area is the nearest support in USDJPY (S1).

The 100 DMA (orange) provides support at around 112.00 together with important past highs, making this a solid technical zone. To the upside, 114.00 is the first and critical resistance zone, which has proven a hard nut to crack so far (R1).