US Dollar Fundamental Outlook: Disappointing NFP Sends USD to 3-Month Low

The past week was terrible for the US dollar all around. Whether we look at the ISM manufacturing and services PMIs, the ADP employment data, or Friday’s jobs reports, it all fell short of expectations. The biggest miss was, of course, in the Nonfarm payrolls and unemployment rate. Consensus forecasts were looking for close to 1 million jobs to have been created in April, but the actual report showed that the number is only 266K. The unemployment rate climbed for the first time in a year and is now standing at 6.1%, far short of the 5.8% that the markets expected.

Everyone expected that the US economy is booming, but jobs are saying “maybe not so fast.” While most economists view this NFP report as a one-off and expect more strength in the US economy, the reports last week undeniably justify the Fed’s patiently dovish approach. FOMC officials have repeatedly stated that they will not begin tapering QE based on expectations for strength and that they will only do it when the actual data confirms that jobs and inflation are moving to target. Last week’s data gives every excuse the Fed needs to keep running QE in full gear.

The highlights on the USD Fx calendar this week are CPI inflation and retail sales. Inflation will surge further due to oil base effects, with the y/y reading forecasted at 3.6%. Watch out for any upside surprises in that report as it could crush the dollar further due to falling real yields. The dollar sell-off is unlikely to be over for now. The combination of the Fed firmly keeping their foot on the QE pedal and inflation surging (base effects or not) forebodes further bearish pressures on the USD. The greenback looks set to revisit its January lows at around 89.00 for the DXY index and 1.2350 for the EURUSD pair.

Euro Fundamental Outlook: Higher v. Some, Lower v. Others

Vaccination rates in the EU are accelerating, and investors were already starting to get optimistic about that in recent weeks. This provided some support for the euro, most notably against the dollar and safe-havens JPY and CHF. However, the euro was not rising broadly in April and actually remains in a downtrend versus the pound sterling and “risk-on” currencies.

With the dollar turning around again, it looks like this EURUSD rally has more legs. As noted above, we could easily see the 1.2350 high in the weeks. But other EUR pairs may not rise so easily as the Eurozone’s growth and inflation outlook remain soft. This will keep the ECB dovish for the time being, standing in the way of a stronger EUR rally.

The light Eurozone economic calendar features no tier 1 data this week, which will leave the euro to trade based on developments with other currencies and the longer-term fundamental drivers.

EURUSD Technical Analysis:

Last week’s developments definitely buried any hopes that the bears may have had for the 1.21 level to hold. The breakout above 1.20 is now officially confirmed, and the weekly technicals turn bullish.

The next resistance level to the upside is 1.22. While this is the February high, there is no other significance to this resistance. Instead, the 1.2350 zone around the pivot highs from January looks like the key resistance in this context. From the chart below, we can also see that the bullishly-looking technicals suggest EURUSD will likely reach this resistance zone in the coming weeks.

The 1.20 zone now turns to key support to the downside. The weekly technicals will remain bullish as long as this support holds.

British Pound Fundamental Outlook: GBP Soars as BOE Tapers QE and Upgrades Growth Forecasts

Sterling soared last Thursday on the BOE announcement to taper QE and upgrade the economic outlook. The pound quickly gave up the gains after that as a lot of the good news was already expected and priced in, but that still doesn’t change the overall bullish fundamentals. Indeed, GBP has rallied by 250 pips since the Friday low and is up 140 pips so far today.

There was some uncertainty around the Scottish election last week, but investors are not worried about another independence referendum because one is not likely in the near future, even if the pro-independence SNP won the election. Today’s GBP rally confirms that the markets are not worried about Scotland.

The success of the Government’s strategy in dealing with the Covid pandemic continues to benefit the currency. Further easing of restrictive measures in the UK will come soon, which will lead to an acceleration of the recovery. With the UK economy set to rebound more strongly than peers, GBP should stay supported with the uptrends likely to extend across several GBP pairs. The soft dollar could help GBPUSD to appreciate more rapidly.

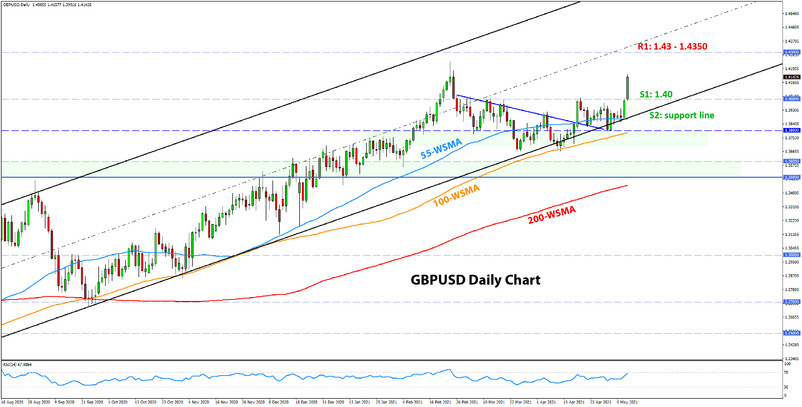

GBPUSD Technical Analysis:

GBPUSD broke above the 1.40 level on the open in early Asia and hasn’t looked back since. The price rallied 150 pips after the breakout, which probably also highlights the psychological significance of 1.40 for GBP traders.

The weekly and daily technicals remain bullish. Although it tested it numerous times in April, GBPUSD never broke below the support trendline of the rising channel that has held for more than one year now.

GBPUSD is moving toward the 1.4240 February high, and there is not much to stop it from reaching it. Above it, the 1.4350 zone at the channel’s middle trendline is the first important resistance. 1.40 is the pivotal support that, if tested at all, should hold and keep the bullish dynamics intact.

Japanese Yen Fundamental Outlook: No Safe-Haven Love for JPY

Risk-on is still the dominant theme in the markets. Stocks are hitting record highs, and bond yields stay on a rising trajectory. Even the abysmal NFP report from the US last Friday didn’t derail investors’ from buying stocks. So it seems, markets got used to the theme that whenever the economy struggles, the Fed comes to the rescue with more quantitative easing (QEternity and risk-on forever!).

There was no support for the safe-haven JPY last week, despite the USD’s plunge. The Japanese currency was the weakest of the 8 major currencies, and there is little that can alter these dynamics as long as the risk-on mood remains so euphoric (or maybe complacent is the right term?). While a steep decline in the yen can’t be expected either, risk appetite will likely keep it soft for the time being.

The biggest risk for short JPY positions remains a sudden souring of the risk mood and sell-off in global equity markets.

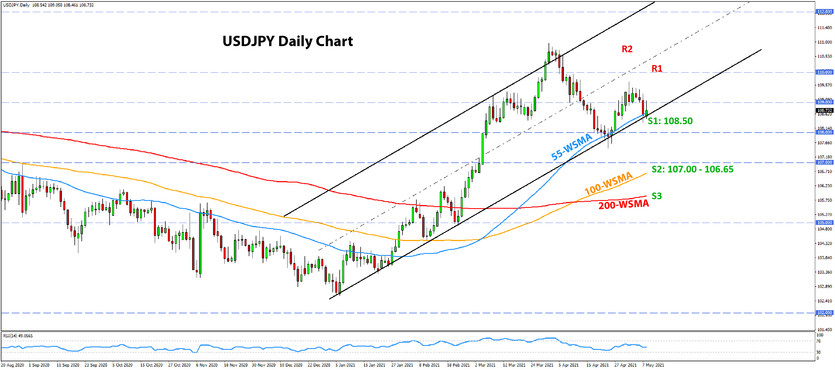

USDJPY Technical Analysis:

USDJPY was holding ground above 109.00 for the most part last week but moved swiftly below it after the release of the disappointing NFP on Friday. The pair tested the support trendline of the channel in the 108.50 support zone, where the 55-day moving average also concurs.

So far, this 108.50 support is holding, but it remains to be seen for how long that remains the case. A break below it could lead to a quick move down toward the 100-day moving average (orange), which stands near 106.65. The 100-day moving average (red) waits slightly lower, near 106.00.

To the upside, resistance is seen in the zone between last week’s highs (109.70) and the 110.00 psychological level.