US Dollar Fundamental Outlook: Fed Taper Prospects Should Keep the USD Uptrend Intact

The USD remains supported but didn’t manage to break to new cycle highs last week. The range consolidation continued as the dollar fell following the release of CPI inflation Wednesday. Many bulls were surprised by the market reaction as (headline) CPI came in slightly hotter than forecasted, but the markets instead focused on the core number, which was in line with expectations.

Core inflation is what the Fed pays greater attention to as well, so the NFP miss two weeks ago coupled with this tame CPI report puts the Fed in no rush to forcefully tighten policy. As we said in our previous weekly analysis, this is why the USD can consolidate in the near term. Some USD bulls were being a little too aggressive with their bullish expectations, and those bets were scaled back.

Nonetheless, this is still likely to be only a correction, and the USD bull trend looks fully intact. The Fed is among the more hawkish central banks of the major ten global currencies, and this will continue to support the dollar broadly. The low-yielding currencies such as JPY, CHF, and EUR, which have the most dovish central banks, should stay the weakest against the greenback in this environment.

The calendar schedule is relatively quiet this week, with only 2nd-tier reports such as housing and activity data. More interesting will be the line-up of Fed speakers, and their comments on inflation and rate hikes could shape Fx trends through the week. Watch out if and how they use the word “transitory.” If FOMC members are worried the inflation spike is no longer transitory, the USD could rally to new cycle highs. On the other hand, if they are not concerned with inflation, the consolidation can probably extend for another week.

Euro Fundamental Outlook: Focus on Friday’s PMI Surveys

The euro was among the weakest currencies last week, only managing to beat the Japanese yen, which is itself getting crushed across the board. Not much has changed for the EUR fundamental outlook. The already slowing economy is getting an additional hit from rising energy costs, especially skyrocketing gas prices, which leaves the Eurozone vulnerable to a deeper economic slowdown than peer developed economies. The ECB has few options but to keep monetary policy ultra-loose for longer to support the economy.

We could already start to get confirmation for the weakening EUR fundamentals on Friday when the latest PMI reports for the manufacturing and services sectors will be released. These are the flash (preliminary) releases and tend to have the most impact on the Fx market as they are leading indicators of economic growth in the Eurozone. Business conditions are expected to have worsened further, and any greater than expected fall in the PMIs could send the euro sliding lower again.

Other than Friday’s PMI reports, the EUR calendar is light, which could mean that range-trading may persist for most of this week before potentially breaking out on the last day.

EURUSD Technical Analysis:

As we suggested in the weekly analysis last Monday, EURUSD did bounce at the 1.1550 support zone. The retracement could extend here for a while, but the bounce lacks any serious momentum thus far, and the odds still suggest that this should only be a shallow correction. The head and shoulders pattern that was triggered by the break and confirmation of the neckline this summer remains alive and has its target projection in the 1.12 area.

If the upward correction extends, then 1.17 and 1.1750 are the key resistance zones that should hold bullish attempts and keep the downtrend intact. While unlikely, a strong move north of 1.1750 can seriously challenge the current downtrend and would at least mean that a move to 1.19 or 1.20 is becoming more probable.

To the downside, the first support remains at the lows at the 1.1550 zone (1.1520 actual low). Below it, if the downtrend resumes, EURUSD could extend toward 1.14 and lower as part of the gradual bearish trend here.

British Pound Fundamental Outlook: GBP Still Buoyed by Expectations for BOE Hikes

GBP was stronger for another week as lofty market expectations for BOE rate hikes aren’t subsiding, projecting the UK central bank will lift rates as soon as next month or December. In their recent communication, Bank of England’s MPC members sounded worried about rising inflation and didn’t push back against the markets’ excessive rate hike pricing.

But GDP growth was a miss last week, perhaps already proving the stagflation narrative of slowing growth and rising inflation. Hence, the CPI report this Wednesday will be very important for pound sterling, where forecasters expect a 3.2% rise in inflation (unchanged from last month). A weaker reading can reverse the recent GBP rally, while a hotter print may fuel a jump to new local highs.

In either case, the Bank of England is in a difficult situation, with no clear way forward. This uncertainty around future BOE policy and subsequent impact on the economy means GBP volatility will remain elevated and could increase further in the weeks ahead.

This week’s GBP calendar also features the retail sales and Markit’s services and manufacturing PMI reports, as well as speeches from several MPC members, including Governor Bailey. Fx traders will again pay close attention to the views of the MPC on inflation and rate hikes, and GBP will react accordingly in both directions.

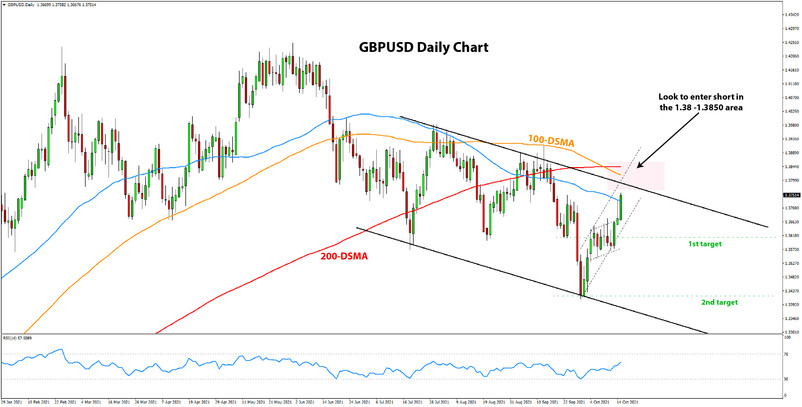

GBPUSD Technical Analysis:

On Friday, we sent this GBPUSD short trade idea, covering much of the current technical situation on the daily chart. The 1.38 area is the key resistance that should hold the bullish attempt. If GBPUSD turns down here as we expect, then the initial support is likely to be at that 1.36 zone that has been important so many times in recent history. Then the 1.34 low is the next support ahead of the 1.33-1.32 zone.

On the other hand, if GBPUSD decisively moves above the 1.38 area, the breakout could accelerate the upside move, and the price could quickly rise to 1.40 in this case, and maybe even challenge levels above 1.40.

Japanese Yen Fundamental Outlook: Crushed by a Perfect Storm

Risk sentiment remains supported as it has for the most part of this year, but it seems there’s more to the steep JPY decline. While stocks had a good week and ended in the green, US Treasury yields actually retraced and closed the week flat. Yet, the JPY was absolutely crushed, with USDJPY climbing by more than 200 pips, the largest weekly gain since the March 2020 Covid turmoils.

The ongoing movements in the yen are a little of a puzzle to Fx traders, though not completely unforeseen. With prices rising globally, many central banks are turning hawkish and will soon start to tighten policy to contain the threat of inflation. In contrast, the Bank of Japan continues to see deflation as the greatest risk to the domestic economy and will therefore stay ultra dovish for much longer than other central banks. This policy divergence between the world’s central banks is certainly helping to lift JPY pairs in the current environment.

Another factor that is hurting the yen is the continued rise in energy and commodity prices. Japan is a major importer with very little domestic production and almost entirely depends on imports for these goods. More expensive imports worsen the trade balance of a country and hence, are bearish for the currency.

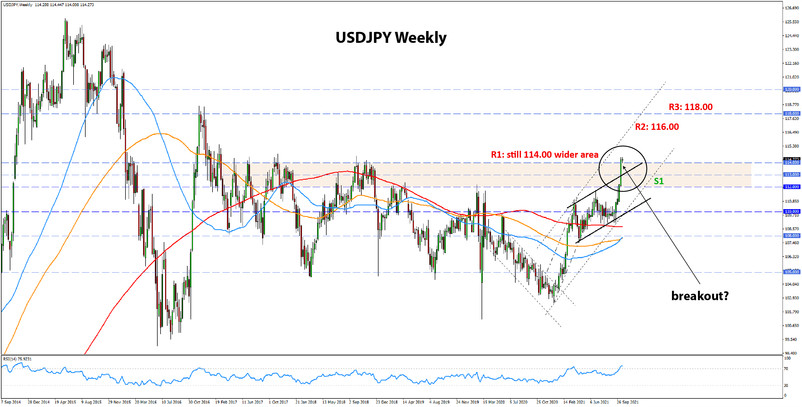

USDJPY Technical Analysis:

USDJPY demolished more resistance levels last week as it continued the march higher. The 114.00 resistance area is now seriously challenged. Another green candle this week, and USDJPY will find itself trading above that important resistance band. Under this scenario, further upside potential will open up toward the 2017 highs around 118.00 and then the important psychological 120.00 area.

While there are hardly any USDJPY bears left at this stage, there are traders who are skeptical of further rapid continuation to the upside. USDJPY is close to a peak or a breakout at these levels, and it remains to be seen which way it ultimately goes.

Looking at the downside, it’s a little hard to find support levels at this stage after such a powerful rally. But the round numbers like 114.00. 113.00, and 112.00 should again prove as important points where USDJPY could find support. Looking at Fibonacci retracement will also be very useful in this situation, though we can’t point out any specific levels yet as for that the bullish move first needs to peak.