US Dollar Fundamental Outlook: Strong Jobs Reports Confirm Fed Is on Course to Tapering; USD Bull Trend Should Be Intact

The strong US jobs reports revitalized the dollar on Friday, which then rose sharply across the board and erased all the losses from the week before. The overall takeaway from the jobs reports was clearly bullish. Nonfarm payrolls grew by 943K (stronger than the 870K forecast), while the unemployment rate took a deep dive from 5.9% to 5.4%. The Fed will be much more comfortable talking about tapering with these numbers, hence the strong upside USD reaction.

Fed vice president Richard Clarida (who is a dove) also spoke in favor of tapering last week, which is a marked hawkish shift from one of the most dovish FOMC members. It appears the stars are aligning for a Fed tapering announcement and for more USD strength over the coming weeks and months.

The CPI inflation report is in focus on the US calendar this week. But with the strong NFP behind us, the inflation report is less likely to have a big impact on the dollar (the conclusion is the same – the Fed will turn more hawkish, regardless of the exact figures of this CPI report). The stage seems set for the USD bull leg from last week to extend higher this week.

Euro Fundamental Outlook: Dovish ECB Is Keeping EUR Under Pressure

Last week, the euro was weaker across the board, with the decline most evident against the US, New Zealand, and Australian dollars. The dovish shift at the ECB stemming from the adoption of the new inflation target is making an impact on the euro, with the currency finding itself more often on the downside trajectory than otherwise in recent weeks.

The ECB’s dovishness has kept the euro pressured even against the safe-haven JPY and CHF. While the downtrends in EURCHF and EURJPY appear unlikely to continue for much longer because the central banks of these currencies (BOJ and SNB) are even more dovish than the ECB, it still highlights the unfavorable position the EUR is in at the moment.

Coupled with a strong dollar now, investors have little interest in parking their cash in the common Eurozone currency. Thus, the euro is likely to stay under pressure more broadly for the time being, with EURUSD looking increasingly likely to break lower.

This week’s Eurozone economic calendar is rather light, with only the German ZEW sentiment survey on the radar for Fx traders.

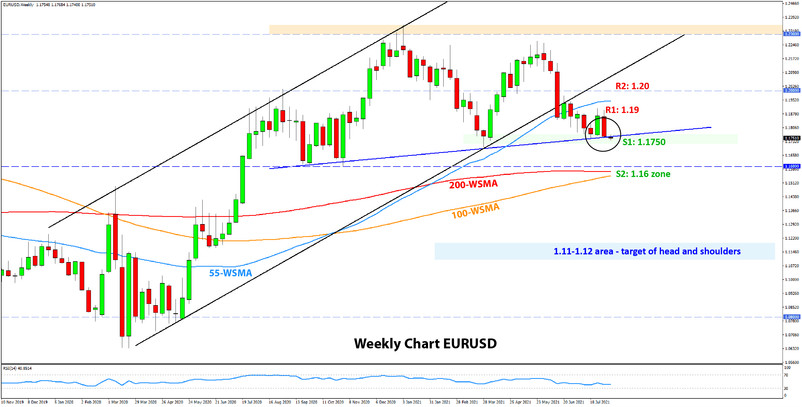

EURUSD Technical Analysis:

EURUSD declined straight down from Monday to Friday last week without looking back. The pair is now back at the lows around 1.1750, where it was two weeks ago. The significant support area that exists here hasn’t been broken yet, although last week’s decline suggests that’s becoming increasingly likely.

In case of a bearish breakout, the next important support lower is at 1.16, which is a confluence of left shoulder lows and the 200-week and 100-week moving averages. The target of the head and shoulders, which would be live in this scenario, is much lower – toward the 1.12 and 1.11 levels.

To the upside, the initial resistance is at the prior highs around 1.19, while the more important resistance zone remains at 1.20.

British Pound Fundamental Outlook: Optimistic BOE Message Keeps GBP Supported

The BOE’s communication at last Thursday’s meeting was largely neutral, but Fx traders still bought the pound afterwards. The Bank of England kept the optimism about the economy and gave more details about their plans for withdrawing stimulus, confirming speculations that the bank is preparing to tighten monetary policy.

In the meantime, Covid cases with the delta variant are declining further in the UK, while hospitalizations and deaths remain far lower compared to the winter wave. This was undoubtedly another reason for the BOE’s optimistic outlook and also for traders’ bullish views on GBP. Overall, there is little negative news for the pound in the current environment, and hence the currency should stay broadly resilient, though it may struggle against rising currencies such as USD.

In focus on the UK calendar is only the GDP report that is expected to print a healthy Q/Q number of close to 5%.

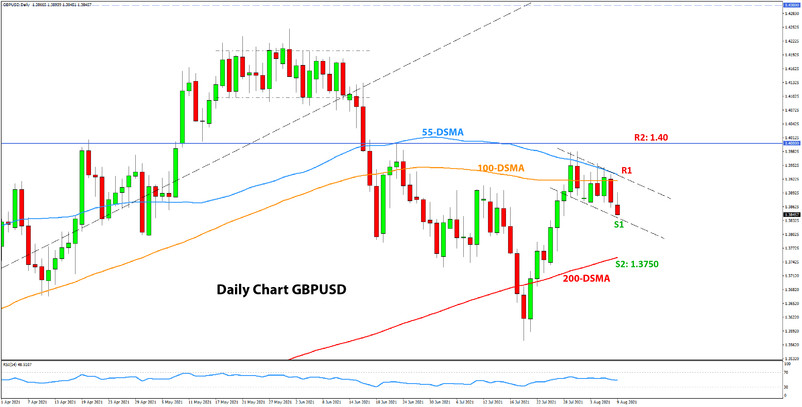

GBPUSD Technical Analysis:

The price action on GBPUSD was much more contained than on its cousin EURUSD. Namely, GBPUSD traded largely in a tight 90-pip range and formed a doji weekly candle (price closed where it opened).

The daily chart below shows the range in more detail, which so far looks like a bull flag continuation pattern. Still, the resistance at 1.40 is strong, so it’s hard to argue for more bullish action before that resistance is out of the way.

To the downside, immediate support sits at 1.3850. The next important support is at 1.3750, near the 200-day moving average (red line).

Given the current technical situation, it wouldn’t be a surprise if GBPUSD trades in a range from here. The likely levels for such a range would be the 1.40 resistance at the top end and the 1.3750 support at the low end.

Japanese Yen Fundamental Outlook: Rebound in Treasury Yields Lifts JPY Pairs

The “good” jobs reports from the US last week lifted Treasury yields across the board, helping to support JPY pairs in the Fx market. Moreover, stocks marched to new all-time highs as another supportive factor for risk appetite and for JPY pairs in Fx.

Still, the yen seems far from breaking out of its ranges in any meaningful way. Volatility across markets is low, and even if stocks and Treasury yields are rising, they are doing so only at a leisurely pace. All this means that large moves in JPY may not come, even if risk appetite remains supported.

That being said, JPY should remain weak as long as risk appetite is the name of the game. Fx traders will, of course, be carefully prepared for any episodes of risk aversion, in which, as we’ve seen in the past, JPY can strengthen materially and rather quickly.

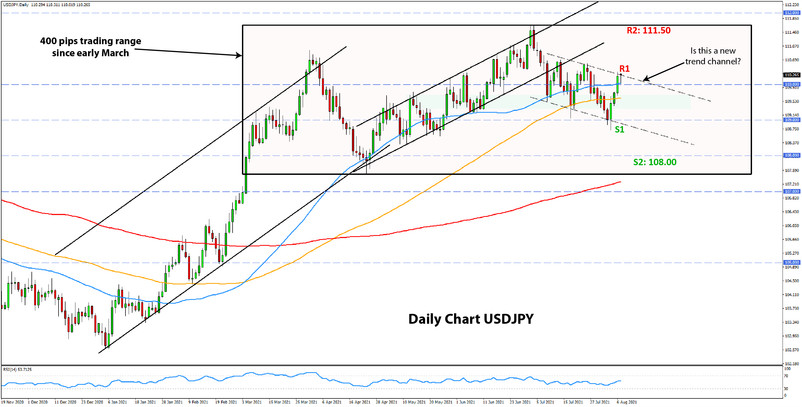

USDJPY Technical Analysis:

USDJPY made another attempt at the 109.00 support last week but was again rejected. The pair is back above the 110.00 psychological level at the start of the new week, but implications remain minor for the overall technical picture here.

Namely, USDJPY remains stuck in these tight formations that oscillate from ranges to gently-sloped channels. But if we take a look at the broader situation, USDJPY is trading in a tight 400-pip trading range between 107.50 and 111.50 since early March. Inside of it, the price has spent most of the time in an even tighter range of 250 pips - between 108.50 and 110.00.

With the range-bound dynamics so strongly ingrained in USDJPY price action, it’s hard to see why or how this would change this week. Did the bounce last week give rise to a decline for this week? If we follow the recent patterns in USDJPY, then the answer is yes.

The nearest support remains at the 109.00 zone. The next support lower is at 108.00. The nearest important resistance is located at 110.50.