USD Fundamentals: Dollar Uptrend Unlikely to Be Challenged

It’s a slow start to the new trading week with the US on holiday for Independence Day. Market action will pick up from Wednesday, when the economic calendar will get busier.

The US dollar remained in consolidation last week, but we could see some breakouts this week. It’s a new month, a new quarter and the 2nd half of the year. Quarter-end rebalancing flows are over and the market may resume trading on fundamentals. And here, the dollar stands to gain, underpinned by a still robust economy and hawkish Fed. The US energy independence while the world is battling the biggest energy crisis in decades also helps drive capital to the ultimate safe-haven currency, the greenback.

In line with this, the USD bullish trend remains intact, and an eventual extension higher (in the DXY index) seems like the probable scenario. This week, traders will focus on the ISM services and FOMC meeting minutes due on Wednesday, while the main focus will be on Friday’s Nonfarm payrolls and jobs reports.

The FOMC minutes will be scrutinized for hints about the size of the rate hike at this month’s meeting (whether 50bp or 75bp). On the data front, a healthy ISM services report and strong NFP job creation could provide the needed boost for the dollar to make an upside breakout. On the other hand, a miss in forecasts could result in the dollar staying in the consolidation range.

It’s worth noting also that moves in other markets like stocks and bonds will continue to have a big impact on Forex. With a resolutely hawkish Fed, risk sentiment is set to remain fragile, which means we could see more bouts of risk aversion across markets. Ultimately, if that happens, it would still be USD bullish even if US economic data misses expectations. So, in this regard, even if this week’s reports on the calendar aren’t great, that is unlikely to be a reason for an end to the dollar uptrend.

EUR Fundamentals: Russia Could Fully Stop Gas Supplies This Month; EURUSD to Stay Under Pressure

A closely-watched event last week was the central banking forum in Sintra Portugal, hosted by the ECB. Fed Chair Powell, ECB’s Lagarde, and BOE’s Bailey agreed that more rate hikes and monetary tightening are needed to control inflation. Powell’s comment that “the negative risks of not dealing with high inflation are greater than causing a recession” gained the most attention in the news.

All in all, this firmly hawkish stance of central bankers increases the chances that we will get a recession later this year. On this front, Europe is the most vulnerable due to its proximity to the Russo-Ukrainian war and its dependence on Russian gas. The Eurozone is likely already in recession, and if Russia cuts gas supplies fully, that recession will only get more severe. This is why the ECB can’t and won’t need to be as aggressively hawkish as the Fed. And this is why the EUR can’t get much support from speculation about ECB hawkishness.

On the economic calendar last week, Eurozone CPI inflation was mixed, but the good news was that the core CPI printed 3.7%, notably lower than the consensus forecast of 3.9%. This is another testament to the much weaker economic fundamentals of the Eurozone compared to the US. For instance, core CPI inflation in the US is running at 6.0%. The Fed is in a much greater hurry to hike rates than the ECB. Thus, the euro is likely to stay under pressure, particularly against the strong dollar, with high chances that EURUSD will reach the 1.00 zone this year.

The EUR calendar is quiet this week, which means the euro will continue to trade on external factors like risk sentiment and global demand for dollars. Developments with Russian gas supplies will continue to be one of the main factors. Here, the markets are increasingly worried that Russia will completely halt gas supplies soon. This would be bearish for the euro and would likely lead to an extension of the downtrend.

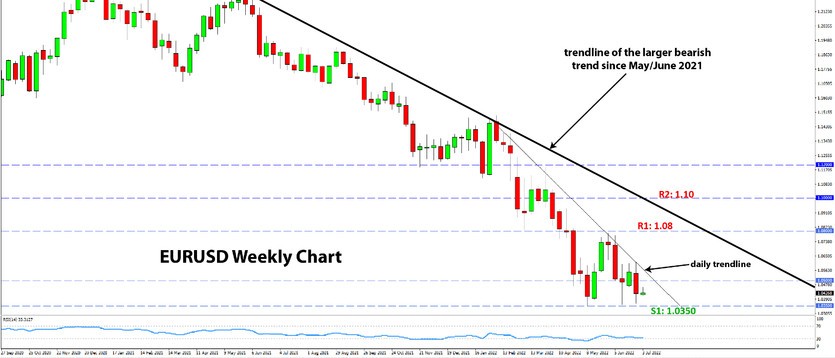

EURUSD Technical Analysis:

The technical situation on the weekly EURUSD chart remains little changed over the past month or so. The pair is in consolidation since the low in mid-May at around the 1.0350 level.

Two further attempts on the 1.0350 support were rejected in recent weeks but without any strong bullish signal. Thus, the trend here remains down, and a break below 1.0350 should give the signal that the trend is ready to continue.

To the upside, the 1.08 and 1.10 zones are strong resistance. As a result, any retracements higher are likely to hit a wall at these resistance zones. To the downside, below the 1.0350 low, Fx traders will watch the parity level (1.00) as the target area for short EURUSD positions.

GBP Fundamentals: Oversold, but Global Recession Risks Will Keep Sterling Weak

The pound sterling remains stuck in ranges with a bearish bias. The currency has already fallen a lot, but the weak fundamental picture isn’t allowing for any relief rally to transpire for now. Much like the Eurozone, the UK suffers from a bearish “stagflationary” cocktail of high inflation due to an external shock (Russia) and the weak economy. Thus, rate hikes from the Bank of England alone are unlikely to provide much help for GBP.

While the oversold conditions suggest GBP losses from here may be slower, the risks for a further extension of the downtrend (particularly vs USD) are not negligible. In fact, with the probabilities for a global recession increasing and risk aversion being the dominant market theme (stocks are in a bear market), there are clear risks for a disorderly GBP sell-off on new adverse shocks. This is what happened during the March 2020 risk-off episode on the outbreak of the Covid pandemic when GBPUSD fell to as low as 1.14. A repeat of such a scenario is possible if we see a major risk aversion sell-off as we saw in March 2020.

On the other hand, the pound may indeed be near the lows if global markets stay calm, and we don’t see a further major escalation in the Russo-Ukrainian war. However, for now, the market is clearly worried about the former scenario, and GBP is likely to stay pressured as long as that is the case. The UK calendar is quiet for the week ahead, with only BOE speakers being of interest to Fx traders.

GBPUSD Technical Analysis:

The bears made another attempt on the 1.20 level last week, the 2nd during the month of June. But, this attempt was rejected too, and GBPUSD is now again trading above the 1.20 level, which is the key support zone in the current context.

However, the overall technical dynamics on the weekly chart remain bearish. GBPUSD is still trading well below the falling trendline that defined the bearish trend since February. As long as that is the case, the bulls won’t feel confident in keeping or adding to buy positions.

Thus, the key resistance for GBPUSD is at the trendline, now standing at the 1.23 zone. Above it, 1.25 will also provide strong resistance. In fact, even if GBPUSD breaks above the trendline but fails at 1.25, the bearish trend would likely be intact. Such a setup would likely indicate an attempted fake breakout of the falling trendline.

JPY Fundamentals: The Trend Is Bearish, but Risks Are Growing For a Surprise Yen Surge

The uber-dovish stance of the Bank of Japan remains the main factor that keeps the bearish JPY trend intact. However, with fears for a global recession rising rapidly over the past week, bond and commodity markets have responded with a classic risk-aversion reaction. That is, commodity prices and bond yields are falling. As a result, the yen’s slide has also been halted.

Many traders are now asking themselves if this could be the top in JPY pairs. If commodities and bond yields continue to fall, then the answer is yes. Remember that rising commodities and yields were the main factors that pushed JPY pairs higher since the start of this year. If those trends reverse, then we can expect JPY pairs to reverse as well, even if the BOJ doesn’t do anything.

With the word “recession” now taking over the term “inflation” in news headlines, it will be no surprise if we get a major risk-off wave of selling in equity markets. This will likely lead to JPY strengthening due to its safe-haven characteristics. While until a few weeks ago, investors were worried about Japanese officials intervening in the Fx market to stop excessive yen weakness. It now seems they won’t need to if a recession will do the job for them.

USDJPY Technical Analysis:

USDJPY touched the 137.00 level last week but was quickly rejected from it. This was the second bullish attempt on this zone in a row, having already been rejected there the week before. As a result, two doji candles have formed on the weekly USDJPY chart, which Fx traders may take as the first sign that the trend here is getting tired.

Nonetheless, the bullish trend is still fully intact, and there are no bearish signals yet. Thus, most traders are likely still looking for upside continuation in USDJPY. The first support they look at is the 135.00 zone. With USDJPY staying above it for the past two weeks, 135.00, it has proven an important enough line in the sand for short-term sentiment. A break below 135.00 could as well be the first signal that USDJPY is ready to take a deeper dive down. In such a case, the next support traders will be looking at is 131.50 and then 130.00.

To the upside, a break above 137.00 may indicate more bullish potential. However, these levels already being in uncharted territory, it’s hard to say which levels would provide resistance above 137.00. The psychical round number levels of 140.00 and 145.00 are obvious focal points, but other than that, technical traders will need to look at other indicators to gauge where bearish pressures may emerge at higher USDJPY levels.U