US Dollar Fundamental Outlook: Modestly Hawkish Fed Was All the USD Needed to Power Higher; NFP Up on Friday

It is another event-filled week in the Fx market, so we better prepare for active trading. This may include quiet sessions, followed by bursts of volatility on any surprises in the actual data and central bank meetings.

The dollar rallied powerfully last week, following the markets’ hawkish takeaway from the Fed meeting. The absence of strong pushback by Chair Powell against commencing QT or delivering a (double) 0.5% rate hike in March was the key reason for the perceived hawkishness. Essentially, the Fed has said anything is possible, and as long as the inflation and employment data justify it, they will not hesitate to tighten policy forcefully. This was all the market needed to take the USD higher.

The US calendar for this week is jam-packed again. The key reports are the ISM surveys on manufacturing (Tue) and services (Thur), followed by the most watched report of all, the Nonfarm payrolls on Friday.

Considering the busy calendar and the hefty appreciation last week, it seems probable that the USD can consolidate somewhat, particularly in the first days this week. Watch out for fake moves as all could be part of the noise, driven by volatility surrounding the high-impact events.

Once the dust settles, however, the dollar can easily extend the gains from last week, especially if US economic data is robust. Moreover, where other currencies will be moving will also be very important for the USD this week, given their own central bank meetings and key economic reports on the calendar (see below).

Euro Fundamental Outlook: ECB to Spread the Dovish Wings Again

The EUR remains among the weaker currencies, held down by a dovish central bank and slower economic growth compared to other currencies. Last week’s PMI data largely confirmed this narrative, and CPI inflation should do the same this week.

There are CPI reports from key Eurozone countries today (Mon) and tomorrow (Tue), followed by the CPI print for the whole Eurozone on Wednesday. A drop from the previous month is expected due to fading base effects, although high energy prices could keep inflation elevated for longer in the Eurozone too.

The ECB meeting will come on Thursday. Everyone is expecting them to be dovish and they most likely will as they have no reasons to change stance, as discussed above. Thus, traders’ focus will be on the communication for the future policy path and on President Lagarde’s presser. In this regard, some words may trigger volatility, but other than that, expect an all-around quiet meeting with a minor impact on EUR.

With the potential for more volatile trading this week, it’s reasonable to expect some consolidation or retracement for the euro. There are also some positive developments on the political front, such as Italy re-electing Mattarella for President with Draghi remaining Prime Minister (seen as the best case scenario for EUR). Also, the Ukraine-Russia tensions are contained so far and not escalating, with diplomacy remaining the main choice for all sides.

Nonetheless, besides some short-term relief, politics are unlikely to stop the EUR downtrend from extending. The firmly dovish ECB stance should keep the euro pressured in the weeks ahead, as most other central banks are already hiking rates or preparing to do so.

EURUSD Technical Analysis:

EURUSD has finally broken that bear flag pattern to the downside, much as we anticipated in our recent weekly Fx posts. The main focus is now shifting to 1.10 as the next significant support down and the target zone for bears.

The 1.10 zone is a key support due to several factors:

· Major psychological and historical price level of importance

· Was the resistance of a tight range in April/May 2020, following the wild Covid-induced gyrations

· 78.2% Fib retracement from the entire 2021 rally

Of course, if the bear trend accelerates enough, the price could push beyond 1.10. In this case, the next support will be at the 1.08 zone.

Resistance to the upside on the weekly chart is hard to find nearby. The first important resistance remains at the 1.15 area, with the 1.17 area being the next one higher.

British Pound Fundamental Outlook: Eyeing Another BOE Rate Hike

Although GBPUSD extended losses, the pound did better broadly in the past week compared to the week before. In fact, among the 8 major currencies, it only fell against the “mighty” dollar.

This week, traders will watch the Bank of England meeting on Thursday. Market participants expect another 0.25% rate hike, which the BOE will most likely deliver. Economists also expect the BOE to proceed with the plan to start QT at this meeting or announce it will soon do so (QT is opposite of QE).

However, the GBP reaction may not be so straightforward, and the BOE rate hike may not result in broad GBP strengthening.

· For instance, a lot of BOE hawkishness is already well priced in, likely even too much (5 rate hikes for this year). In light of this, the scope for disappointment by the Bank of England should not be underestimated.

· On the other hand, GBP positioning is largely neutral, especially after the recent fall, and this may be an opportunity for GBP to rebound on the BOE delivering what they promised.

Overall, the pound should stay supported in the coming period with the caveat that it may struggle against the currently strong US dollar.

GBPUSD Technical Analysis:

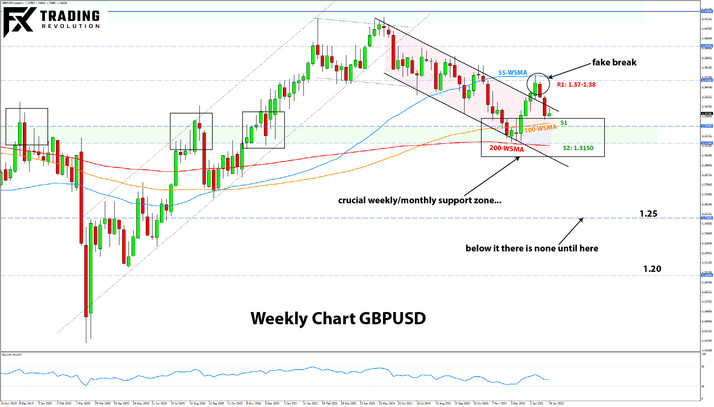

Following that upside breakout around the turn of the year, GBPUSD is now back inside the descending channel formation. Essentially, this means that the break was a fake-out, and the technicals have shifted bearish.

That being said, support is not that far either. Namely, the 100-week moving average (orange) is near the 1.33 zone, a support also strengthened by the prior highs and lows here (most notably from December and November). The next support zone is at the lows around 1.3150.

To the upside, resistance may exist at the 1.35 zone (being former support). The key weekly resistance, however, remains at the 1.37-1.38 area.

Japanese Yen Fundamental Outlook: JPY Also Pressured By USD Strength

JPY stayed relatively firm last week in broad terms, though it weakened materially against the top-performing US dollar (USDJPY closed up 150 pips). US Treasury yields stayed range-bound, as did US stock indices, although the latter saw volatile swings in both directions throughout the week. Overall, the yen remained firm versus the other currencies and even closed mostly stronger.

The crucial focus where JPY will trade in the period ahead remains on the outlook for equity markets and US Treasury yields. Generally, Expectations are for yields to extend the uptrend, with contained weakness in stock markets.

However, all scenarios remain possible, and if equity indices break below key support zones, a further accelerated sell-off could be triggered. In such a scenario, JPY’s safe-haven characteristics should eventually emerge to the forefront and result in yen strength. On the other hand, if stocks start climbing again, JPY weakness could return too.

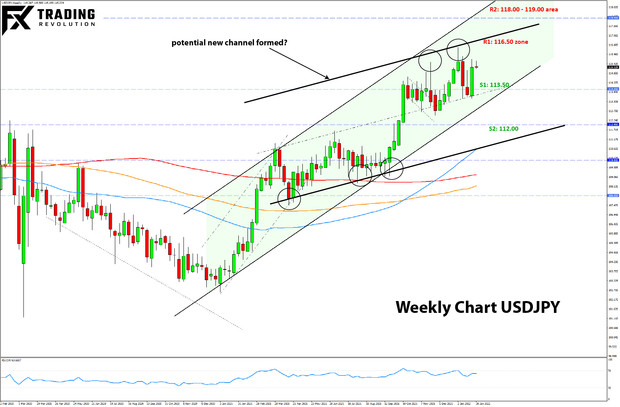

USDJPY Technical Analysis:

USDJPY bounced off the 113.50 support zone and rallied through 115.00 on what is the third attempt to move above 115.00 in the past three months. The bulls want to see USDJPY hold above this level to remain confident of the bullish picture here. On the other hand, a return back below 115.00 would likely hurt the bullish sentiment, if anything, from a psychological perspective.

In either case, USDJPY remains within the 1-year bull channel, with the upper border coming around the 118.00 - 119.00 levels, which is also the main resistance area on the weekly and monthly charts. The lower end of the channel (support trendline) is close to the 113.50 zone, potentially fortifying the support here if tested.

Another important point emerging on USDJPY is the potential formation of a new channel (see chart below). It is more gradually sloped upwards than the current larger channel but could potentially take over as the dominant one. Its resistance line has already held twice in the 115.50 – 116.00 range, and its mid-line held as support on multiple occasions in the last 3-4 months.