US Dollar Fundamental Outlook: Fed’s Powell Gives Green Light to USD’s Advance

Powell didn’t provide much further insight on the FOMC’s thinking regarding rising Treasury yields or the average inflation targeting (AIT) regime. Instead, the Fed Chairman avoided giving too much information and said they would do so at a later date once they are closer to reaching their dual mandate targets. This came as a bit of a disappointment for traders since forecasts are projecting inflation to surge above the Fed’s traditional 2% target in the spring months. Still, Powell refused to say how far above 2% they are willing to let inflation overshoot under their new average inflation targeting policy.

While the initial takeaways from the Fed meeting were dovish, Powell’s lack of concern for the climb in longer-dated Treasury yields effectively is giving the green light to USD bulls to take the currency even higher. That quickly came into being on the following day when the dollar rebounded from the lows. The speedy deliveries of COVID vaccinations coupled with the recently approved $1.9 trillion fiscal stimulus set the stage for a further rise in Treasuries on the back of a strong economic recovery. In turn, this should further support the dollar, at least in the near-term as long as yields in the US keep climbing faster than in other countries.

This week’s calendar is not as busy as the previous, though it features some events to keep an eye on. First in focus will be treasury secretary Yellen’s and Fed Chair Powell’s testimony before Congress on Tuesday and Wednesday. GDP date (final) is then scheduled on Thursday and the PCE inflation gauge on Friday. The data will be closely followed for evidence to back the Fed’s optimistic views on the economy.

Euro Fundamental Outlook: Preliminary PMIs to Show Impact of New Lockdowns

Europe is under pressure from new coronavirus outbreaks, which officials are now calling the third wave. EU countries are imposing new lockdowns, even if many weren’t out of the previous lockdowns. Combined with the slow pace of vaccinations, this paints a contrasting picture for the Eurozone economy to that of the United States and other countries, where infections are falling and vaccine rollout is fast.

Based on this, the euro currency is likely to underperform its peers, especially those with fast vaccine delivery or low number of cases. Considering that the UK and the US are leading the vaccine race, whereas Australia, New Zealand, and even Canada never experienced bad outbreaks with a huge number of infections, it appears the euro is set to stay weak on a broad basis as well.

Traders will closely watch the Flash PMI surveys on Wednesday and the German Ifo report on Friday. These will show how business sentiment fares in light of the newly imposed lockdowns. The focus will then shift to the EU summit, which will be held online and carry into the weekend.

EURUSD Technical Outlook:

The overall situation here remains unchanged. EURUSD is still between 1.19 and 1.20 as the week before and it’s still inside of this downward channel formation that a few weeks ago we highlighted as our base scenario for this pair.

It now seems EURUSD can make another run higher, possibly above 1.20, maybe even test the resistance line of the channel and then come back down again. Keep in mind, the fundamentals favor a lower EURUSD exchange rate, but a rally may still occur due to other factors. Under such a scenario, strong resistance is likely to be located in the 1.2050 – 1.2100 area.

Regarding support zones to the downside, the key focus is on the 200-day MA (red line) in the 1.1850 price zone. A break below may trigger a rather steep acceleration toward the next support area, which is 1.16.

British Pound Fundamental Outlook: Vaccinations Progressing According to Plan

Vaccinations progress rapidly, much in line with the government’s plans and target dates. The UK economy will start to reopen very soon, with a full reopening and return to “normal” social life expected to take place in June. This argues for a much stronger economic boom in the UK during 2Q, and potentially also in 3Q, compared to other developed nations.

The British pound has already strengthened materially on the back of this narrative, when GBPUSD reached levels above 1.40. The pair is now below this figure and consolidating, but it remains firm on a broad basis. GBP is trading close to the recent highs and will likely resume the uptrend once the consolidation phase has passed.

The UK calendar this week features the employment reports, CPI inflation, and retail sales. Still, despite the busy schedule with tier1 data, there’s likely to be only a limited direct impact on GBP’s volatility and direction around these reports.

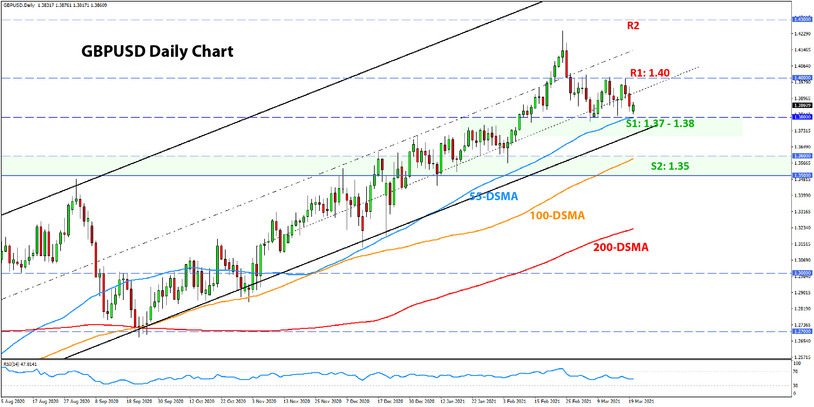

GBPUSD Technical Outlook:

Cable made another run at the 1.40 level last week but was rejected again. The pair then found support near 1.38, effectively forming a trading range between these support and resistance zones.

Now that we have a clear chart pattern, it’s easier to trade potential scenarios, bullish or bearish. Obviously, that 1.38 zone, extending down toward 1.3750 and even 1.3700, is solid support now. A break below this band of support can result in a sharp sell-off in pound sterling. The 1.35 is the next support zone lower, which would likely be reached under this scenario.

To the upside, 1.40 is established as the pivotal breakout point. If broken, the bullish dynamics will be reestablished, and a potential attack on the February highs and the 1.43 area will be likely.

Japanese Yen Fundamental Outlook: BOJ Meeting Was no Game Changer

The BOJ meeting passed with no fireworks, or at least as far as the yen and Fx exchange rates are concerned. USDJPY traded in a tight range last week, despite the two central bank meetings of the Fed and BOJ.

Overall, the underlying dynamics remain unchanged for the Japanese currency. The main drivers remain yields and risk sentiment, with the former being the dominant one at the moment. The yen is set to stay in the underperformers’ camp as long as these two factors continue to exert downward pressures.

Other than that, we need to keep an eye on the charts, especially for major technical zones that could cause a reversal. More on that in the following section below.

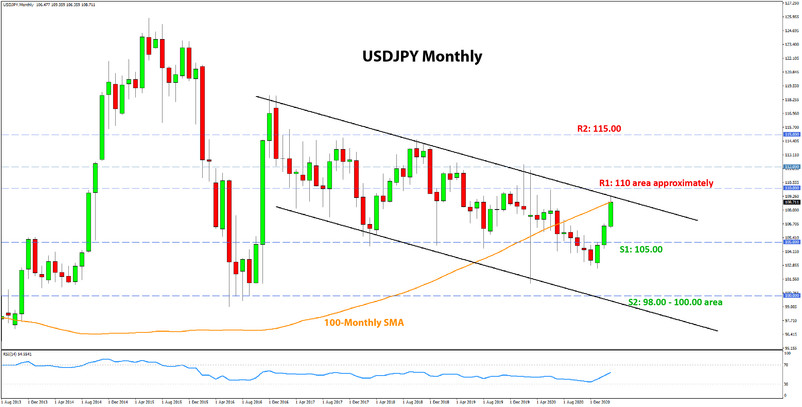

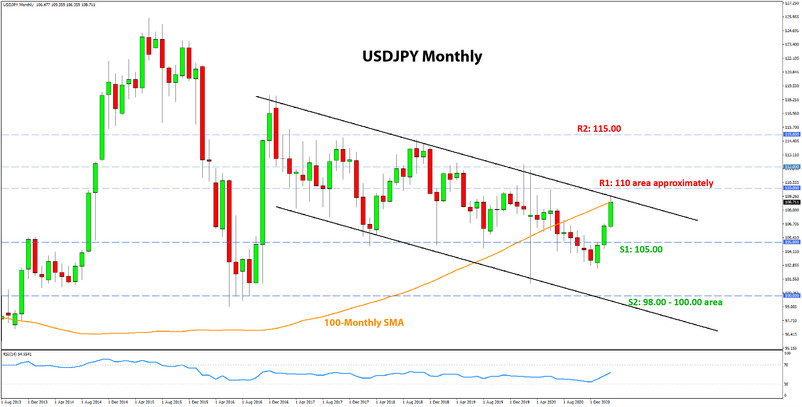

USDJPY Technical Outlook:

This week we decided to show the monthly USDJPY chart as it appears something of great importance is happening there. Namely, the pair has reached a significant monthly resistance zone at the 110.00 area, which may stretch as high as 112.00 before being considered fully broken.

Essentially, this chart shows the protracted USDJPY consolidation with a downward tendency since December 2016. It appears clearer now that the consolidation has shaped up into a channel formation, which presently puts its resistance trendline around 110.00. Notably, March 2020 saw both the resistance and support lines of this channel tested.

What happens here now is hard to tell. Although lower timeframes show momentum is strong and USDJPY can go to 110.00 and above, the monthly resistance here is significant. Remember, only with a strong momentum close above 112.00 will this consolidative channel formation be deemed broken. Subsequently, such a scenario – if it transpires – would have massive bullish implications for the USDJPY pair.