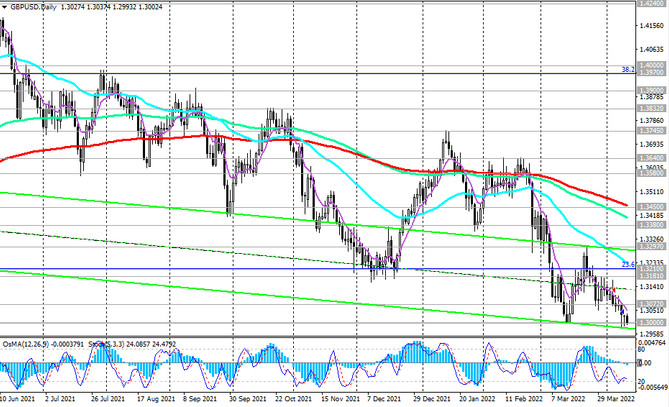

“Unlike the Bank of England, the Fed is taking a tougher stance on rising inflation,” and the divergence between the monetary policies of the Fed and the Bank of England is likely to widen, creating prerequisites for a further decline in the GBP/USD.

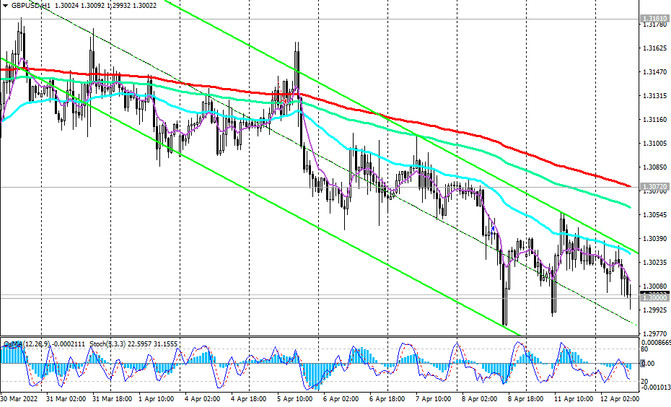

Our main scenario still assumes a decline in GBP/USD. The first signal for the resumption of short positions may be a breakdown of the recent low and the local support level 1.2980.

The immediate target of the decline is the level 1.2865, through which the lower border of the descending channel on the weekly chart passes. Breakdown of this support level will strengthen the negative dynamics of GBP/USD, sending the pair towards local lows 1.2685, 1.2400.

More distant targets for the GBP/USD decline are located at the local support levels 1.2250, 1.2085, 1.2000 (the low in the GBP/USD decline that began in July 2014 near the level 1.7200).

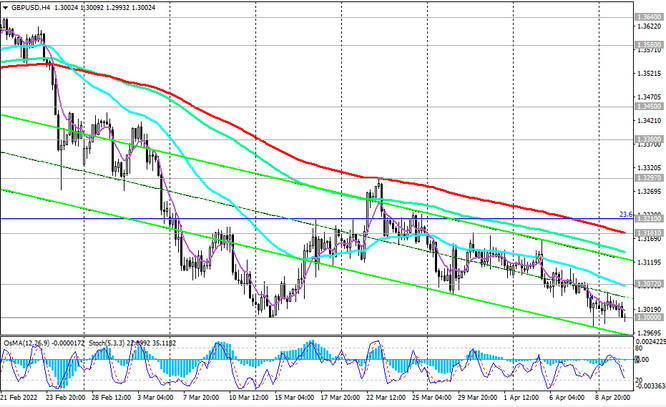

In an alternative scenario, and after the breakdown of the resistance level 1.3072 (EMA200 on the 1-hour chart), GBP/USD will resume growth. The target of this upward correction may be resistance levels 1.3181 (EMA200 on the 4-hour chart), 1.3210 (Fibonacci 23.6% level of the correction to the GBP/USD decline in the wave that began in July 2014 near the level 1.7200), 1.3230 (EMA50 on the daily chart).

However, only growth into the zone above the resistance levels 1.3450 (EMA200 on the daily chart), 1.3580 (EMA200 on the weekly chart) can turn the tide, increasing the likelihood of GBP/USD growth into the zone of a long-term bull market above the key resistance level 1.4580 (EMA200 on the monthly chart and Fibonacci level 50%). The first signal for the implementation of this scenario may be a breakdown of the local resistance level 1.3040.

Support levels: 1.3000, 1.2980, 1.2865, 1.2685, 1.2400, 1.2250, 1.2085, 1.2000

Resistance levels: 1.3040 1.3072 1.3181 1.3210 1.3297 1.3380 1.3450 1.3580 1.3640 1.3700 1.3745 1.3832 1.3900 1.3970 1.4580

Trading recommendations

Sell Stop 1.2970. Stop Loss 1.3050. Take-Profit 1.2865, 1.2685, 1.2400, 1.2250, 1.2085, 1.2000

Buy Stop 1.3050. Stop Loss 1.2970. Take-Profit 1.3072 1.3181 1.3210 1.3297 1.3380 1.3450 1.3580 1.3640 1.3700 1.3745 1.3832 1.3900 1.3970 1.4000 1.4580