Trading with forex is one fascinating experience. However, don't be too excited, as forex can reduce you from a millionaire to being a broke guy in seconds. Yes, it’s that risky. More so, many people lose more money in forex than they have ever made from it.

You shouldn't dismiss forex because of this dark side, as it can also make you a millionaire in the easiest way possible. So, in this article, we’ll be sharing 5 tips that will help you become a successful forex trader. For more information about this, check out this review at Newton Advisor.

5 steps to becoming successful in forex trading

1. Have realistic expectations

Many people who have never traded forex believe it's some platform where one can make thousands of dollars overnight. Well, that's possible, but it comes with many determinant factors. It’s common to hear traders saying you must be ready to take risks, but you must avoid being greedy.

This usually results when a trader is bent on making high profits after losing some cash. This typically makes you take risks that are way too big, and you risk blowing up your capital in a short space of time. Take your time; you'll make those millions in the long run.

2. Define your trading strategy

Becoming a forex trader is just one on the long list of things you'll need on your forex trading journey. More critical is choosing a strategy you'll use in the forex market. If you miss this step, you'll do lots of dabbling and lose precious money in the long run.

There's no one right way to go about trading forex. Different strategies might work in different markets for a particular currency pair. However, you must create a strategy in line with your risk profile. Study the pattern of the market alongside trading tools and techniques. Lastly, innovate ways to fit what they've learned into their strategy.

3. Invest what you can afford to lose

With the excitement of finally landing on a platform that has the potential of fetching you millions, one can easily go berserk. The forex market is sensitive and requires a high level of analysis before you drive in your hard-earned capital. Therefore, you must take your time to understand how the forex market works before making that move.

Following this, you must define your risk profile. Since you're just starting, we recommend using a conservative risk profile instead of an aggressive one. Therefore, take the time to research currency pairs and markets where you intend to trade. The key point is to diversify your investments – don't put all your capital in a single market or trade.

4. Stay abreast with the news.

You could be a technical trader who makes trades based on analysis from market instruments. Even with this, you must always be on the lookout for important market news. This is because many movements in the forex market are influenced by the news.

Such news can come from sources such as central banks or political news. In addition, you can also refer to the forex calendar irrespective of whether you're a technical trader. Don't make the trade if any upcoming events can disrupt your trade.

5. Set predetermined closing prices for trades

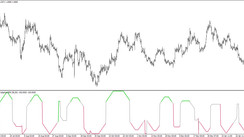

A lot can go wrong in seconds in the market during trades. However, this doesn't pose much concern since you have tools at your disposal – thanks to the 'stop loss' and 'take profit.'

A stop-loss helps you end a trade if the trade goes against you, while a take profit helps to end a trade if you get a desired amount of profit. Simply set these limits while making the trade, and they will help you end trades even if you're absent.

Conclusion

Forex comes with many opportunities but can also cost you a lot if you're not careful. Despite all the potential promises, you must ensure your goals are not unrealistic. Create a marketing strategy that favors you. Since you're just new, avoid being overly aggressive.

Since you can't guarantee trade safety, we advise that you only trade with a capital you can afford to lose. Never put all your capital into a single trade; it can be a recipe for disaster. Lastly, setting stop-loss and taking profits will help you avoid regrettable situations.