USD Weekly Fundamental Outlook: Uptrend Ready to Resume?

The dollar finished the past week moderately stronger, finding a bid into the Friday close on that solid Nonfarm payrolls report. Coming in at 390k, the NFP beat the consensus expectations of 325K. Other parts of the jobs data were mixed but healthy overall and will undoubtedly keep the Fed firmly on its hawkish trajectory of quantitative tightening (QT) and 50bp rate hikes. Thus, after two weeks of correcting lower, the dollar may be ready to rebound higher again and can perhaps even resume its uptrend to fresh highs.

The long-term bullish factors for the US dollar haven’t changed. With inflation being slow to come down from 40y highs above 8% and the jobs market robust, Fed communication is set to remain very hawkish. QT starts this month and, coupled with the 50bp rate hikes, will deliver a significant amount of monetary tightening this year. Such instances of massive Fed tightening tend to be broadly positive for the US dollar and relatively negative for risk assets. This means that the US dollar may continue to receive support from a slight risk-averse environment in the coming months, in addition to the yield advantage coming from the Fed interest rate increases.

The CPI inflation report on Friday is the main focus on this week’s economic calendar. The dollar can strengthen if inflation prints above the consensus forecasts of 8.3% headline and 5.9% core y/y. A downside surprise in these numbers, on the other hand, could result in the USD staying in its consolidation range.

EUR Weekly Fundamental Outlook: Focus on ECB Meeting and Speculation of 50bp Hikes

Last week we sent this newsletter, discussing why the euro is in a lose-lose situation and is therefore likely to remain weak over the coming months.

ECB communication has been turning increasingly hawkish recently due to the several high CPI inflation prints that took Eurozone inflation above 8% y/y. Some hawks on the ECB governing board (Klaas Knot) even touted the idea of a 50bp rate hike at the July meeting. Fx and bond markets have responded and repriced higher expectations for ECB tightening, and this was reflected in the upside correction in EUR currency pairs.

The EUR may remain resilient in the very near term as the thought of a large 50bp rate hike by the ECB is a new and entertaining idea for markets to speculate on. Traders will hence especially watch the ECB meeting this Thursday for any inputs about this and for clues into the ECB’s thinking. However, it’s worth noting that the most recent speeches by President Lagarde were much more toned-down and neutral compared to some of the ECB hawks.

The ECB keeping a similar neutral message looks like the most likely scenario for this meeting on Thursday. Around that, there are possibilities for a hawkish or dovish surprise, depending on what the ECB will choose to focus its worries on:

1) more worried about inflation (hawkish - considering 50bp rate hikes as an option – EUR likely bullish reaction on Thursday)

2) or about the deteriorating growth outlook (dovish – possibility for 50bp hikes dismissed – EUR may sell-off this Thursday).

However, despite the hawkish talk, how much the ECB can actually do remains a big question. The likelihood of the ECB out-hawking the Fed and other hawkish central banks this year is pretty low. For instance, the dismal growth outlook is likely to be the big negative that will eventually stifle any efforts by the ECB to tighten policy. The divergence between the ECB and the rest is here to stay; thus, the euro is unlikely to have bottomed yet for this cycle.

The EUR calendar this week is very quiet other than the ECB, which means we may see little volatility in EUR pairs outside of the Thursday meeting.

EURUSD Technical Analysis:

The EURUSD retracement lost momentum as soon as the pair entered the 1.07 - 1.08 resistance zone. The attempt was held back, though a convincing sign that the bulls have been rejected here is yet to come. EURUSD remains close to the resistance zone and opened the new week above the 1.07 level.

While a break through this strong 1.07-1.08 resistance zone is not likely – should it happen – EURUSD could accelerate the corrective move higher. Still, even in this scenario, the next important resistance is not far at the 1.10 area. This is also a robust resistance area; in fact, a more critical one based on the weekly and monthly charts.

To the downside, 1.05 and 1.0350 remain the technical levels worth our attention. Below them, traders’ focus will shift to the parity zone (1.00) as the next support zone.

GBP Weekly Fundamental Outlook: Corrective Bounce Close to Running Out of Steam

Following that rebound from mid-May into the month-end, it seems the pound has completed or is near to completing its retracement phase. The positive surprises in UK economic data and some stretched oversold conditions helped to drive the rebound. However, the market is now much more balanced as extended short positioning has been reduced and can open up space for fresh downside action if the conditions turn bearish again.

Fx traders are likely to return their focus on the medium to longer-term factors, which still look rather unfavourable for GBP. The outlook for the UK economy, with a slightly different mix, is similar to the Eurozone – deteriorating fast. In addition, the Bank of England has already done its job by hiking rates several times and is now about to pause as it becomes more worried about the negative hit to economic growth. The gradual dovish shift at the BOE can potentially create a divergence with the ECB, which is just beginning to talk hawkishly. This could help to drive EURGBP further higher during the summer months. The outlook for GBPUSD remains bearish with clear risks that the 1.20 area will be traded some time this year.

The UK calendar is very quiet this week. UK political noise is back on the radar with PM Boris Johnson set to face a no-confidence vote later today (6 pm UK time). Still, this is unlikely to move GBP much because a change in political leadership is unlikely to alter economic policy, which is what Fx investors primarily care about.

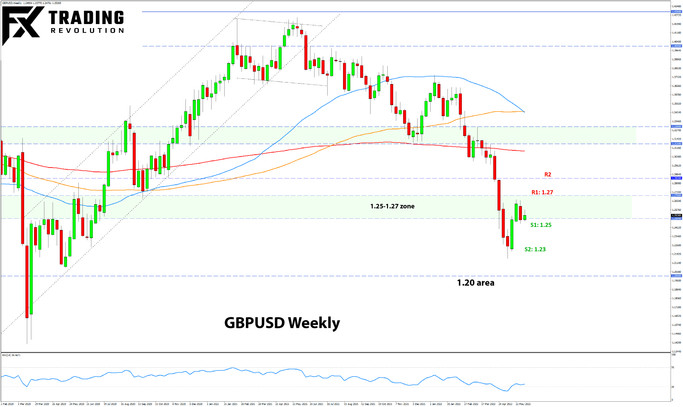

GBPUSD Technical Analysis:

GBPUSD is giving the first signs that the upside correction may have peaked. Namely, last week’s candle is a bearish engulfing pattern, suggesting strong selling forces are present at that 1.2650 - 1.27 zone near the high.

If GBPUSD attempts to move further above this resistance, the upside correction may extend higher. The 1.2850 zone above will be looked at as the next resistance in line and the last one before that significant 1.30 area.

Looking at the downside potential, 1.25 is proving a stubborn support and GBPUSD is rebounding from it today. However, a fresh move below 1.25 could unlock a new bearish impetus that may quickly take GBPUSD toward 1.23, which is the next key support lower based on the daily chart technicals. Below it, the focus will shift solely on the big 1.20 historical and psychological support area.

JPY Weekly Fundamental Outlook: Rebound in Yields Sends Yen Lower Again

The yen continues to retain the high correlation with US Treasury yields. The rebound in US Treasuries since the start of this month has coincided with a strong rebound in USDJPY and in other JPY pairs by extension.

Therefore, the outlook for US yields remains key for where JPY will be moving. Fx traders should, in this sense, also look at the bond market, particularly the 2-year and 10-year Treasury yields. With the US economy still running at a solid pace and the Fed starting QT, upside pressures on US yields are likely to remain. However, given the sharp move higher this year, the pace of the ascent may now slow down considerably compared to the March/April episode. This means that USDJPY’s climb higher will likely also be slower than before.

That being said, downside risks for USDJPY will remain tied to a potential reversal of the uptrend in US yields. That doesn’t look likely for the near term but could possibly come later this year if the Fed pivots hard from the hawkish trajectory (e.g., either takes a pause in rate hikes or starts outright easing policy again). However, as noted, that is a story for much later, and for now, USDJPY is likely to stay pressured to the upside.

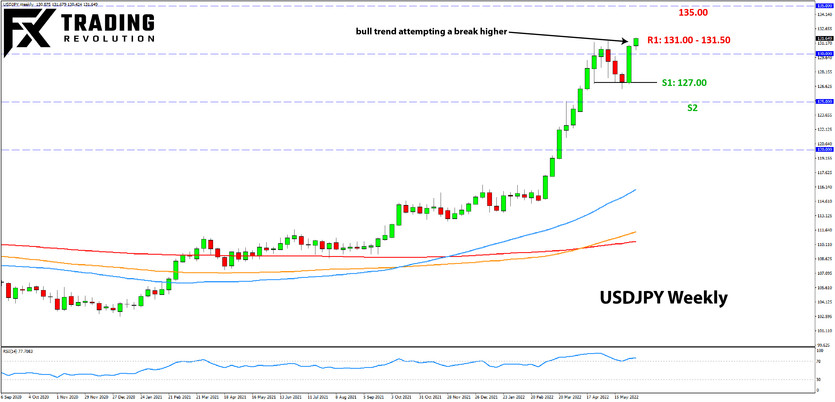

USDJPY Technical Analysis:

USDJPY gained almost 400 pips in the last week, recording a tall green candle on the weekly chart. The pair is back to the previous highs at the 131.00 – 131.50 resistance zone. USDJPY is now facing a test of whether this bullish move has the power to break higher or will the attempt be contained by the resistance here.

A break above 131.00 – 131.50 would likely lead to upside continuation, with the 133.00 and 135.00 zones coming into focus as the next resistance zones higher.

To the downside, the 127.00 zone of the rebound has now become a key support on the weekly chart. 125.00 below it remains an important technical area.