USD Weekly Fundamental Outlook: Fed 50bp Hike and QT Start Should Keep the Dollar Firm

The opening week of a new month usually comes with a busy economic calendar, and this one is no different. The main highlights in the US are the Fed meeting on Wednesday and the Nonfarm Payrolls report on Friday. The other reports that markets will focus on are the ISM manufacturing PMI (now released at 55.4 vs 57.5 estimate) and the ISM services PMI (due Wed).

The main attention will be on the Fed. They are expected to raise rates by 50bp and announce the start of QT. This is almost fully priced into the market, so the scope for surprises is mainly in the forward guidance and press conference with Chairman Powell. If there are surprises, they are likely to be on the hawkish side (e.g., a larger 75bp hike). Thus, the risks for a USD correction seem small, despite the overbought conditions on some technical indicators due to its sharp rise in recent weeks.

The longer-term trend, which is the divergence between the hawkish Fed and other central banks that are either less hawkish or outright dovish (e.g., BOJ), will likely keep the dollar strong during this and in the coming weeks. Aside from the hawkish Fed supporting it, another reason for the strong dollar is the weakness in other currencies (more about this in the sections below).

On Friday, the NFP report is expected to show 400K jobs were created in April, while the unemployment rate is forecasted at 3.5%. If the actual numbers are anything close to this or stronger, they can only provide further support for the dollar as this will be fully in line with the very hawkish Fed.

EUR Weekly Fundamental Outlook: Will the Russian Gas Stop Flowing? Euro Under Renewed Pressure as EU Considers Complete Ban on Russian Oil

The big news last week on the Russia-West front was that Russia had halted gas flows to Poland and Bulgaria after the two EU countries failed to make payment in roubles. This news added to the already bearish sentiment on the EUR currency and pushed its downtrend to new cycle lows.

The European energy crisis remains in focus this week as the EU should announce a new (6th) package of sanctions against Russia. Rumors suggest this could include a complete ban on oil and gas imports. If this is the case, gas and oil prices may push higher again, while the EUR currency will likely go the other way.

Economic data last week provided more evidence of the stagflationary environment in Europe (high inflation, low growth). CPI inflation came in at a record 7.5%, while the core CPI also increased to a record 3.5%, further highlighting the unpleasant situation the ECB currently finds itself in. They have to hike rates and stop quantitative easing because inflation is getting uncomfortably hot, while at the same time, this will additionally hurt the already weakening economy.

Given this backdrop, little can offer support to the euro, and the downtrend is likely to stay intact. Another factor contributing to the bearish EUR sentiment is China and the slowing economy there due to new harsh Covid lockdowns. China is the largest trading partner of the EU, so any economic weakness there is quickly felt in Europe as well.

The EUR calendar is rather light this week, with only 2nd-tier reports, with the highlights being retail sales and some German factory orders and industrial production data.

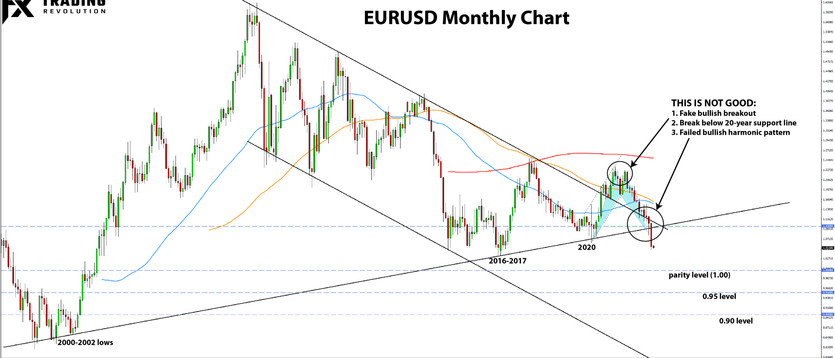

EURUSD Technical Analysis:

It is time for an update of the monthly EURUSD chart. A key development in April is the effectual bearish breakout of the 20-year support trendline (see chart below). In simple terms, this bearish breakout was confirmed with the very weak close (tall red candle) and the break of the 2020 Covid low around 1.06. Technically, this is a clear bearish signal and implies that EURUSD’s destination is toward the next important support area, which is parity (1.00).

Moreover, it is important to note that the 1.00 level is not a major support area, but a rather modest one (based on monthly chart perspective). The more important support areas are located below 0.95 and toward the 0.90 area. That’s some 1500 pips below current levels. If such a move transpires, it will be history in the making for EURUSD.

To the upside, monthly resistance is found at the 1.10 area. This technical zone should now hold and reject any potential bullish attempts – should they happen – to keep the bearish breakout intact. Remember, this is a monthly chart, so tests of the 1.10 area and above can happen, but the monthly close is what matters. If EURUSD stays below 1.10 in the coming months, the technicals on this chart will remain bearish.

GBP Weekly Fundamental Outlook: BOE to Keep a Toned-Down Hawkish Stance, Unlikely to Alter Pound Bear Trend

GBP got hammered last week as the market finally comes to the realization that the UK economy is facing serious troubles ahead, and the BOE needs to shift dovish (or at least much less hawkish than previously thought). The Bank of England already provided a slight dovish surprise at the previous meeting, and at this Thursday’s meeting, they are likely to keep the same cautions language from last time.

So, although the BOE will hike rates by 0.25bp on Thursday, this is unlikely to alter the now strong bearish GBP trend. The bank will likely keep dovish guidance by focusing more on the risks to economic growth than on upside inflation risks. This should also be evident in the MPC votes (8-1 expected), with at least one MPC member likely to dissent against the rate hike.

That being said, there is a risk for a near-term GBP rebound due to the oversold conditions as a result of the steep decline over the past two weeks. However, it’s difficult to say whether the BOE event could be a trigger for such a bounce or it could be something else. At the same time, it will not be a surprise if a bounce doesn’t happen at all, given the strong bearish dynamics.

Finally, traders should take note of the pound’s strong correlation to global risk sentiment and equity indices recently. The stock market fall added to the downside in GBP last week, and by the same token, if stocks bounce, GBP could experience a short-term recovery as well.

Besides the BOE meeting, it’s a quiet UK calendar this week.

GBPUSD Technical Analysis:

In only two weeks after the break below 1.30, GBPUSD has already fallen to the key 1.25 support area. The speed and size of the move are not a big surprise, as the trending nature of the GBPUSD pair often creates such sharp, one-directional moves.

GBPUSD has now entered oversold territory on both the weekly and daily charts. The weekly timeframe is less oversold, of course, so a bounce is not a given, although it is more likely now that the RSI and other indicators are oversold. Although it is certainly possible that the trend can extend further down, if anything, oversold readings are usually a warning sign to be careful with shorts, especially when combined with a solid support area like here at 1.25.

Below 1.25, the next crucial support is at the 1.20 area, while the key resistance to the upside is at the 1.30 zone. Before it, 12750 - 1.28 may also provide some moderate resistance.

JPY Weekly Fundamental Outlook: BOJ Green-lights More Yen Weakness; USDJPY on the Way to 135?

The Bank of Japan disappointed any hopes that it may save the yen from further weakness by abandoning some of its dovish policies at the meeting last Thursday. Instead, they stayed fully committed to the yield curve control (YCC) policy reiterated that they will continue conducting purchases of Japanese Government Bonds (JGB) to defend the 0.25% yield cap on the 10-year bond that they’ve set for themselves. So, effectively, the BOJ didn’t do anything to stop or, even at least slow, the JPY’s decline.

These decisions and communication from the BOJ are a green light for further JPY weakness. This means the bullish USDJPY trend remains intact until proven otherwise. The focus here is now shifting toward the 135.00 area as the next target higher (more about the technicals in the section below).

JPY traders should also keep global stock indices and risk sentiment on their radar. For now, the trends of higher Treasury yields and relatively stable stock markets remain intact, which should keep the bearish JPY trend in place.

Finally, note that Japan is off until Friday (golden week holiday). Thinner liquidity during the next four days may keep volatility lower or exacerbate the reaction of potential breakouts if key technical levels capitulate.

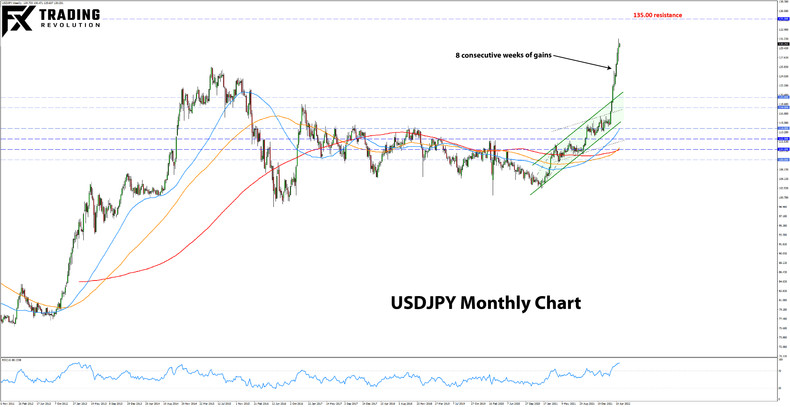

USDJPY Technical Analysis:

USDJPY recorded another green and strong close on the weekly chart. The market attempted to correct last week, but the move down was quickly rejected, and the situation resolved with USDJPY breaking above 130.00 and closing the weekly candle in the green.

The bullish trend is strong here, and it seems an extension further higher is likely in the near term. Last week’s bullish price action should support at least a retest of the 131.25 high, and more likely a breakout above it. With that in mind, the 135.00 zone would be the next key resistance to the upside.

To the downside, 130.00 should now act as support. Under it, 128.00 and 127.00 should remain moderate support zones.