US Dollar Fundamental Outlook: Will the Fed Trigger Large Breakouts in Fx?

In Fx, it’s all about the Fed meeting this week. The US central bank finalizes the meeting on Wednesday and releases its new economic projections (known as the dot plots), which include forecasts for GDP, inflation, employment and interest rates. Traders will pay close attention to the dot plot for interest rates to gauge the sentiment among Fed policymakers for when they might start raising interest rates in the coming years. In their last projections (June meeting), the median projection was for no rate hikes until 2023. A bullish dollar reaction is likely if this projection is moved to a rate hike in 2022.

Thirty minutes after the rate statement and dot plots release, the press conference with Chair Powell will begin. He will likely acknowledge the positives on inflation (moving closer to AIT target), but will also express concerns about employment (which is still way below pre-Covid rates). This combination of hawkish and dovish comments could result in a much more neutral and dampened price reaction than many expect from this event.

The Fed will also remind everyone that they will remain data-dependent and wait for new incoming information before deciding when to begin with tapering QE. It would be a hawkish surprise, especially after the NFP miss, if they announce tapering on Wednesday. On the other hand, a dovish surprise would be if the Fed is more nonchalant about surging inflation (possible now that CPI started to come down) and focuses on employment as the main factor for deciding on tapering.

Except for the Fed, the USD calendar is pretty light, which may augment any price reactions to the event and potentially extend into Thursday and Friday.

Euro Fundamental Outlook: Path of Least Resistance Remains Lower

The euro is trading mixed going into the Fed meeting, stronger vs risk-on currencies and weaker vs safe-havens. An exception is the CHF, which fell sharply against the EUR last week, but perhaps that has more to do with SNB interventions than with standard fundamental factors.

The EUR calendar is quiet until the latter part of the week. On Thursday, flash manufacturing and services PMIs for the Euro area will be released. Traders will also pay attention to the PMI releases for the two largest EU economies, France and Germany. Germany also reports the Ifo Business Climate index on Friday.

On balance, the euro will likely continue to be driven more by global and foreign factors than domestic fundamentals for the time being. With the ECB holding firmly dovish, the path of least resistance for the EUR currency should remain down in general.

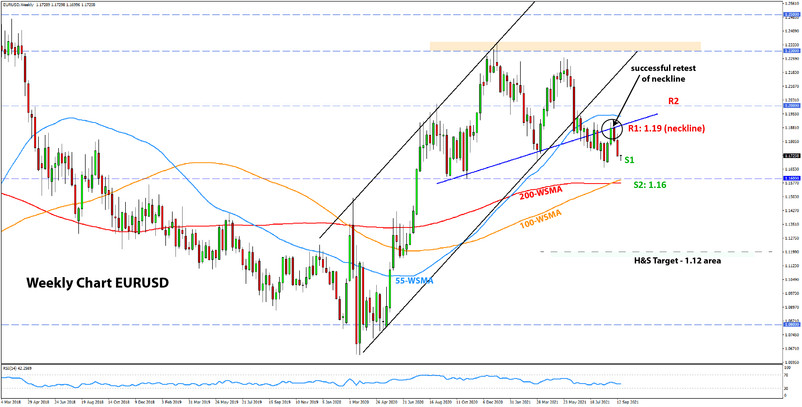

EURUSD Technical Analysis:

After testing the broken neckline two weeks ago, EURUSD continued the slide and is now pressing on the 1.17 lows again. Given the head and shoulders pattern and the successful retest of the neckline (both of which we discussed extensively in recent months), the weekly EURUSD technicals are clearly turning bearish here. The target of the H&S pattern is at the 1.12 zone, which EURUSD could reach in the months ahead.

On the way down, there are a few important support areas where the price could react. Firstly, the 1.17 zone near the prior lows is a moderate support zone. The more important support is located at the 1.16 area, where the 200-week (red) and 100-week (orange) moving averages meet. If and when this support breaks, the 1.12 H&S target will become a much more realistic scenario, if not even quickly reached because there are no big support areas in between.

As for the nearest resistance levels to the upside, 1.19 around the neckline remains the key zone that needs to hold for the bearish dynamics to remain intact.

British Pound Fundamental Outlook: High Bar for a Hawkish BOE Surprise

For sterling, the Bank of England meeting on Thursday is the central event this week. Expectations are high. This year, GBP was among the strongest currencies, driven by forecasts for a BOE that will start tightening sooner than other central banks. A lot of the hawkish commentary and predictions for rate hikes are already in the price of the currency. This situation by itself is a setup that quite often leads to disappointments and reversals in the Fx market.

Adding to it, recent developments like the misses in UK GDP, employment and retail sales reports make it less likely that the BOE will want to rush with tightening monetary policy. Hence, the bar is high for a hawkish surprise, and, given the high expectations, there is a risk of disappointment. GBP could sell off sharply after the event in this case.

The GBP calendar on other days this week is uneventful, which means that all Fx traders will focus on will be the BOE meeting.

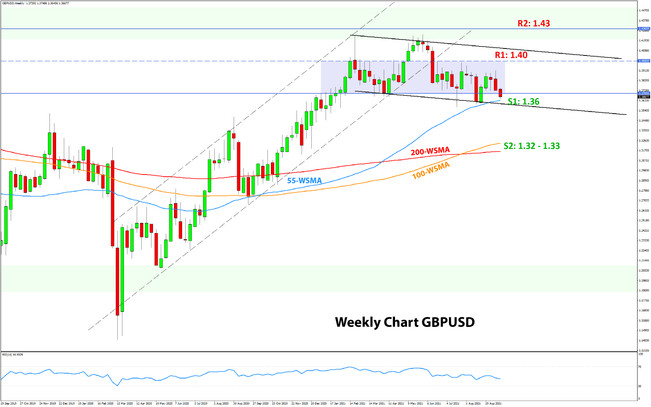

GBPUSD Technical Analysis:

Cable has been falling for several days since the rejection at 1.39 last Tuesday and is even probing levels below 1.37 today. But support is not far, and the crucial area stands around the 1.36 level. This support won’t break easily, and strong bearish momentum will likely be needed for that. Then - if it is broken - the path lower gets easier as the next big support is some 300 pips lower, at the 1.33 area.

In our previous weekly analysis, we said that GBPUSD has recently traded between 1.37 and 1.40 for most of the time. This is more of a loosely defined range, and it’s still possible that cable will return in it, especially if the 1.36 support holds.

To the upside, resistance remains at the 1.39 and 1.40 zones.

Japanese Yen Fundamental Outlook: Political Developments at the Forefront

The JPY is having a good time on a general pick up in the risk-off mood. For example, the S&P 500 sold off moderately but finished lower for two weeks in a row and is falling further today. It seems that the prospects for Fed tapering are naturally starting to trigger some profit-taking in stocks. US Treasury yields are still not moving higher either, and that is a supportive factor for JPY.

Domestically, Japan’s political scene is heating up. The ruling Liberal Democratic Party will hold an election on September 29 to choose the successor to the incumbent leader Yoshihide Suga. There are several candidates who may win, each with a different profile and implications for fiscal and monetary policy (which is conducted by the BOJ). Depending on who wins, this could turn into the dominant driver for JPY in the months ahead, especially if the new leader wants to shift fiscal and monetary policy in a new direction. If, however, the new Prime Minister continues the legacy of Shinzo Abe with expansive policies, then the impact on JPY will be very small.

All in all, the sell-off in stocks (whether it stops or extends lower), US yields and Japanese politics are likely to be the main drivers for JPY in the foreseeable future.

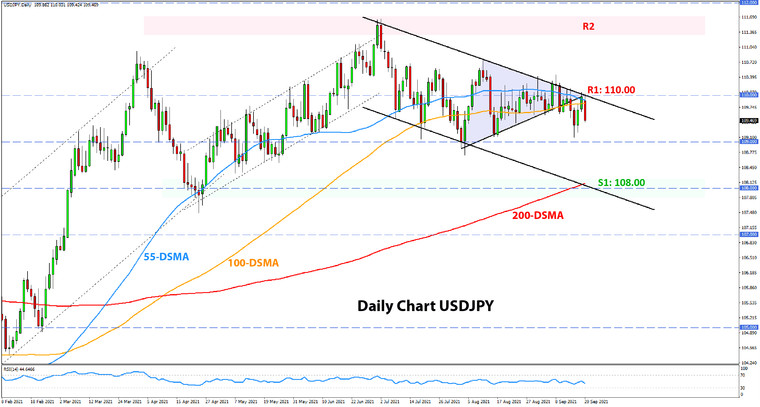

USDJPY Technical Analysis:

USDJPY finally shows signs of breaking the tight compressing range in which it traded for around 45 days. The support trendline was broken, the price fell to almost 109.00, then recovered for a retest of the broken trendline and was it is getting rejected down here again. The USDJPY daily chart has clearly turned more bearish, therefore.

As we noted in our last weekly analysis piece, in this bearish scenario, there is downside potential for USDJPY to reach the 108.00 zone. This is also the key support area lower, defined by the 200-day moving average (red line) and the lower line of the descending channel (see chart below).