USD Fundamentals: Are Markets Overreacting to One CPI Report?

A big move down in the dollar last week is seriously disturbing the established trends in the Fx market and is getting many traders, especially USD bulls, to question their outlook for the future. However, as discussed in our Free FxTR newsletter this Friday, we are of the view that this correction is rather a big overreaction to a single piece of CPI inflation data that is not changing (for now) the broad macro factors that are USD bullish.

Even ECB Vice President Luis De Guindos commented on Friday that markets may have overreacted to the US CPI report. Indeed, that’s what it seems like, as US inflation at 7.7% y/y is still way too high from the Fed’s target of 2%. The road down to 2% is a long and hard one, and Fed members are already pushing back on the rumors for a “pivot”. More interest rate hikes and QT from the Fed are coming, and when markets realize that, we may get the start of a new bullish USD leg.

Nonetheless, in the very short term, the USD correction/consolidation may continue as the giant retracement last week will surely scare traders. Still, the broad bullish factors of a stronger US economy compared to Europe and the rest of the world remains in place. Inflation in the US fell sharply, as the CPI report showed last Thursday, but this only means that inflation will fall even more sharply in Europe and elsewhere (since their economies are still running weaker). This is not a bearish USD dynamic; in fact quite the opposite. USD strength may return with a vengeance, and that’s something Fx traders should be careful about in the coming weeks.

The final outcome of the mid-term election is not yet known, but so far, it appears that Democrats should retain the Senate while Republicans will get the House. This should not have big near-term implications for the dollar at the moment. The US calendar this week is much lighter with no 1st tier market moving events scheduled, so the focus will be on the various Fed speakers and reports like retail sales (Wed) and Philly Fed Manufacturing Index (Thur).

EUR Fundamentals: EURUSD Jump Not About Individual Euro Strength

The big jump in EURUSD last week makes it seem like the euro currency is getting stronger, but a look at other Fx pairs reveals that it’s not what happened. For instance, the other major EUR pairs of EURJPY, EURCHF, and EURGBP closed the week lower or unchanged. Only the Canadian dollar was a weaker currency than the euro last week (EURCAD closed higher). So, the EURUSD jump is more related to a broad retracement in the dollar than any individual EUR-specific strength.

The “perceived” improvement in risk sentiment is certainly helping the EUR also. Following the US CPI report Thursday, bond yields fell, and stocks rose – a clear indication that sentiment is turning more optimistic. However, whether that will last is a very different story.

The weather across the European continent remains unusually warm for mid-November, keeping the need for heating at a minimum and, therefore, gas storage full. However, that will begin to change this week when temperatures in central and northern Europe are set to drop closer to the freezing 0°C. Gas storages will begin to decline as a result, and we may see upward pressures on LNG prices soon. The help for the euro from lower gas prices may have run its course, and if gas prices indeed start to increase again, it could be a renewed EUR bearish factor.

The EUR calendar this week is again relatively light, except for tomorrow (Tuesday) when the German index ZEW Economic Sentiment and Eurozone flash GDP data will be released. The ZEW index is a leading indicator for economic activity in Europe and is set to remain near multi-decade lows, suggesting a deep recession in the Eurozone is very likely in the coming months.

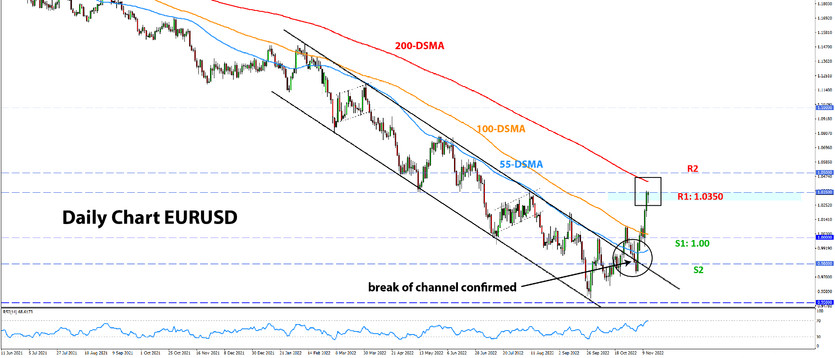

EURUSD Technical Analysis:

The break of the EURUSD bear trend is finally confirmed as the pair pushed strongly through both the 1.00 and 1.01 resistance zones last week. From a technical analysis perspective, at least a larger correction, or potentially a full-scale reversal of the bearish trend, has started.

EURUSD is now testing the 1.0350 resistance zone, which, as we described in Friday’s newsletter, is quite important. This is where the high from August this year sits, converging with a strong Fibonacci zone. The resistance here should be tough, which means if EURUSD breaks higher, 1.05 – which is the next resistance higher – could be reached fairly quickly.

To the downside, the former resistance at the parity zone (1.00) would now be a solid support.

GBP Fundamentals: Focus on Thursday’s Budget Announcement in a Potentially Volatile Week

Sterling also benefited from the “dollar correction” story last week, and cable (GBPUSD) was a big gainer – 500+ pips on the weekly close. The suddenly “good” risk environment also helped to lift the pound as other risky currencies against the safe-haven dollar. However, much like the euro, the pound is facing the same long-term economic issues, and perhaps in some aspects even worse. A deep recession is coming, and the UK is not energy independent, meaning high gas and electricity prices are a big problem.

It is going to be a very active week on the GBP pair as the calendar is packed with market-moving reports and events. The main and biggest focus will be on the Government tax announcement on Thursday when UK Treasury Chancellor Jeremy Hunt will reveal how much spending cuts and tax increases are in the plan of the new Government. While this could be good for the pound in the long term, over the short term, it means more pain for the economy, thus definitely not very GBP bullish.

On the calendar, Fx traders will also watch the UK jobs reports (Tue), CPI inflation (Wed) and retail sales (Fri). Additionally, there is also the BOE’s testimony before Parliament scheduled for Wednesday. All of those events and reports are potentially very market-moving, so we should brace for higher volatility across GBP pairs this week.

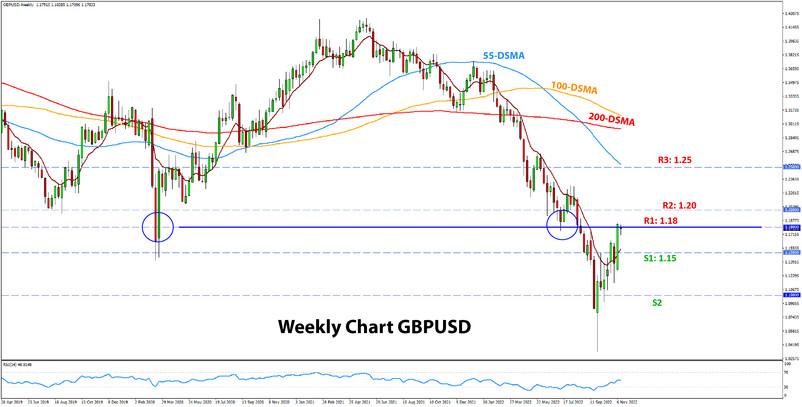

GBPUSD Technical Analysis:

GBPUSD reached the 1.18 resistance zone on the correction higher, and now the big 1.20 area is also coming into focus. 1.18, though notable, is not a particularly strong resistance. So, GBPUSD could soon push further higher and test 1.20 as well (especially given this week’s busy calendar, anything is possible).

The fact that the pair now also has a strong close above the 55-day (blue) and 100-day (orange) moving averages is also casting a bullish bias. The 200-day MA (red) is sitting around the 1.21 level, which could mean that the wider 1.20 resistance could stretch 100-150 pips higher.

To the downside, 1.15 is now the first technical zone in line, ahead of the now “distant” 1.10 area.

JPY Fundamentals: Yen Gains Big as Bond Yields Plunge

The yen was the strongest currency in major FX for the past week, with USDJPY closing some 850 pips in the red. The strength of the yen may be a little puzzling, given that risky assets rebounded and risk-sensitive currencies (AUD, NZD, CAD) also gained in the past week.

It’s strange that the supposedly “safe-haven” yen was the strongest currency in a week positive for risk sentiment. However, that indicates that the move was more related to the falling bond yields (especially US Treasuries), which was also big. The 10-year US Treasury bond yield is now below 4.00%

The outlook for the yen will thus remain connected to the performance of bond yields. Given the scale of the decline last week, yields may be in for a rebound soon, which could fuel a bounce in USDJPY too.

Japan’s economic calendar is light this week, though Friday’s National core CPI report will be worth watching to see how inflation is developing in Japan. It is unlikely that it will have a notable near-term impact on the JPY exchange rate, however.

USDJPY Technical Analysis:

The daily chart of USDJPY shows that a potentially critical downside break of the uptrend is unfolding. Not only did USDJPY crater through the 145.00 support zone and the 55 and 100 DMAs, but it also broke and closed the week below the 140.00 level.

These are some significant technical developments on the larger charts and would certainly be a very bearish signal had it not been the strong uptrend that precedes this downside correction. However, the powerful and extensive uptrend dims this signal and makes it slightly less reliable. The reason is that USDJPY has merely corrected by around 38.2% of the uptrend after last week’s moves, which is by no means a deep correction yet.

Also, such a surge in volatility is very common during powerful and extensive uptrends, and the almost 800 down move last week could easily be followed by a 400-500 pips move up this or next week. When volatility increases, it means that the market is more likely to move sharply in both directions, so this is something to be careful about.

USDJPY is testing the 140.00 support now. A break lower could result in a quick extension to the next support at 135.00. To the upside, 145.00 is now a clear resistance.