US Dollar Fundamental Outlook: Modest USD Strength May Stay in the Near-Term

The dollar was somewhat higher last week, driven by a combination of factors such as risk aversion and extended short positioning that we discussed here last week. The Fed didn’t provide much new information and repeated the stance that they will keep QE running at the current pace for as long as the economic recovery needs it.

The week ahead is packed with economic data. Starting with the IMS manufacturing today, the calendar that features the ISM services PMI on Wednesday, and finally, the Nonfarm Payrolls on Friday. Despite the busy calendar, we may not see too much volatility in Fx pairs because the market’s sensitivity to economic data remains low during the pandemic. Nonetheless, if the US data is clearly positive and exceeds expectations, then the dollar would certainly receive some support from it.

On the fiscal side, Republicans and Democrats don’t seem to be able to agree on the $1.9 trillion corona relief package that Democrats proposed. So, the Biden administration will most likely opt to bypass Republicans in congress in order to pass the stimulus bill. This could take longer, which in the meantime could mean that a light risk-off tone will be present in markets as investors are awaiting when and how large the actual stimulus will be.

Euro Fundamental Outlook: Traders Watching CPI Inflation Data This Wednesday

Despite the better than expected GDP data last Friday, the euro is struggling to hold higher levels, and is instead back at two-month lows versus the dollar. This is often a sign that the stretched EUR long positioning is playing a hand in this type of price action. Thus, if EU data disappoints for some reason, then the euro currency will probably correct even lower.

The new test for that will be this week’s CPI flash inflation data on Wednesday. It is a preliminary release to which the markets and the ECB pay close attention to. The risks remain higher for a EUR downside correction in case the data disanoints compared to upside potential in case CPI inflation beats expectations.

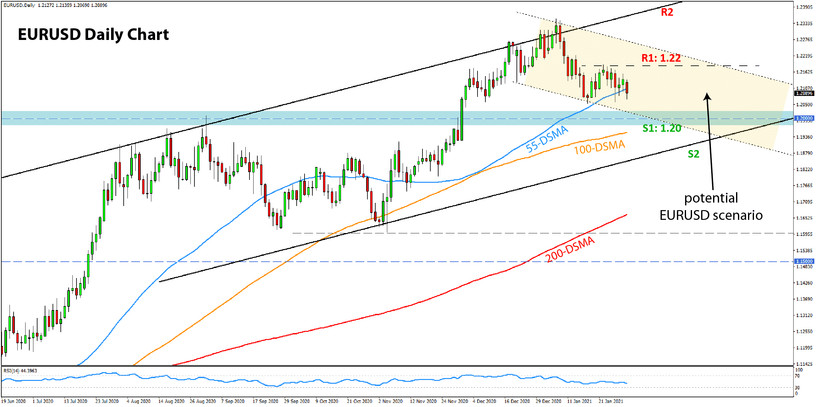

EURUSD Technical Outlook:

Last week’s EURUSD trading range remained completely inside of the previous week’s trading range (an inside weekly bar), so the technical situation is not much changed compared to 7 days ago. This time, we would like to outline three potential scenarios for EURUSD that may play out in the coming weeks:

· 1st (base case) - EURUSD follows the downward channel shown on the chart below. That is, it moves higher toward 1.22 in mid-February and then lower toward 1.20 and 1.19 in March. The already established technical zones will give us insights into what EURUSD is doing at any moment. For this scenario, the 1.22 resistance zone needs to hold.

· 2nd - If, on the other hand, EURUSD stages a momentum break above the 1.22 resistance zone, then new cycle highs will be on the cards, and probably even a move toward 1.25 and higher.

· 3rd - A more aggressive bearish scenario would be if EURUSD breaks through 1.20 earlier than we expect and continues down through 1.19. In that case, the road for lower levels will be clear, and EURUSD visiting 1.15 will become a realistic possibility again.

British Pound Fundamental Outlook: BOE in Focus This Week While GBP Waits for Vaccine Advantage Effects to Kick In

Pound sterling was the best performing currency last week, although the gains were largely contained and moderate. Traders continue to be optimistic about the UK because the country has the fastest and most effective vaccination program among big developed nations. Eventually, GBP should draw more strength from this factor, especially if the UK service economy already starts to lift most of the pandemic restrictions this spring.

For this week, the traders will be closely focused on the Bank of England. Investors are expecting more clarity on negative rates, which Governor Bailey has previously dropped as unsuitable in the UK. If he repeats that again this Thursday, GBP can jump higher, taking such a stance as a hawkish. If, on the other hand, the BOE says that negative rates are still on the table, then GBP may continue to trade in relative ranges, as has been the case recently.

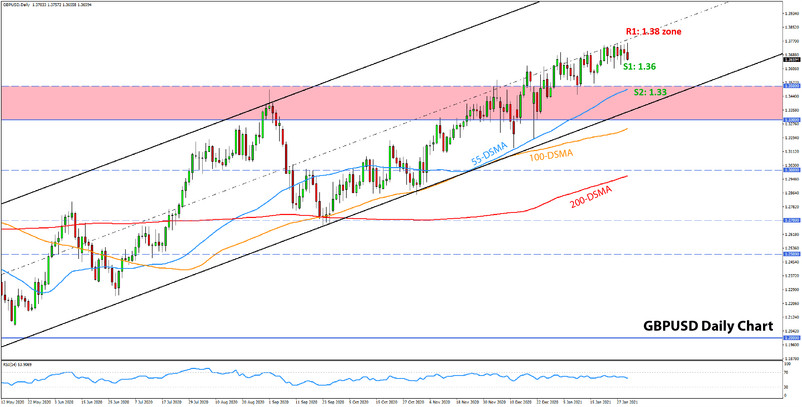

GBPUSD Technical Outlook:

Nothing of crucial importance has changed on the GBPUSD charts either. The pair continues to move gradually higher but is restricted by the mid-channel line, which acts as resistance in this case. It currently stands near the 1.38 level, one that GBPUSD hasn’t yet reached in this cycle. Combined with the psychological and historical importance of this 1.38 technical zone, this could prove to be a short-term top for GBPUSD.

To the downside, the nearest modest support is around the 1.36 lows. If this support breaks, it may open the potential for a deeper retracement toward the 1.33 support zone. On the other hand, a bullish breakout above 1.38 may open the door to the 1.40s.

Japanese Yen Fundamental Outlook: JPY the Weakest Major Currency Last Week

Interestingly, the yen was a little more wild than usual last week. The Japanese currency was the weakest among the major currencies, though there were no particular clear drivers for the weakness.

One factor that is helping to lift USDJPY higher – in addition to extended USD shorts and broader USD strength – is the rise in US yields. As Fx traders know so well, USDJPY has been closely correlated with movements in US Treasury yields in recent history, and that seems to be playing out again in absence of other more dominant factors.

We also talked in our past weekly analyses that USDJPY levels near 100.00 could be a pain threshold for the Bank of Japan and the Ministry of Finance. Perhaps, this is also why it has been so hard for USDJPY to come anywhere near the 100.00 handle.

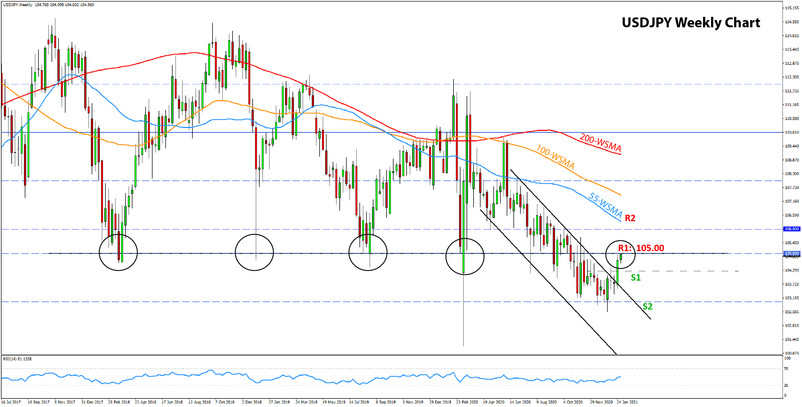

USDJPY Technical Outlook:

The USDJPY pair is a rare occurrence these days, where we are finally seeing some more notable moves and technical breakouts. For instance, USDJPY made a clear break of the falling trendline last week, breaking out of the 7-month downward channel. The only remaining hurdle for much more potential upside is the 105.00 resistance zone. If the bulls break it, USDJPY will be “free” to rise toward the 108.00 and 110.00 areas.

However, if 105.00 holds, USDJPY may start moving sideways again. In this case, the first support would likely come around the prior highs at 104.00 and then the next one around the 103.00 lows.

Don't Miss:Yearly Forex Forecast Of EUR/USD, GBP/USD, USD/JPY (Fundamentals&Technicals) See it Here 100% FREE