Only Long is a trading method in which the trader executes only long trades in assets and trading instruments whose price usually increases over time.

Gold and stock indices tend to be the most common assets that continuously rise over time due to inflationary effects. Conversely, this cannot be said of individual stocks, even though even the strongest stocks have managed to fail many times in history.

And why is this the case for indices and not for stocks? It is simply because when one of the stocks included in a stock index fails, it is usually discarded and replaced by another of higher quality. The index then usually falls a little, but over time its value rises again due to inflationary effects.

Strategy entry rules

Entering long positions

1) Regular entries

2) Long entries after price changes

3) Combined long entries

How to Trade Only-Long (Only Long Positions)

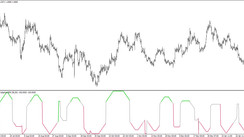

It was mentioned in the introduction that the Only-Long strategy may not be suitable for every asset and trading instrument, so it is better to choose only those that are growing over time (see charts above - SAP500/DAX, see chart below - Gold)

Only-Long trading is most commonly done using the following three methods

1) Regular entries

In this case, the trader enters trading positions based on a regular time period, regardless of where the current value is. Thus, purchases occur, for example, on the first day of every month, or every Monday. The advantage is that the trader does not have to engage in lengthy market analysis and participates in the market even if it is constantly rising.

2) Long entries after price changes

Here, on the other hand, price and its change plays a big role. Entries here usually occur only when the market falls by a certain, predetermined value. This can be a percentage value, for example, or of course an absolute value (number of dollars, number of points, number of pips). The disadvantage of this method is that if the market is "constantly" rising (e.g.: SAP500 index), then there are only a limited number of entries. The advantage here, on the other hand, is that due to the entries being made only during price drops, the average price value of all entries is usually slightly lower than in the case of method number 1.

3) Combined long inputs

This is a combination of the first two methods, in such a way that there is a wait for a certain price fall, after which an entry is made of a volume that would correspond to regular investing.

For a better understanding, let us rather give an example:

Suppose that in the case of regular inputs we decide to make purchases every Monday and in the case of method number 2 we intend to make purchases only after a 5% decline. In the case of combined inputs (method 3), we would then wait for a 5% drop, which for example would occur after 4 weeks. This means that the moment we make an entry, we increase its volume by 4 times, since with method number one we would have made four entries by then.

The above charts show that the Only-Long strategy used on properly selected assets and trading instruments achieves almost 100% success rate over time, which means that literally anyone can participate in very interesting trading opportunities with this form of trading.