USD Weekly Fundamental Outlook: Has Inflation Peaked? Dollar Consolidation May Extend as Bond Yields Fall

The dollar continued to consolidate lower over the past week, driven mostly by sharp moves in other markets, while Fx action remained subdued. While a few days ago, everyone feared inflation, a series of bad leading indicators (PMI reports) from developed economies and falling commodity prices turned this around, with many now questioning if we might be near the peak of inflation.

The large drop in commodity prices (including oil) helped to relieve inflation fears, and the focus has turned to the risks of an incoming global recession. If inflation is really peaking here, it will have significant implications for central banks. They will likely not need to tighten and hike rates as aggressively as currently anticipated. The Fed would probably also tone down its hawkish stance in such a scenario. The markets already adjusted rate hike expectations lower last week, which is the reason behind the extension of the USD correction and the fall in bond yields.

But, it’s not just Fed rate hike expectations that declined but for all other central banks too. So, while peaking inflation might mean some of the trends in global markets will reverse, in Fx the US dollar still stands to gain on two pillars in the months ahead – via the yield differential factor (higher rates than other countries) and via the safe-haven factor given the overall risk-off tone in markets this year. Both of these are unlikely to change soon, regardless of whether the Fed proceeds with the aggressively hawkish plans or dials down a bit.

Ultimately, the better-performing US economy and the country’s energy independence are the two fundamental bullish USD factors. This is what allows the Fed to be more hawkish than other central banks and deliver more aggressive rate hikes. So, even if the Fed turns less hawkish in case inflation has peaked, other central banks would likely turn even more dovish in such a scenario. Therefore, the US dollar should still largely remain a winner.

On the calendar, PCE inflation (Thur) and the ISM manufacturing (Fri) will grab the main attention. High inflation prints and above estimates numbers in the ISM manufacturing should prove USD bullish again, while a miss may extend the dollar correction. There will be several Fed speakers throughout the week (including Powell) as well as other economic data like consumer confidence and final GDP. Overall, depending on the outcome of these events, the USD may extend the correction lower, particularly if inflation fears further abate this week, e.g., via further decline in commodities or lower (US) PCE and (Eurozone) CPI inflation readings.

EUR Weekly Fundamental Outlook: Euro Stabilizes, but Recession Risks Mean Bearish Pressures Will Likely Resume Soon

The Eurozone manufacturing and services PMI reports released last Thursday were all dismal, missing expectations by wide margins. This confirms the negative outlook for the economy in the face of the Russo-Ukrainian war. Furthermore, the recent sharp increase in European gas prices (TTF futures contract) as Russia further cuts supplies is another fresh negative for the EUR currency.

Yet, the euro held up last week, though largely due to external factors. In an overall wild action in bond and commodity markets, Fx took a back seat, allowing for some consolidation to transpire. However, the already established Fx trends are unlikely to change soon, with the bearish dynamics for the EUR currency remaining fully intact. A recession in the Eurozone later this year now looks like the probable scenario, with economic fundamentals much weaker than peer economies due to Europe’s reliance on energy imports. With Russia unlikely to increase gas flows any time soon, prices remain high and will keep weighing on the economy.

The focus on the economic calendar this week is CPI inflation. CPI reports from various EU member states will start rolling in from Wednesday, while the main attention will go to the aggregate CPI inflation report for the whole Eurozone due on Friday. However, traders need to particularly watch the German and French CPI reports, which are released on Wednesday and Thursday and may have an early impact on the market.

Markets will also focus on the annual central banking forum in Sintra Portugal that starts today and will last until Wednesday. There will be many speakers, including Fed chair Powell, ECB’s Lagarde and BOE’s Governor Bailey. The markets will listen closely as central bankers may use this opportunity to hint at important policy changes (they’ve done so in past years). Nonetheless, if they don’t announce anything big, we will likely see only muted market action.

EURUSD Technical Analysis:

EURUSD is still trading inside of the downtrend channel that started in February but is making another test at the trend’s resistance line today. The trendline resistance is currently located at the 1.06 zone on the daily chart. The still strong momentum of the bears suggests a bullish breakout is unlikely to come easily here.

In any case, if a break above 1.06 happens, the next resistance is at the prior highs around 1.08. In such a case, EURUSD will need to be looked at within the larger context (weekly/monthly charts). But those are also in a bear trend that started with the highs from one year ago (May 2021).

To the downside, support is now solidly standing at the 1.0350 zone. The 1.05 level will remain an important technical point on the charts if EURUSD starts moving down again.

GBP Weekly Fundamental Outlook: Ugly Retail Sales Confirms Stagflationary Economy; Pound to Remain Out of Favor

UK economic data released over the past week confirmed the stagflation state of the UK economy. Inflation remained high, though it came in largely within expectations, therefore not causing a big GBP reaction. The big surprise was the Friday retail sales report, which had an ugly revision lower of the previous month’s solid number.

A squeezed UK consumer due to high prices means the economy will continue to weaken while inflation is set to remain elevated. This bearish “stagflationary” cocktail is the dominant theme driving GBP performance. Ultimately, this will limit any potential for BOE hawkishness going forward and should keep the British currency under pressure.

That being said, it’s worth keeping in mind that the stagflation situation is similar pretty much everywhere. The UK economy may only be earlier in the cycle and experiencing the symptoms ahead of others. This could help limit further GBP losses. In addition, the currency has already fallen a lot and is quite oversold at these levels. The scope for further steep losses is certainly smaller compared to 2-3 months ago when GBPUSD was still trading above 1.30.

Still, barring any good news, the pound will remain under pressure, and the main risk is that the BOE will have to disappoint the bulls and deliver less than the 150bp of hikes expected by markets for the next six months. Thus, the bias for GBP remains bearish with risks for an extension of the downtrend.

The UK economic calendar is very quiet for the week ahead, with only the speech from Governor Bailey at the Sintra central banking forum on Fx traders’ radar.

GBPUSD Technical Analysis:

The GBPUSD daily chart looks almost like a replica of EURUSD. But, of course, GBPUSD’s losses were steeper than EURUSD’s since the February highs.

Trendline resistance of the bear trend for GBPUSD stands at the 1.2350 - 1.2400 zone. Similarly to EURUSD, strong bullish forces (supported by a fundamental catalyst) will likely be needed to push through this area. Above this trendline, the next resistance is at the prior local highs from last month around the 1.27 zone.

On the downside, the main focus remains on the 1.20 area as the crucial support. Before it, 1.2150 could offer some bullish pressures, but this support is only of moderate importance.

JPY Weekly Fundamental Outlook: Recession Fears and Fall in Bond Yields Help Yen Recover

Just a few days after the uber-dovish BOJ meeting – when the yen sold off sharply – global factors came to the rescue, and USDJPY escaped a further runaway move higher. As global economies weaken (the US joining too, though still holding better than others) and central banks press on with even more forceful hawkish actions, bond markets reacted with a flight to safety last week on growing recession fears. Bond yields fell as a result of reduced inflation fears, also notably helped by a broad-based slide in commodity prices.

This translated into positive flows for JPY, as remember that the main reasons for its sharp weakness were the rapidly rising bond yields since the start of the year, then further aggravated by the rising commodities due to the Ukraine war. Both of these corrected last week, and thus it’s understandable to see the JPY benefit from this. In fact, it has not yet benefited to the extent the decline in bond yields and commodities would suggest. So the JPY may have scope to regain some more, particularly if the fall in bond yields and commodities sticks.

With the Bank of Japan holding policy firmly unchanged, the yen’s performance will continue to be driven almost entirely by external factors. Thus, the developments in bonds and commodities will remain critical for JPY pairs in the short term.

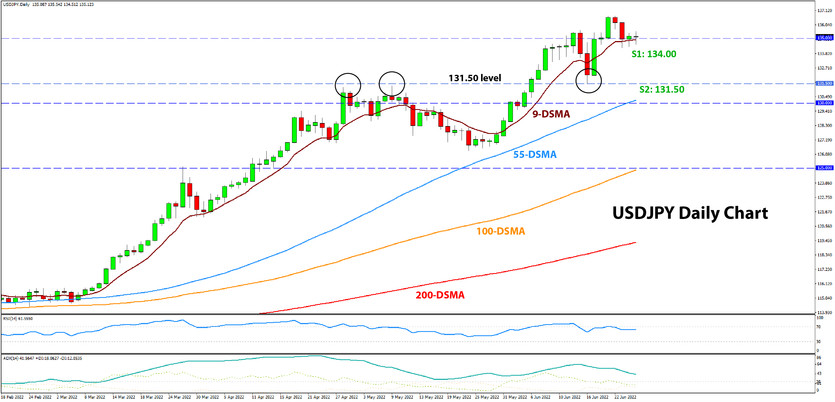

USDJPY Technical Analysis:

USDJPY has backed off a little from the highs above 136.00, but nonetheless, it remains well within the powerful uptrend. This, of course, doesn’t mean some further correction to the downside can’t happen.

Traders will watch the 134.00 zone as the first local support for that. The more important support, however, is at the 131.50 zone. A break below it could trigger a deeper correction, potentially below the 130.00 mark.

To the upside, Fx traders are looking at uncharted territory above 136.00 for USDJPY. Major historical highs from 24 years ago are at the 145.00 area, but that is far from current levels. Thus, if USDJPY resumes the upward move, Fx traders could be better off using trend-following indicators and trailing-stop tools to potentially trade such a USDJPY scenario.