Today the Fed meeting begins, which will end on Wednesday with the publication of the decision on the interest rate at 18:00 (GMT). Recall that since March 2020, the Fed has kept its key rate at 0.25%, and since June 2020, it has been purchasing government bonds and mortgage bonds worth at least $ 120 billion every month.

Earlier, the leaders of the Fed have repeatedly stated the need to adhere to the current course of super-soft monetary policy. In their opinion, the economy must "show further significant progress" towards the targets set by the Fed before there is a need to discuss the possibility of reducing the volume of purchases of assets.

They allow the inflation rate in the US to exceed the Fed's target of 2% for some time. At the same time, even if a decrease in the volume of asset purchases begins, the level of interest rates will be held unchanged until the end of 2023.

Nevertheless, unexpected statements are not excluded. Earlier, some Fed officials have already sounded alarming statements that it is necessary to prepare to think about curtailing monetary stimulus measures. In their opinion, the US economy continues to recover from the recession caused by the pandemic, and the Fed should be ready to make changes in its policy if necessary.

Many economists expect the Fed to begin phasing out stimulus in the coming months, and at the end of this meeting, the Fed will announce the start of cutting bond purchases in the third quarter of 2021 and raising interest rates at the end of 2022. If this happens, then the real yield on US government bonds may rise, pulling the dollar with it.

And although the American stock market remains bullish, it could start a downward correction if Fed Chairman Jerome Powell actually announces such a decision on Wednesday.

The DXY dollar index maintains the positive momentum it received last week from the publication of strong macro data, according to which the consumer sentiment index rose to 86.4 points in June (from 82.9 in May and against the forecast of 84.4). Consumers' assessment of the current economic situation in June rose to 90.6 from 89.4 in May.

Consumers expect the US economy to grow faster, also expecting a reduction in unemployment. At the same time, the previously published consumer price index (CPI), producer price index (PPI) and price index for personal consumption expenditure (PCEPI) came out with record values, indicating the acceleration of inflation.

As of this writing, DXY futures are traded near 90.50 mark, just 11 points below the 4-week high reached last week. The DXY has gained 72 points since the beginning of this month.

But among the main American stock indices, there is a contradictory picture.

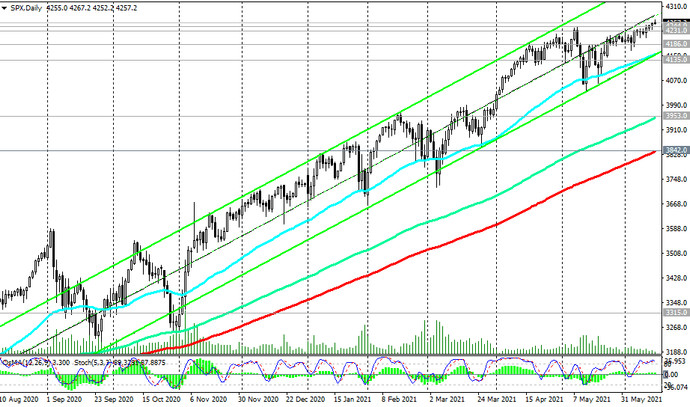

If the high-tech NASDAQ100 is rising again today, for the 4th week in a row, then the industrial DJIA is declining today for the 7th day in a row, and the S&P 500 broad market index at the time of this article is traded in a range close to yesterday's closing price and 4257.0 mark, however, also maintaining positive momentum and staying in the long-term bull market zone.

If tomorrow from the FRS will follow tough signals indicating the imminent start to roll back the stimulus policy or change its parameters in the direction of reducing the volume of asset purchases, this will lead to the closure of a significant part of short positions in the dollar and to its strengthening. The tougher the statements of the Fed leaders following the June 16 meeting, the stronger the dollar will strengthen, and the deeper the correction in the American stock market will be.

From the news for today, which will increase the volatility of dollar quotes and stock indices, it is worth paying attention to the publication at 12:30 of the report of the US Census Bureau on retail trade. The Retail Sales indicator reflects the total sales of retailers of all sizes and types. Changes in retail sales are the main indicator of consumer spending. A relative decrease in the indicator may have a short-term negative impact on the dollar, while an increase in the indicator will have a positive effect on the USD. The forecast for May is -0.8%, which is likely to negatively affect the USD if the forecast is confirmed.

Retail sales is the leading indicator of consumer spending in the United States, showing changes in retail sales. The Retail Control Group, which measures volume across the retail industry and is used to calculate price indices for most products, is expected to hit -0.6% (after a -1.5% decline in April), which is likely to negatively impact the dollar in the short term as well.