US Dollar Fundamental Outlook: USD Downside Retracement Likely a Part of Consolidation, Not Reversal

The US dollar was beaten down last week, though the losses were limited to the safe-haven currencies like CHF, JPY, and also EUR. The greenback was flat or higher against the other currencies in the major 8 Fx pairs. As we said in last week’s analysis, most of the good news was already priced in USD exchange rates, so the retracement doesn’t come as a complete surprise. The main question on traders’ minds right now is whether this retracement stops here and USD reverts higher, or it turns into a reversal of the recent USD bull trend.

The calendar this week, though not completely uneventful, doesn’t feature high-impact reports. The main attention will go to the CPI inflation and retail sales data, both of which are expected to surge; Y/Y inflation due to oil base effects from last year while retail sales were likely boosted by last month’s Biden’s COVID stimulus checks. This suggests the USD should be supported, though it’s unclear how markets would react to a large overshoot or undershoot in the inflation reports.

Geopolitical developments are also coming to investors’ radars again after raising tensions along the Ukrainian border. An escalation of the situation here can provoke a risk-off wave in markets, which is unlikely to be “bad news” for the dollar. This front will be closely watched. This week’s calendar also features the Fed’s Beige Book and speeches by Chairman Powell and other FOMC members. The USD consolidation doesn’t look like it’s over, but an inflection point seems to be near. How USD reacts to ongoing newsflow should provide some clues for the “true intents” of the dollar and its near-term direction.

Euro Fundamental Outlook: EU Vaccine Effort Still Lagging Behind

The euro ended the previous week higher, but the move was mostly driven by technical factors rather than a notable improvement in EUR fundamentals. While EU vaccination rates should soon start to improve materially, for the time being, the lag behind the US and the UK should still translate into some more euro weakness.

The light EUR Fx calendar doesn’t promise too much excitement in this week’s trading, though traders will watch the Ukraine situation (noted above) for potential risks. An escalation in Ukraine would be negative for the euro, so that’s another risk worth watching.

Retail sales this morning provided a bit of good news for the single currency, coming in stronger than expected. The German ZEW survey, industrial production, and CPI inflation are also scheduled for release this week, though their impact on Fx markets is likely to be limited. The euro will continue to be driven by expectations related to the global recovery from the coronavirus pandemic and who will win that race, i.e., which economy will recover the fastest from the recession.

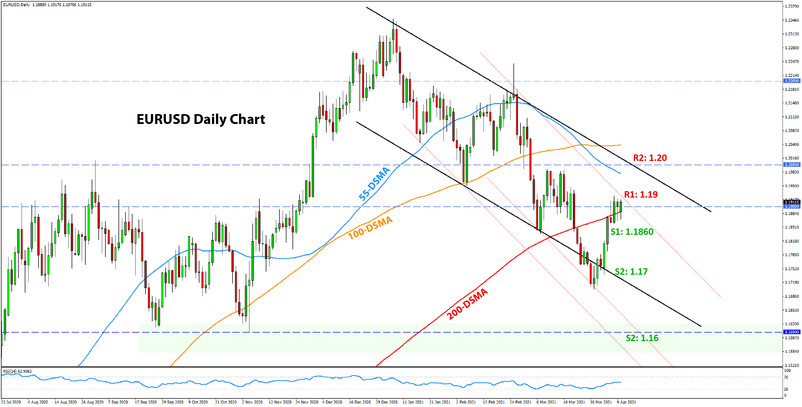

EURUSD Technical Outlook:

The strong close last week took EURUSD above the 1.19 level. However, the bulls have more work to do if they want to break the downtrend that begun with the January highs. In this regard, the 1.20 zone remains the key resistance that needs to be broken to turn around the picture here.

The chart below shows another potential structure of the downward channel, which is of a slightly steeper nature (orange lines). We show this channel as a possible scenario because EURUSD broke somewhat below our original channel’s support in late March, although it quickly returned inside. The new channel lines suggest that resistance could come even slightly before 1.20. The original channel resistance indicates that 1.20 exactly is the zones we should watch. In either case, if/when EURUSD will reach 1.20, selling pressures are likely to intensify a lot!

The multiple daily lows around the 1.1860 level make the nearest support zone to the downside. The important support zone remains at the 1.17 lows and then even more so at the 1.16 area.

British Pound Fundamental Outlook: GBP Waiting for a Bullish Catalyst to Start Advancing Again

The pound sterling is still in the consolidation phase that started a month ago and largely is moving sideways against its peers. With most of the good news related to the fast vaccine rollout in the UK already in the price of GBP, the consolidation is an expected and maybe a “healthy” development.

Traders will be now looking for tangible new catalysts to take the pound higher. This would most likely need to come through strong economic data that should confirm the narrative that the earlier lifting of COVID restrictions in the UK than in other countries is indeed boosting the economy.

The GBP calendar this week is as lame as last week, so we can’t expect much volatility to come from the economic data this week. For the time being, GBP is likely to still be driven by general Fx flows, risk sentiment, and technicals.

GBPUSD Technical Outlook:

GBPUSD rallied above 1.39 last week but was eventually rejected there and fell back to lows around 1.37 that were set two weeks ago. This support area between 1.37 and 1.38 is also a major weekly support zone, so it won’t be broken easily.

We are seeing evidence of that already this Monday as GBPUSD is rebounding here. The 100-day moving average that is near 1.37 is bolstering this support zone further. To the upside, resistance is seen above 1.3850 and toward 1.39, last week’s high. The 1.40 zone above it, is the major resistance that could open up much greater upside potential if broken.

Japanese Yen Fundamental Outlook: JPY Comes Down from Oversold Levels

US yields and dollar trends remain in the driving seat for USDJPY, while risk appetite is keeping JPY weak broadly also. However, a lot of the positive news has already been priced in, and the yen corrected higher (JPY pairs lower) last week. USDJPY closed the week notably lower for the first time since January and had the biggest decline since November 2020.

Despite last week’s JPY correction, the trends remain very much in place. As long as risk appetite and the economic recovery from the COVID crisis remain supported, USDJPY and other JPY pairs will too. That could change, though. The main risks remain related to a collapse in risk appetite and a bout of risk aversion. Perhaps the build up of geopolitical tensions in Ukraine could provide the catalyst? Or, a sudden sell-off in stocks coming after a prolonged and stable uptrend? Either one could trigger flows to come into the safe-haven JPY. And, judging from a valuation and technical perspective, there would be larger scope for JPY strength in such a scenario than there would be for JPY weakens in case of the risk appetite and rising yields trends continuing.

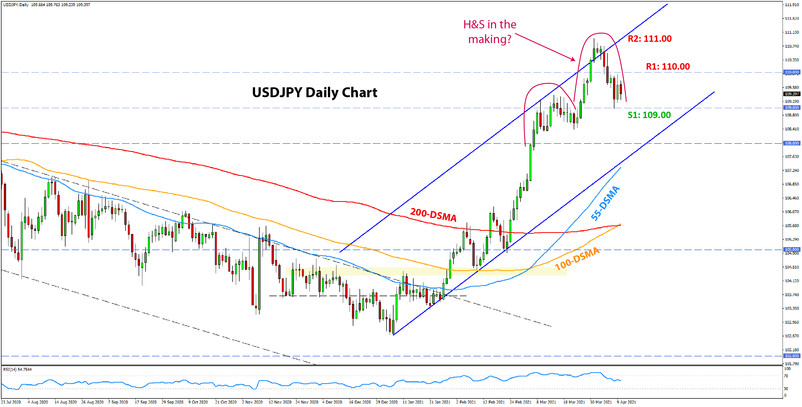

USDJPY Technical Outlook:

This week we are taking a look at the daily USDJPY chart. For the larger context, check out last week’s analysis, where we discussed the monthly USDJPY chart.

After breaking above 110.00, USDJPY has now returned below this level. While it is an important psychological mark, the higher timeframes (weekly and monthly) show that the particularly important support stands at the 109.00 zone. For instance, it is where the 100-monthly and 200-weekly moving averages converge with the monthly resistance trendline. USDJPY broke all three on the way up, so this could be a retest before the continuation. If that’s indeed the case, then 109.00 needs to hold.

The daily chart shows us the potential for a head and shoulders pattern, right at this same 109.00 support zone. All of this suggests that 109.00 is a very important technical zone that we should closely watch. Particularly, a bearish break below it is likely to be very negative and result in a steep depreciation down, as is often the case when such important zones are broken.

If, on the other hand, 109.00 holds, the first resistance higher is back at 110.00.