In financial markets there are a lot of different brokerages with very different approaches to working with their clients.

Some brokers offer low trading costs and other brokers offer a little bit higher trading costs.

Some brokers are direct market makers – and are on the opposite side for all your trades - and they directly profit from your losses.

And other brokers directly send your trades to the interbank market for execution.

Some brokers consider their business and their clients only in the short-term, and prioritize quantity over quality. On the other hand, other brokers build long-term partnerships with as many profitable traders as possible. It involves lower short-term profits and slightly fewer clients globally, but it is the best environment for retail traders to succeed.

In most cases, traders in financial markets think that their trading is the most important factor of their success - a trading strategy, a money management system, and psychology. However, they completely forget that it is the choice of their broker that decides if they will be able to make a profit or even be allowed to withdraw their profits.

Simply stated - you can have the best and the most successful trading strategy in the world, but if you trade with a bad broker, the trading strategy will still not bring profits.

About the FX Trading Revolution Team

Our team is called FX Trading Revolution, we are algorithmic traders, we profit directly from financial markets. Our only interest is providing verified information and experience from real trading. You can also read more about our story here .

Our team, FX Trading Revolution, has tested hundreds of retail brokers all over the world on real accounts. Unfair brokerage companies do not want you to find out insider information, or the truth about how exactly financial markets work, and principles about how retail brokerage companies work and how they make their biggest profits.

Professional trader needs without any compromises for his profitable trading direct interbank market execution, respectively a broker which will provide without any conflicts of interest an interbank market execution of every single trade.

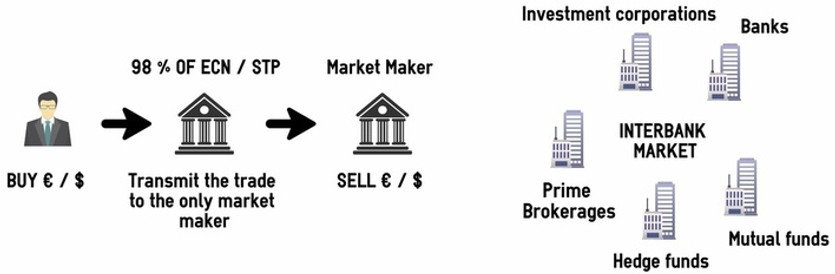

More and more, professional traders are realizing that they need STP / ECN trading accounts to be successful. In response, the vast majority of brokers are offering STP / ECN trading accounts. However do not get confused by the marketing of similar brokers.

98 %

OF TRADERS THINK THAT THEY TRADE THROUGH ECN / STP BROKER

IN FACT ONLY

2 %

OF TRADERS TRADE DIRECTLY ON REAL INTERBANK MARKET!

Practically every trade on STP / ECN accounts by a poor broker is sent to only one market maker for an execution - clients of the poor broker have a major conflict of interest with the poor broker, and his the only one market maker usually owned by the broker.

This is insider information, and is how Forex brokers currently work to make the utmost profit from their clients, which 98% of retail traders do not know. In the picture below, you can see that our trades are not executed at true interbank market.

Insider information: How 98% of retail brokers make their biggest profits!

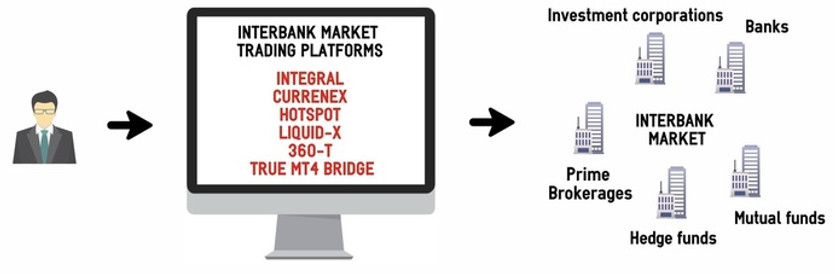

A broker which provides true and direct interbank market access, where all transactions of his clients are executed, connects his MetaTrader 4 trading platform with a bridge to get liquidity to the MetaTrader 4 from an interbank market platform and liquidity providers.

Some brokers even offer interbank market platforms for their clients. However, similar solutions are typically usable only to hedge funds and big financial institutions. So only these technologies will ensure that you will not have conflicts of interest with a poor broker or his market maker, and that your trades will be executed at the best prices on the interbank market.

Based on the facts stated above, it is probably clear that there are huge differences between brokers. A vast majority of traders think that their trading strategy is losing because of market changes and that it is simply not profitable anymore. But the fact is that a lot of traders are losing money, or they are making lower profits than they could be because of a poor and unfair broker.

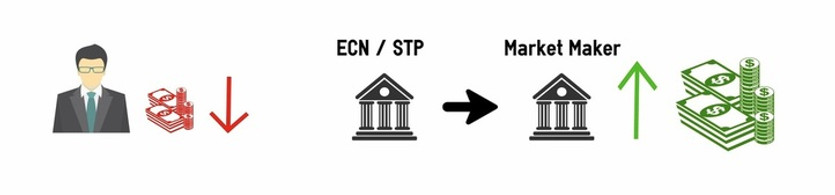

A principle of market makers is really simple - if you make a profit, a market maker loses the same amount of money (that’s why trading is sometimes called a zero sum game). That’s the reason why if your trades are executed with the only one market maker, it will never turn out well for you.

And if a trader makes some profit with a poor broker, the market maker uses dirty practices which are not obvious at first - the market maker will hunt his Stop-Losses, expand spreads in the time of trades execution, freeze his trading platform for a while, and so on.

So if a trader would like to be profitable or to achieve better trading results, he needs a direct interbank market access through his brokerage, as liquidity providers will compete and provide the best prices for his trades there.

The main problem is not that trading is a zero-sum game, as a lot of people think, the main reason why traders lose money are conflicts of interest with market makers. If your trades will be executed without any conflicts of interest, it will open a new opportunity for you to earn big profits from trading financial markets.

Extremely important costs that are not well known - slippage

A vast majority of traders also think that the only cost which they pay to their broker is a spread or commission. The fact is that a spread or commission is only a small fraction of the whole costs of every single trade. Every single trade also includes a cost, which brokers mark as execution costs or “slippage”.

Slippage is the difference between the expected price of a trade, and the price the trade actually executes at. Keep in a mind that this difference highly influences a profit / loss from your trades and that the slippage is usually a subject of both your market entries and exits.

The slippage at solid and fair brokers depends on the current market liquidity and a volume which you would like to execute. Unfair and poor brokers are artificially increasing the slippage. Please do not get confused - we are not saying that brokers with enormous spreads / commission are the best choice, but now you can see the reason why so many low cost brokers can work nowadays.