Similar to stocks, you can also make money with forex trading. Within just a few hours, high returns can be achieved when trading currencies. However, it also requires luck and is overall quite risky.

Today, we will explain how the largest financial market in the world works, what opportunities and risks there are, and how you yourself can earn money with forex.

What is Forex Trading?

Forex is the world's largest foreign exchange market in terms of trading volumes and revenues. Trillions of dollars are circulating here daily. Based on the definition of Forex, which is short for foreign exchange, this is the exchange of foreign currency. Currency trading involves the central and commercial banks of the world, transnational corporations, large investment companies, funds, private investors, and traders.

In simple words, the essence of Forex trading is speculating on the price differences of currency pairs. There is an opportunity to make money on the growth of currencies as well as on their fall. The income can exceed considerably both bank deposits and investments into traditional tools of the stock exchange and amount to dozens of percent a year, provided there is a balanced and well-thought-out approach to trading.

What to Consider Before Starting Forex Trading

Each broker has its own conditions and choosing a broker is the first big decision you will have to make. Among the most popular and reliable brokers in South Africa are:

● Brokstock;

● AvaTrade;

● Exness.

These are suitable for beginners and professional traders. Consequently, choosing a broker is the first step in our list of starting Forex trading.

Steps for Starting Forex Trading in South Africa

There are several steps a beginner needs to take before they can start trading on Forex. Below we describe them and give a few tips.

Step 1: Choose a Forex Broker

When choosing a forex broker it is essential to consider a number of factors:

● Spreads and commissions;

● Available currency pairs;

● Customer support;

● Trading platform;

● Leverage and margin trading;

● Standard, mini, and micro accounts;

● Payment methods;

● A valid license.

Each of these points must be considered separately. A particular platform might have an amazing number of currency pairs but your preferred payment method will be unavailable and so on. It is useful to look through the user reviews as well since many insights can be found there.

Step 2: Open an Account

Thanks to the Internet, opening a forex account is much easier than it used to be. During the registration, you will need to fill out information such as:

● First and last name;

● Address;

● E-mail;

● Phone number;

● Account currency type;

● Password setting;

● Date of birth;

● Country;

● Social security number, ID, or passport number;

● Employment status.

Sometimes, in the course of registration, you will be asked to answer a few questions about your financial knowledge and trading intentions.

Most brokers also require additional verification, so you will need to send a photo of your ID or passport and a selfie.

Step 3: Get Familiar with the Platform

Each platform has its own interface, features, etc. Get familiar with everything the platform has to offer. There is often a learning center or FAQ page that can help you with this.

Step 4: Fund Your Account

Forex brokers require different minimum deposit amounts, from 0 to 10,000 dollars. More important than the minimum amount is the security deposit that the trader must deposit for their Forex order, the so-called margin. It can be seen as a pledge for trading a higher currency amount. The minimum margin amount can be a decisive criterion in choosing the right Forex broker, especially for beginners.

Step 5: Start Trading

Now that you have an account and have made a deposit you are ready to start trading. We have several tips for that as well.

Essential Tips for Trading Forex

If you have never worked with Forex, the first trades can be not only stressful but also end up with a loss. To avoid this, follow a few simple tips.

Have a Trading Plan

A trading plan is a plan of action for any event that may occur during trading. Usually, in drawing up a trading plan users try to include the rules on money management, and so on. This is very helpful to beginners, especially during the initial trades.

Set Realistic Expectations

Many of the so-called “gurus”, that sell forex courses, like to promise a thousand percent return for a month of trading – they are simply lying. Yes, it is possible under certain conditions but consistently getting such results is simply impossible.

Realistically, Forex traders with a good strategy can make 5-15% profit on their portfolio every month. As a beginner, you will be very lucky to see such results.

Use Leverage Wisely

Most brokers offer to trade with significantly more money than you put in. This works via leverage in the amount of 10x to 500x. The larger capital investment can result in large profits and losses if the trade does not work out.

So that you better get the idea, let’s look at an example. The trader invests $1,000 of their own money and receives from the broker the opportunity to participate in forex trading with $100,000 through borrowed money. This corresponds to leverage of 100x.

Practice with a Demo Account

Most forex brokers offer their clients a free demo account. This allows to practice trading under real conditions with virtual money for a limited period of time. With a demo account, you can learn what makes the foreign exchange market tick, try out different strategies and stop-loss orders without risk, and ultimately determine whether you are at all made for such an investment.

Advantages of Forex Trading in South Africa

A significant advantage of currency trading is the availability of financial markets. The Forex is practically open at all times. So, when trading currencies you are not bound to certain trading hours of exchange but can participate 24 hours a day in international currency trading.

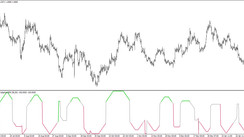

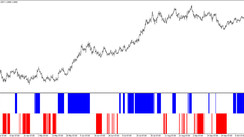

It is important to note that volatility, i.e. the price fluctuation of currency pairs, increases significantly when both markets of the traded currency pair are open. In the case of the EUR/USD forex pair, the opening hours overlap between 14:00 and 18:00, so forex trading at these times carries a greater risk, but also allows for a higher potential profit.