As a forex trader, you have most likely encountered hundreds or thousands of different trading systems, strategies, various trading approaches and techniques.

Forex traders often try to enter and exit the market without detailed verification of their strategy being effective in their respective market; especially when taking into account the volatility and structure of the market.

While it is true that there is no one right way to go in Forex trading, meaning there isn't just one correct trading strategy, long-term successful traders often follow certain guidelines that enable them to achieve, most of the times, stable results. One such guideline is adjustment to the current market conditions and volatility.

First, let´s establish what volatility is. Intuitively, volatility is the ferociousness of the market fluctuations or range of the market. For example, if EUR/USD is traded on a narrow sideways trend with the width of a several dozen pips, the market´s volatility is low. Conversely, if a US NFP employment report was published and EUR/USD rose 150 pips after, the market's volatility is high.

From the last two sentences, it is probably clear that these two completely different situations require different approaches, including different Stop-Loss and Profit-Target settings if they are to be traded successfully. It is volatility which sometimes causes quick and premature Stop-Loss order activations or unnecessarily low Profit-Target closure.

Below, you will find 5 tips on how to adjust to the current market conditions, and things you should always consider when trading.

1) After a low-volatility (sideways-trend) period usually comes a trend period - volatility increase. These two phases usually alternate on the market after a while.

2) A strong volatility increase usually appears during the release of important fundamental (economic) reports. Many of them are planned ahead, and so you can adjust to the increased volatility of the market in advance.

3) Depending on their trading strategy, a number of seasoned traders adjust to market volatility by taking into consideration the minimums/maximums of the current candlesticks. For example, traders trading candlestick formations simply enter at the candlestick marked on the graph below, and place Stop-Loss orders under the minimum of this candlestick.

In the case of a sell trade, they place a Stop-Loss above the maximum of the candlestick formation. That allows them to set a Stop-Loss that is neither too high or too low, because when the market is calmer, meaning the volatility and candlestick range are lower, it will also result in a proportionally tighter Stop-Loss.

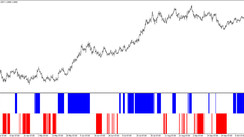

4) Support and resistance price zones are also used by seasoned traders for planning trades, Stop-Loss and Profit-Target orders. For example, if you were entering short after the marked resistance (upper zone), you could plan Stop-Loss above the resistance zone and Profit-target then above the marked support (lower zone).

Thanks to S/R zones, you can very effectively analyze the current structure of market volatility.

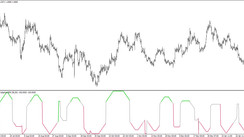

5) Forex indicators such as Bollinger Bands, Average True Range (ATR) and many other also provide a big help when analyzing the ferociousness of the market. In the case of Bollinger Bands, the volatility of the market is low if the upper and lower lines of the indicator are close together. Conversely, a wide line range means high volatility. With an ATR indicator, low values mean low volatility and high values mean high volatility.

Ultimately, the way you adjust to the market conditions is up to you. What’s clear is that certain tendencies and market phases can be seen in this aspect of the market. It’s also important to say that the market will never adjust to you. Correct entries and exits based on the current volatility of the market is one of the trading aspects which you should master, if you want to perfect your trading skills.

If you would like to practice the volatility trading techniques described in this article please feel free to open a Demo account at Purple Trading .

If you need any assistance with opening the Demo account or if you have any questions about Purple Trading our team is at your service at all times.

About the Author

Team Purple Trading

Purple Trading is a true and 100% fair ECN / STP forex broker providing direct access to the real market. High speed orders execution, no trade-offs, no limits for any type of trading, the most advanced trading technologies. Explore more about Purple Trading at www.purple-trading.com .

For more information on the risks of trading, click here .

P.M. Purple Trading is a trade name owned and operated by L.F. Investment Limited., 11, Louki Akrita, CY-4044 Limassol, Cyprus, a licensed Cyprus Investment Firm regulated by the CySEC lic. no. 271/15.