US Dollar Fundamental Outlook: All Eyes on Fed This Week, Will the Ranges on USD Pairs Break or Not?

Despite the volatile price action around the US CPI release last Thursday, the trading ranges held as the markets gear up for the Fed press conference at 8:30 pm CET this Wednesday (2:30 pm ET). Thirty minutes before, the Fed will publish the new FOMC statement and economic projections containing GDP and inflation forecasts. As no changes to interest rates or the QE pace are expected, the key focus will be on the FOMC's GDP and inflation forecasts as well as Chairman Powell's forward guidance at the press conference.

While there is scope for the ranges (on USD pairs) to break on the Fed announcement, it may as well not happen. Indeed, the impact on USD will depend on how much more hawkish or dovish the Fed's wording is compared to the consensus expectations, which are justifiably dovish at this point. The Fed will likely play it safe and try to sound as "neutrally dovish" as possible in an effort not to "scare" markets by accidentally using hawkish words. Hence, it will be no wonder if the ranges hold past this Fed meeting and extend for a few more weeks.

A big hawkish surprise will be if the Fed chooses to talk about last week's inflation surprise as worrying and hints at tapering plans for later this year. This, of course, is unlikely, despite the much hotter y/y CPI reading of 5.0% already as the Fed is determined to attribute it to basing effects and designate the rise in inflation as transitory. The price action in markets last week also confirms that no one expects the Fed to be hawkish this week.

Euro Fundamental Outlook: ECB Keeps Policy Unchanged, EUR Snoozes

The ECB kept policy unchanged last Thursday, completely in line with market expectations. After the initial bullish reaction, the euro reversed all the gains and ended lower versus most currency peers. Traders realized that the ECB is not too optimistic about reaching their inflation target and, similarly like the Fed, it will take a long time before ECB policymakers think about tapering.

The EUR calendar for this week is lighter with mainly 2nd tier data such as final CPI readings from several Eurozone members. Remember, the "final" readings for Eurozone data tend to have less impact on markets as they usually act as confirmation for the early "flash" releases, which tend to have the most impact. With that in mind, the euro will be left to trade on other factors this week, such as developments with other currencies and global macroeconomic drivers.

EURUSD Technical Analysis:

The toppish pattern around 1.2266 suggests more downside action is on the cards for EURUSD. The key focus lower is the 1.20 support zone, as is so obvious from this weekly chart shown below.

Indeed, there isn't much to stop the pair from reaching the 1.20 area, as both the weekly and daily charts seem to point out. But, if and once that happens, strong buying forces are likely to emerge in this 1.20 support area. The bulls need to hold 1.20 as a break below it will clear the way toward the next weekly support, which is down at the 1.16 area.

For the bears, a sustainable return of the price above 1.22 would be an early bad sign. The key weekly resistance area is between the 1.2266 highs and the more prominent highs from January near 1.2350.

British Pound Fundamental Outlook: GBP Holding Up High Ahead of Busy Week

The pound continues to hold up well, despite some negative news flow in recent weeks. It is now confirmed that the full re-opening of the economy originally planned for June 21 will be delayed due to the resurgence of Covid cases from the Indian variant. But thus far, there is little reaction in GBP as the markets hold onto the view that the vaccines are effective against this new variant, and a slight delay to the re-opening will not hurt the UK economy too much.

The other negative factor that could potentially hurt GBP is UK-EU relations regarding the Northern Ireland protocol. The EU has threatened with tariffs in response to the UK breaching the agreement. If this happens, GBP would be negatively impacted, but so far, this too seems unlikely to metalize, which is why GBP is still able to hold near its highs.

This week's GBP calendar is a busy one, featuring jobs data on Tuesday (claimant count change, average earnings, and unemployment rate), CPI inflation on Tuesday, and retail sales on Friday. For a few weeks, we've been saying that GBP needs more strength in the fundamentals (such as this week's data) to justify a further move higher. Either that will happen, or GBP can sell off in case the data falls short of expectations.

GBPUSD Technical Analysis:

Nothing much has changed on the GBPUSD charts last week, with the daily timeframe looking like a fractal image of the weekly, largely portraying the exact same story with more details. The pair continues to trade inside of the sideways range and awaits a breakout either higher or lower.

A bullish breakout of the range would be in line with the predominant trend here, which has been up for more than a year (since the Covid crisis lows in March 2020). However, the trend has also hit a significant multi-year resistance in the wider price area of 1.42 – 1.46 and is close to overbought levels on higher timeframes. On the other hand, if the range breaks to the downside, it will soon encounter strong support in the 1.40 area that extends down toward 1.39.

Overall, GBPUSD looks like a difficult call currently, with strong resistance and support zones located just outside the current range. The risk is that the potential breakout of the range may not result in notable continuation in the direction of the breakout. Instead, the price may reverse at the resistance or support areas that we noted above.

Japanese Yen Fundamental Outlook: USDJPY Breaks Correlation with Treasury Yields, Will It Last?

JPY remains stuck as USDJPY continues to move sideways, which means that the yen is mainly moving in lockstep with the dollar against other currencies. The main theme is unchanged here, and USDJPY is likely to remain stuck in ranges until some larger-scale event triggers a breakout one way or the other.

The BOJ meets on Friday as the main event on the Japanese calendar this week. No changes are expected in policy or guidance, so we can expect little impact on JPY pairs as usual. Domestically, Japan is battling the coronavirus pandemic and is lagging in the vaccine rollout, which could keep the economy running slow for longer compared to western peers.

Elsewhere, even the decline in US Treasury yields last week failed to translate into lower USDJPY, posing some questions about the longevity of the correlation between the two. Fair to say, however, the current market dynamics seem driven more by technicals than fundamental factors, so perhaps the break in the USDJPY – US yields correlation is not much of a big deal.

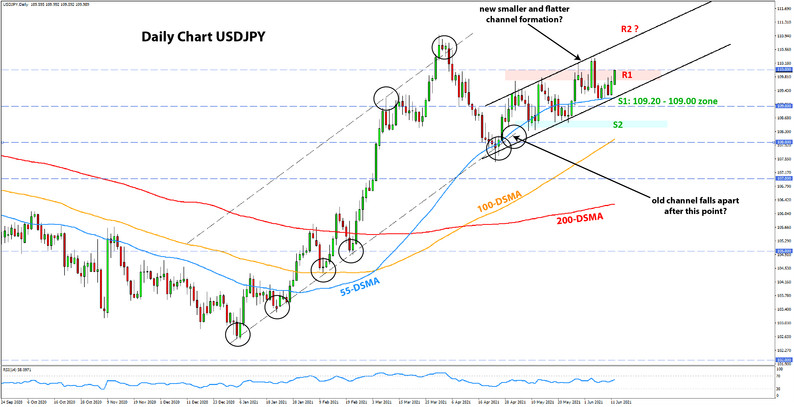

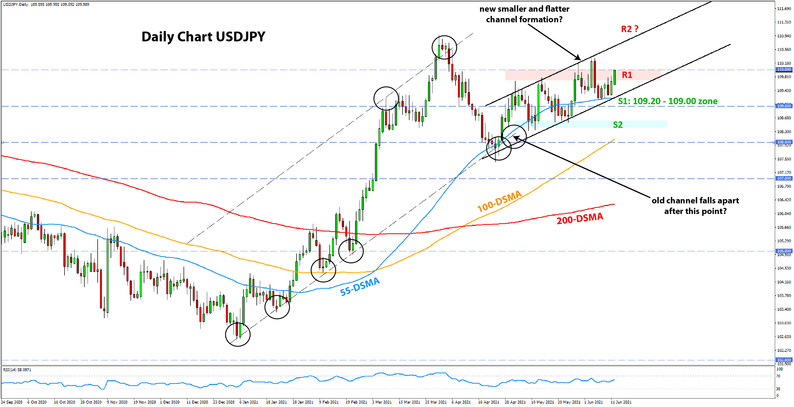

USDJPY Technical Analysis:

It was another range-bound week for USDJPY, the range being only a mere 70 pips. There appears to be a slight change to the technical picture, however. Namely, it seems the gradual rising uptrend is taking a firmer hold over the horizontal range between the 108.40-108.60 support and the 109.70-110.00 resistance that we watched in recent weeks.

If it is true and the ascending channel formation prevails, then USDJPY will likely move above the 109.70-110.00 resistance, with the next resistance higher likely to be located around 110.80-110.90.

On the downside, support has been cemented at 109.20, with the price bouncing off the 55-day moving average and the rising trendline last week.