USD Fundamentals: Fed Decision Time - Pivot or Not?

The dollar extended the downside correction last week, although it managed to rebound partially on Thursday and Friday for the DXY dollar index to close above the 110.00 support zone. After the speculation that the Fed is reading to pivot (shift) dovish at this Wednesday’s meeting, new rumors (from the same WSJ source) suggested over the weekend that may not be the case. The dollar is continuing the rebound today as a result.

In what is likely to be a volatile trading week, given the Fed’s meeting on Wednesday and Nonfarm Payrolls release on Friday, we may see tight trading ranges ahead of these events. The Fed meeting is the big event, where they are expected to hike rates by 75bp again. More important, however, will be their forward guidance for the rate hike in December - whether it will be another 75bp or a smaller 50bp. The forward guidance for future rate hikes has the most potential to move markets big time on Wednesday.

After the Fed, expect the focus to quickly turn to the NFP report. If the Fed meeting passes without much volatility, the Fx market could stay in ranges into Friday’s release of the jobs reports. The consensus forecasts stand at 200K for the NFP, 0.3% m/m for average hourly earnings, and 3.6% for the unemployment rate. More strength in the employment data will only further solidify the case for a more hawkish Fed for longer. Such a scenario should be bullish for the US dollar.

Other economic data worth watching this week are the ISM manufacturing PMI (Tue) and the ISM services PMI (Thur).

EUR Fundamentals: Dovish ECB Hike Keeps Bearish Bias on Euro Intact

The European Central Bank raised interest rates by 75bp at their meeting last Thursday but delivered rather dovish guidance in the statement and press conference. They admitted the economy is slowing and view the risks to economic growth as tilted to the downside. This is why the EUR market reaction was rather bearish, as the ECB’s message clearly means that they won’t be able to hike rates many more times from now on.

The Eurozone economic calendar this week features mostly 2nd tier reports, aside from the already released today CPI inflation data which brought another upside surprise. Headline CPI was a significantly higher 10.7% vs 9.9% forecast, while the core CPI increased by 5.0% vs a forecast of 4.8%.

All in all, the inflation data is more bad news for EU policymakers as it fully confirms the stagflationary environment that the continent faces. Unfortunately for the ECB, there is not much they can do to quickly lower inflation, as Europe’s high CPI readings are largely a factor of high gas and energy prices.

ECB rate hikes can’t help to bring down those in a short time, and more rate hikes would only do damage to growth - making things worse than they already are. In light of this, the EUR currency is unlikely to exit its downtrend against the strong currencies (e.g., USD, CHF), at least not until we exit the stagflation environment. That seems to be at least several months away.

EURUSD Technical Analysis:

Interestingly, EURUSD broke the bearish channel to the upside last week, only to reach the 100-day moving average near the 1.01 level (orange line) before sleeping back below parity (1.00) by the Friday close. This is not the most bullish price action in a breakout, to say the least.

In fact, EURUSD could soon be headed even lower again. Yes, the channel was broken, but the slip back below 1.00 indicates the chances of it being a fake-out are pretty high. Moreover, the 100-day moving average held as resistance, which is an important indicator within trends.

EURUSD is now moving down toward the 0.9850 level, which should be the first support zone. It is the confluence of the 55-day moving average (blue line) and the prior swing highs. A bearish break here would reinstate the firm bearish break, and we could see EURUSD go for the 0.97 lows quickly after (which is the next support).

GBP Fundamentals: Bank of England Meeting in Focus

Markets celebrated the appointment of Rishi Sunak as the new leader of the UK’s Conservative party and Prime Minister following the resignation of Liz Truss. The gilt bond market calmed down while the pound rallied and recovered all Truss-induced losses.

However, beyond the short-term, it’s hard to imagine GBP extending the gains on Sunak’s election alone. The economy remains in stagflationary mode, in some aspects even worse than the Eurozone. A recession in the UK is also imminent, which will make it tricky for the Government to navigate a risky environment. Moreover, there is the possibility for a further worsening of risk aversion, which would additionally hit the pound, given its correlation to global risk sentiment.

This week, the focus is on the Bank of England meeting on Thursday, for which market expectations are split between a 50bp and 75bp hike. A 75bp is seen as more likely for the sake of the BOE retaining more credibility, but it won’t have a big long-term impact either way. Like the ECB, the BOE can’t lower CPI inflation that is mainly driven by raising energy costs. Further aggressive rate hikes can only make the incoming recession worse. The pound doesn’t have much choice in this environment than to stay on the defensive versus the currently firm currencies such as the US dollar.

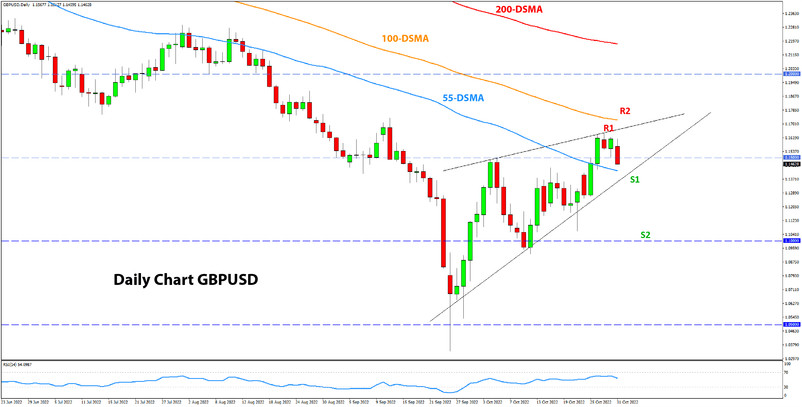

GBPUSD Technical Analysis:

GBPUSD not only climbed above 1.15 last week but even poked above 1.16 before some bearish forces emerged to take it back below 1.15 today (Monday). The resistance area between the 55-day and 100-day moving averages seems to be working for now, although the 100 DMA actually stands near 1.18.

Now that GBPUSD has returned to around 1.15, the pair may take some form of consolidation. The high of 1.1644 may be the top, but there is a possibility that GBPUSD will make another push higher to test 1.18. The 1.18 area is the more important resistance currently, ahead of the big 1.20 area.

To the downside, below 1.15, the focus could turn to 1.13 as support, while 1.10 remains the key zone further out.

JPY Fundamentals: BOJ Keeps a Firm Dovish Stance at Meeting

The yen has stabilized somewhat following the intervention by the Ministry of Finance and Bank of Japan last Monday and the Friday before it. The Bank of Japan also held its meeting last Friday, but they didn’t say anything about the intervention and in no way altered its uber-dovish stance.

By now, the BOJ remains solely the most dovish central bank. This doesn’t help the beaten-down Japanese yen, and aside from periodic interventions, there is little else that can help to stop its further losses. Chances are, if the broad USD uptrend resumes, USDJPY will soon press on the 150.00 highs again.

Japan’s economic calendar is very light this week. The yen will continue to be driven by moves in bond yields and appetite for US dollars. Rising Government bond yields around the world should keep the yen pressures as the Bank of Japan continues to artificially hold Japanese yields at around 0%.

USDJPY Technical Analysis:

USDJPY corrected to the 145.00 area last week following the BOJ intervention, where it then rebounded and closed on Friday at 147.50. What is interesting to observe here is how the price continues to react with the 9-period EMA (purple line). On the intervention, it broke below it, closed Friday almost exactly at the line, and is now moving above it again. Are we re-entering the bullish trend with this signal?

To the upside, 150.00 is coming into focus again and could soon be tested. If we break above it, 155.00 will quickly come into light as the previous high near 152.00 is not very significant in a historical context.

To the downside, the 145.00 zone is now solid support.