USD Fundamentals: SVB Bank Crisis & Tomorrow’s CPI Report & Key Near-Term for Fx Market Direction

Financial markets were shaken last Thursday by the news that Silicon Valley Bank (SVB) is experiencing issues with paying its depositors. Late on Friday, SVB was closed by US regulators, following which the authorities had a busy weekend. Finally, they came up with a decision late on Sunday evening to protect all SVB depositors’ funds (including uninsured deposits) while letting Silicon Valley Bank fail.

The decision to protect deposits was taken as positive news (for risk assets) by markets. Stocks and risky currencies rallied while the dollar was down on the late Sunday open in Asia. However, the moves have reversed now, as speculation continues as to what the failure of Silicon Valley Bank could mean for the wider financial system.

Central bank rate hikes are also being massively repriced. This is the other cause of the big moves in markets today. The moves are huge (as can be best seen in bond markets), with investors now (again) expecting the Fed to be cutting rates by the end of the year. What a week it has been. During Powell’s testimony last Tuesday, the market repriced higher for the Fed to hike by 50bp on March 22. Three days later, the consensus market expectations for the March 22 meeting are for the Fed to hike by 25bp or hold rates unchanged!

Depending on how the situation around SVB and the US financial system will develop, expectations around Fed policy will change rapidly. This means there is now potential for high volatility under certain circumstances if things don’t soon calm down.

The events around SVB may even overshadow tomorrow’s US CPI report (Tuesday), which was previously viewed as the key event to determine what the Fed does on March 22. It will now be only one piece in the wider puzzle that the Fed will look at when deciding how much (and if at all) to hike rates on March 22.

EUR Fundamentals: ECB Meets This Thursday - SVB Crisis Has Trimmed Chances for a 50bp Hike

Markets are moving rapidly in the Monday session today, given the fallout in US banking stocks and the ripple effects in the wider equity market and other financial markets. Central bank rate hike expectations (as priced in by futures markets) are rapidly being adjusted, including for the ECB. Apparently, the 50bp hike for Thursday (which was a given until today) is now in doubt!

The current volatile environment in bond markets and the risks to the financial system make this Thursday’s ECB meeting that much more tricky. Will they back away from a 50bp hike in fear of a similar banking crisis spreading to Europe? Will the ECB announce new measures following the Silicon Valley Bank failure?

These are just some of the questions that traders will demand answers to, and that can make the markets more volatile. Arguably, volatility is the only thing we can confidently predict for this week, while the direction of Fx moves will be hard to forecast.

Other than the ECB meeting, the Eurozone calendar is very light this week.

EURUSD Technical Analysis:

Support at 1.0550 held and EURUSD rebounded late last week. The pair is now trading above 1.07 as rapidly evolving fundamentals are driving the market action (see USD and EUR fundamentals sections).

To the upside, 1.0730 is resistance, which EURUSD has already reached. The 1.08 zone should also be resistance, and above it, the key resistance in the current picture remains at 1.10.

To the downside, all focus is on the lows at 1.0530 - 1.0550. A new test toward this zone again can’t be excluded as a possibility.

GBP Fundamentals: Employment Report & Annual Budget Announcement This Week

The pound sterling is being pushed around by the volatile swings in bond markets and the pricing of central bank rate hikes. GBP has been largely unchanged versus the euro since last week; it is up against the USD and down against the safe-haven CHF and JPY.

Risk sentiment so far remains rather resilient, and most market analysts don’t expect the problems stemming from the US financial sector to spill over to the broader economy. While stock markets are down some 3-5% since last Thursday (when news about SVB hit), there is only a contained risk aversion reaction in the Fx market. This is helping GBP to stay supported for now.

The pound will potentially also be impacted by domestic events on the calendar this week. The UK jobs report is in focus on Tuesday, while the Government (HM Treasury) will announce the annual budget plan on Wednesday. These two events will impact BOE rate hike expectations and thus impact GBP. However, given the major focus on the SVB crisis in the US, GBP is still more likely to be mainly driven by these global events than the domestic UK economic calendar.

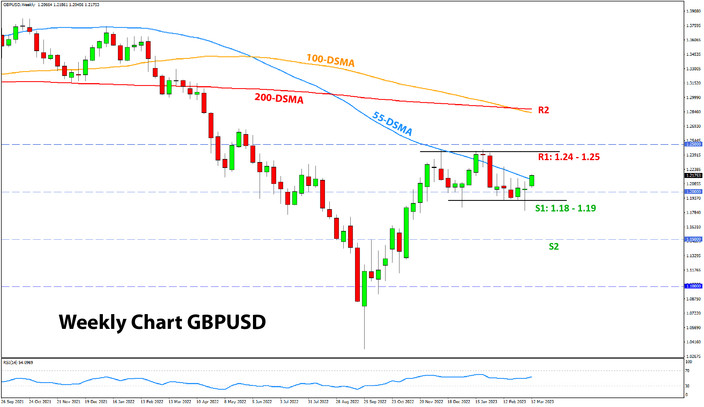

GBPUSD Technical Analysis:

GBPUSD dropped sharply below 1.19 last week (on Powell’s hawkish testimony), but by the end of the week returned above 1.20 and closed there. The weekly candle closed unchanged, almost like a doji, but the bounce off the lows is worth noting.

GBPUSD is now continuing to move higher and may soon head for a test of the resistance at 1.22. This is the February high. The key resistance remains at the 1.24 - 1.25 area.

To the downside, the 1.18 - 1.19 area has now been solidified as support. For now, the weekly chart shows GBPUSD is trading comfortably in a range between 1.18 as the bottom zone and 1.24 as the top zone of this range.

JPY Fundamentals: Safe-Haven Flows Amid SVB Crisis Lift Yen

The closely watched BOJ meeting this Friday passed without a lot of fireworks. It was the last meeting that current Governor Kuroda headed before his departure next month. There was much speculation going into this meeting that the BOJ may deliver another hawkish adjustment of their YCC policy as they did back in December. But that didn’t happen, producing a muted market reaction.

However, the focus quickly shifted to JPY’s safe-haven characteristics, given the situation in the US financial sector and the crisis stemming from SVB. The yen has strengthened since last Thursday, even without the BOJ’s help. This trend is only likely to continue if risk aversion remains in the driving seat.

The JPY economic calendar is light this week.

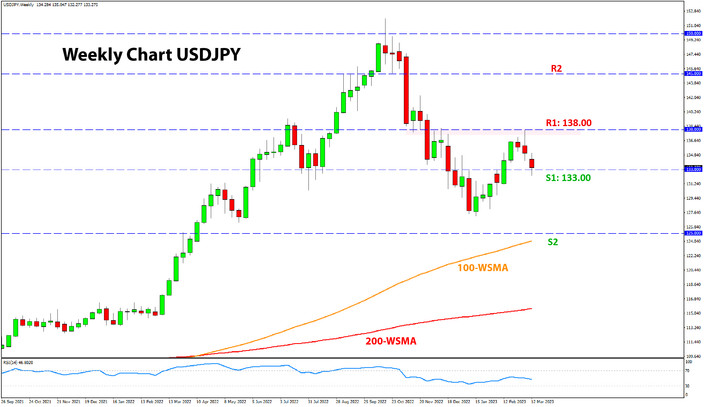

USDJPY Technical Analysis:

USDJPY briefly tested the 138.00 resistance last week and then reversed from it. By now, USDJPY has plunged through 135.00 and quickly came to test the 133.00 support, where the previous highs are located.

Below 133.00, USDJPY will find support at 130.00 and then at 125.00. The lows from January around 127.00 are also a support zone, but so far, have not proven as technically significant.

To the upside, 138.00 is now confirmed as resistance. Above it, 140.00 and 142.00 could be the next levels where resistance will exist.