Due to the rising dollar, volume on a prominent FX platform is up 30%.

Compared to the previous several years, there was a buzz at a conference for experts working in the currency market. At the recent meeting in Amsterdam, top managers from financial institutions and brokers were upbeat about the future of foreign exchange trading. They've spent years watching with envy as the cryptocurrency market flourished in an extremely unpredictable environment while conventional currency stayed boring. The focus of the action is currently on currencies. An sector that has struggled with stagnating volumes for the past 10 years is seeing a 30% spike in trading and unprecedented moves as a result of rapidly rising interest-rate concerns all around the world and rising geopolitical tensions.

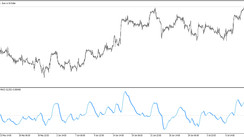

With the Bitcoin Volatility Index declining by more than 50% since a peak in May, the usually erratic swings in the cryptocurrency markets have abated this year. Crypto players appeared dejected. Since last year's climax above $70,000, the price of bitcoin has been flat at approximately $20,000 for months. Also the movements of currencies are alarming: for the first time since 1998, the Japanese government sold dollars to support the yen, while the euro dropped to a 20-year low below parity with the dollar.

Macro hedge funds and other speculative players have been attracted by the activity, and real-money investors have been brought in because their portfolio valuations are now susceptible to sharp fluctuations. The swings were accelerated by the conflict in the Ukraine and the Fed's rash rate increases, which attracted capital to the dollar as a safe haven and affected markets ranging from stocks to Bitcoin. Due to two key factors—the dollar's status as the only remaining effective market hedge and the fact that speculative investors have had a lot of success trading the dollar's appreciation—FX market has become a much stronger concern for investors who aren't usually focused on it.

Despite all the attention they receive, cryptocurrencies actually only account for a small portion of the volume of the foreign exchange markets. National currency trades total about $6.6 trillion every day. Markets are probably moving toward a greater range of interest rates and bond yields right now, and that will likely be accompanied by generally more currency volatility.