US Dollar Fundamental Outlook: Multiple Uncertainties & Russia-Ukraine Tensions Likely to Keep USD Rangebound

Following the volatile price gyrations in the first half of February, the market action last week was much more contained. Yet, the stabilization doesn’t come because anything has actually “stabilized,” but rather is more a reflection of market participants staying away from accumulating large positions due to the many uncertainties that currently cloud the markets.

The Russia-Ukraine tensions, for example, were front and center last week, pushing markets up and down, even as the situation remains in “deadlock” mode (with neither escalation nor de-escalation). Although the moves were relatively modest, safe-havens were bought and risk-sensitive currencies were sold on news headlines that “Russia is about to invade Ukraine.” Then it became clear that this was not the case and the moves duly reversed.

The other uncertainties stem from the 40-year inflation highs in many developed countries, which has prompted their central banks to turn hawkish. This factor could lead to more volatility via the bond and stock markets over the coming days and weeks. In particular, the main risk is a big sell-off in stocks, which can be very negative for risk sentiment and trigger similar risk-off moves in the Fx market.

Turning to the immediate USD outlook for this week, the established ranges seem unlikely to break. Risk sentiment improved early this (Monday) morning on reports that Presidents Vladimir Putin and Joe Biden have agreed to meet (date not specified yet). The news has eased the greatest fears of war for now because investors assume “the Presidents agreeing to meet” means negotiations are still the primary method rather than military escalation. Ultimately, this means that the markets will be kept in ranges, as the status quo and the uncertainties remain largely unchanged.

The US economic calendar is light this week, with the markets only focusing on the (2nd preliminary) GDP number on Thursday and the PCE inflation figure on Friday. While both are important economic reports, they are unlikely to trigger a big USD reaction. On the geological front, the focus will be this Thursday on the meeting between the Russian and US foreign ministers Blinken and Lavrov, which should come as a prelude to that potential Putin-Biden meeting sometime after that.

Euro Fundamental Outlook: Ukraine Worries & ECB’s Pushback Against Market Expectations Weigh on EUR

The EUR was generally weaker last week, though the losses were modest. The markets’ focus on the Ukraine-Russia tensions and more warlike rhetoric between the two sides there seems to be the reason for investors dumping the euro in recent days.

While few - if any - are expecting an outright war in Ukraine, traders are careful as they know that Russia-Ukraine escalations will be most harmful for the EUR currency due to the geographic proximity and close economic links (especially energy imports). This risk aversion factor is likely contributing to the EUR’s underperformance in the past two weeks and remains a big uncertainty for the next few weeks.

In the meantime, the ECB continues to push back against the markets’ “too hawkish” expectations for them to tighten policy. ECB officials who spoke last week reiterated that removing accommodative monetary policy will be a very gradual process.

The EUR is likely to continue trading with a modest bearish tone pressured by Ukraine-related geopolitical risks and the scaling back of ECB’s hawkish bets. However, the risks are two-directional in the near term. In one scenario, the bearish pressures can significantly intensify if Ukraine-Russia tensions escalate in a big way. On the other hand, improvements on this front could see a relief rally in EUR pairs.

The Eurozone calendar is also scant of any major releases or events, mainly featuring some business sentiment surveys. The PMI reports were already out this morning, while the German Ifo business climate index will be released tomorrow. However, given the unfriendly geopolitical backdrop, EUR traders will likely focus more on that Thursday Blinken-Lavrov meeting instead of any economic report.

EURUSD Technical Analysis:

EURUSD was contained between the 1.13 and 1.14 zones over the past week, indicating that support and resistance zones may be establishing here. While the pair may stay capped between those two zones this week too, such a range of 100 pips is very tight and rarely can hold for more than a few weeks.

That being said, the next key resistance higher is at the 1.15 zone. This is the more critical technical zone, and thus even if EURUSD moves above 1.14, the bulls will not get too excited as long as the exchange rate stays below 1.15.

To the downside, below the nearest 1.13 support zone, there is support at 1.1250 (modest) and the low at 1.1150, which is somewhat more significant. The next support lower is at the historically crucial 1.10 area.

British Pound Fundamental Outlook: GBP Stays Buoyant Supported by Hawkish BOE

The pound sterling continued the mixed performance but was generally resilient, rising versus the dollar and even more so against the euro. Indeed most of the tier-1 economic data released from the UK last week was positive and beat expectations.

Inflation was slightly higher, but not so much to incite a big concern. BOE rate hike expectations remain fully intact, and pricing in futures markets reflects decent probabilities for a larger 50bp rate hike in March. This narrative should continue to provide modest support for the GBP currency.

But, while the Bank of England is hawkish, so are many other central banks. In this sense, there is not much “relative” Fx advantage for GBP against other currencies that are also underpinned by hawkish central banks. Hence, low-yielders like JPY, CHF, and even EUR, remain the main candidates against which GBP can have some edge. But this narrative strongly rests on the premise that there will be no significant risk aversion episodes (see above in USD section). On the other hand, if risk sentiment worsens, then GBP would likely suffer versus JPY and CHF.

The UK calendar is very quiet this week, with the main focus on Wednesday when BOE Governor Bailey will testify before the UK Parliament’s Treasury Committee. He also has a speech scheduled the day after (Thu).

GBPUSD Technical Analysis:

Over the past two weeks, GBPUSD traded in a tight range of roughly between 1.35 and 1.3650. The pair is still within this range and it will be no surprise if it stays inside all the way until the Friday close.

Keep in mind that, only some 50-100 pips higher, the 1.37 – 1.3750 zone is strong resistance due to previous highs and the 55-day moving average (blue). Thus, we could easily see a scenario where this 1.35 – 1.3650 range stretches by 100 pips into a 1.35 – 1.3750 range. Above 1.3750, the next support higher is the psychologically important 1.40 area.

If the support at 1.35 breaks, look for the next one in the 1.33 – 1.3350 zone. This also touches the upper end of the major 1.3150 – 1.33 weekly technical area that we discussed in the previous edition of our weekly Fx analysis.

Japanese Yen Fundamental Outlook: JPY Rangebound Oscillations Continue, Pulled by Opposing Forces

The JPY so far seems less reactive to the Russia-Ukraine news, though since there is no full escalation or de-escalation, there is also little to react to. The reactions in other markets are also generally modest so far, with perhaps the price of oil and gold being the most impacted for now.

Both risk sentiment and movements in bond yields (especially US Treasuries) remain key drivers for JPY in the period ahead. The two factors continue to act as opposing forces, keeping the JPY currency (and USDJPY pair) largely stuck in ranges. Government bond yields have climbed notably in developed countries due to rising inflation, but Japan is a different story. Inflation is low, and the uber-dovish BOJ will keep yields close to 0%. This cements the JPY currency as one of the least attractive to hold in Fx and should continue to exert downward pressure (bullish JPY pairs).

However, while the BOJ’s policies will keep the bearish pressures on the yen intact, equity market volatility and risk aversion are doing the opposite. The JPY will still react strongly to any Russia-Ukraine escalations or a big sell-off in stock indices. And it appears that the risks for one or both of those to realize have recently increased. The risk-averse tone is, thus, likely to keep the JPY relatively firm for the time being.

USDJPY Technical Analysis:

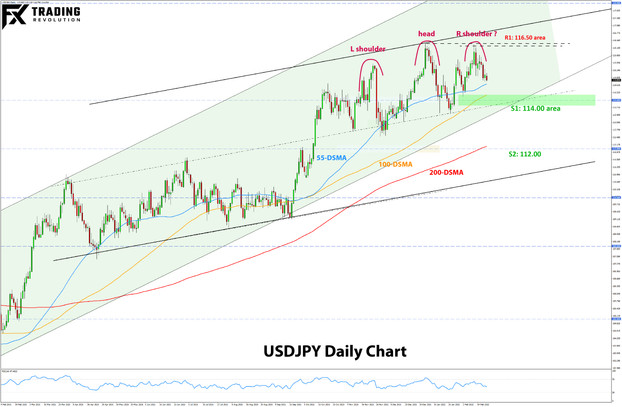

USDJPY remains well within its already established ranges and channels. For example, last week, the trading range was roughly between 115.00 and 116.00, without USDJPY challenging any critical support or resistance zones.

The daily chart (see below) shows that we are currently at around the mid-point between the key 114.00 support and 116.50 resistance zones. USDJPY can continue to trade between the two for a prolonged period without much directional bias.

A downside break (below 114.00) should clear the road toward the 112.00 zone. On the other hand, a bullish break (above the channel’s resistance around 116.50) would likely see USDJPY quickly extend toward the 118.00 technical zone.

Finally, note that the potential for a bearish head and shoulders remains, with the right shoulder possibly forming at the moment. That 114.00 support zone would be crucial for this potential H&S pattern too.