US Dollar Fundamental Outlook: Fed Announces QE Taper Will Start Soon; Why Isn’t the USD Higher Already?

The Fed clearly leaned to the hawkish side last week. Chairman Powell practically gave USD bulls what they wanted to hear when he said tapering could end around mid-2022. This was him effectively preannouncing that the QE taper process is set to commence as early as November. The overall takeaway from the meeting was no doubt hawkish.

Yet, the dollar reaction failed to follow through. So is this a worrisome sign for USD bulls or simply a minor anomaly? It’s likely the latter.

Gyrations in global risk sentiment due to the Evergrande developments in China likely played a role in restraining the USD rally. Adding to this, there are some active political events currently with the German election yesterday and Japan’s LDP party election of a new Prime Minister. Finally, the Fed remains data-dependent, which means the next Nonfarm payrolls report (due on October 8) will be crucial for the USD rally. All of this means traders may want to wait and see how these events unfold (especially the NFP) before they load up on US dollars, thus holding back the USD rally for now.

On balance, the picture for the dollar is bullish, but until the next NFP report confirms this (above 700K print likely needed), the dollar may stay range-bound. The other possible scenario (perhaps equally likely) is the dollar moderately rallying going into the October 8 Nonfarm Payrolls release.

Euro Fundamental Outlook: Not Many Positives for the EUR; German Election with Minor Initial Impact

As we’ve been saying here in our several past weeklies, there aren’t many bullish factors to support the euro at the moment. In fact, things may soon turn to quite the opposite. Misses in PMI reports across the board last week as well as in the German Ifo Business Climate index showed that the Eurozone economy is slowing at a faster than anticipated rate. This trend of deceleration is likely to continue over the coming months, which will firmly keep the ECB as one of the most dovish central banks in the world.

Furthermore, the Covid picture in Europe could start to get worse as autumn sets in. In this case, the economy could be further hit if, e.g., new lockdowns are imposed like last year (though this is less likely as there are vaccines now).

The German election only has a muted impact so far today. While the Social Democrats have won, coalition talks are likely to be lengthy, and there are several possible combinations in play for the final Government. So, the market reaction may be delayed for when a coalition is announced.

The flash CPI releases on Thursday and Friday are in focus on the EUR calendar this week.

EURUSD Technical Analysis:

The successful test of the broken H&S neckline confirms the bearish picture on the weekly EURUSD chart. The target of the H&S pattern is at the 1.12 zone, which EURUSD could (realistically) reach in the months ahead.

On the way down, though, there are some important support areas where the price will likely react. Firstly, the 1.17 zone near the prior lows is a moderate support zone. The more important support is located at the 1.16 area, where the 200-week (red) and 100-week (orange) moving averages meet. If and when this support breaks, the 1.12 H&S target will become a much more realistic scenario, if not even quickly reached because there are no big support areas in between.

As for the nearest resistance levels to the upside, 1.19 around the neckline remains the key zone that needs to hold for the bears to remain in control here.

British Pound Fundamental Outlook: Greater Downside Risks for GBP than Potential for Further Strength

Sterling traded higher after the Bank of England meeting last Thursday but later reversed some of the gains. It what was a mixed reaction overall, the bullish move likely was not caused by the Bank of England’s message alone (which wasn’t that hawkish), but rather the risk-on rally that happened on the same day (related to China’s Evergrande) played a role too.

However, GBP may face some difficulties once the positive risk-on reaction fades. As we’ve said in recent weeks, a lot of the good news and BOE rate hikes are well-priced in the market, and GBP remains at risk of a sell-off, especially on possible disappointments ahead. For example, if economic data starts to get weaker or some other negative news comes out, GBP could be hit hard.

The GBP calendar this week features only 2-tier, low-impact data.

GBPUSD Technical Analysis:

Cable bounced at 1.36 last week and is extending the move into the new week. The daily technicals show that GBPUSD is currently in a 300-400 pips range. Support is firmly at 1.36, while resistance is located at the 1.39 and 1.40 zones, respectively.

The support around 1.36 is strong, with three solid bounces over the past three months. So, the current rebound could go further higher and perhaps lead to another test of the 1.39 or 1.40 resistance.

On Friday, we sent a short GBPUSD trade idea based on this range, with a plan to sell the pair near the resistance zone. The daily chart from the newsletter is shown below.

Japanese Yen Fundamental Outlook: Vote to Elect the New Prime Minister of Japan in Focus This Week

The risk-off moves were reversed last week, and so were the JPY’s gains. This is no surprise, as we all too well know the main driver of JPY exchange rates (though strange times when these risk correlations broke down did exist too).

The yen was sold heavily (i.e., USDJPY & other JPY pairs higher) after risk appetite was revived on positive news from China regarding the indebted real estate giant Evergrande. The risk-on boost came on the news that the PBoC (China’s central bank) has done liquidity injections to ease the situation. Further positive news on this story could fuel the JPY sell-off further, especially if US Treasury yields happen to rise also.

The bank of Japan kept all policy decisions unchanged as expected. However, the more important story domestically is on the political front. The LDP party’s election to choose Suga’s successor as Japan’s Prime Minister is the key focus for JPY traders this week. The vote is held on Wednesday (September 29), and based on the outcome, the JPY could move either higher or lower. There are 4 leading candidates seen likely to win the spot, and they all have slightly different views on economic policy (the part that matters for where JPY will move).

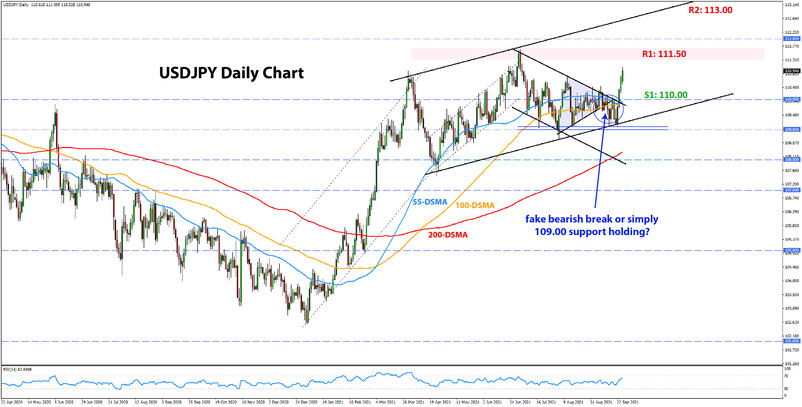

USDJPY Technical Analysis:

What looked like a bearish breakout of the triangle formation, turned into more of a fake-out last week after USDJPY strongly pushed above 100.00. It could also be that simply the 109.00 support held, but of course, this all happened simultaneously with the Evergrande developments in China that greatly affected risk sentiment all throughout the past week.

The daily chart now shows that USDJPY is headed to the 111.50 area, where it will likely meet the strong resistance. There is little that stands in the way between current prices and 111.50, which means this area will likely be reached.

What happens there could be anyone’s guess. In case of a bullish break above 111.50, the next resistance is likely to stand at levels above 112.50. Based on a newly-formed ascending channel formation, USDJPY can rally toward 113.00 before it hits the upper line of this channel. So, this zone would be the next resistance higher.