US Dollar Fundamental Outlook: Can the Fed Kill This USD Uptrend?

It’s a big week in the Fx market with three central bank meetings taking place, the main attention of which will go to the Federal Reserve on Wednesday. Traders are looking for Fed Chairman Powell to elaborate his views on rising Treasury yields and how the Fed may react if some “pain” levels are reached.

It’s improbable that Powell will change his stance only two weeks after he said, “rising yields are a healthy sign of a return to normal.” Still, his press conference following the release of the Fed’s statement will be closely watched by market participants and can be a source of volatility in USD Fx pairs. The US economy continues to recover steadily, and the Fed doesn’t feel pressured to provide additional easing like other central banks. They’ll likely confirm this narrative at Wednesday’s meeting, helping to keep the dollar rally intact for the time being.

Traders will also watch the retail sales reports tomorrow (Tuesday), which will show the state of the US consumer. If the data is strong, it will be another reason for the Fed to stay relaxed about climbing Treasury yields. And as long as that is the case, there is little that can stand in the way of the USD steamroller.

Euro Fundamental Outlook: EUR Likely to Remain an Underperformer for Now

The EUR calendar doesn’t feature a central bank meeting, but it sees two elections, the Dutch Parliamentary election on Wednesday (March 17), while the local German election already took place on Sunday. No big impact on the markets is expected around these events, but it will be important to see where anti-EU sentiment stands in the Netherlands and if the polls are right to disregard such risks.

The slow vaccination pace in Europe will keep the economy lagging behind countries faster in the process. As a result, the ECB also made a dovish tilt at their meeting last week and announced they will amp up PEPP QE purchases. Over the near-term, this is likely to remain a headwind for EUR, especially versus currencies of countries that are rolling out covid vaccines at a speedier rate.

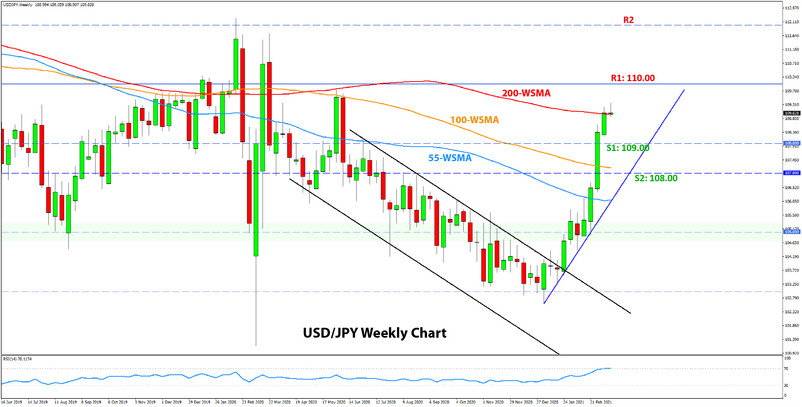

EURUSD Technical Outlook:

As we warned in our previous weekly analysis, the move below 1.19 last Monday smelled fishy, and EURUSD returned above it already by Tuesday morning. The weekly candle closed near 1.1950, however, providing no additional clarity on the future direction of the pair from here.

While 1.19 held, we also have to note that the bearish pressures are building. EURUSD is making lower lows and lower highs since the January peak and is now below the psychological 1.20 mark. 1.19 remains the last line of support. If it breaks, the probabilities will be high that EURUSD will move below the 200-day moving average as well (currently at 1.1828). Below there, the next support area is at 1.16.

The nearest resistance from current levels remains at the 1.20 zone. As said above, 1.20 has psychological importance and the bulls will feel reinvigorated if the price moves above it.

British Pound Fundamental Outlook: BOE to Keep a Cautiously Optimistic Tone

The Bank of England meeting on Thursday will be front and center for pound traders. The UK’s central bank will likely acknowledge the country’s fast inoculation program and keep an optimistic tone for the economy as the reopening may be just a few weeks away in early April.

While the downside risks for GBP around this BOE event are low, that doesn’t mean there is big upside potential. We should remember that a lot of the “vaccine” optimism is already in the price of GBP. Watch out for a possible “buy the rumor sell the fact” price behavior after the BOE meeting.

That being said, the longer-term outlook for GBP remains positive, and eventually, the currency is expected to resume its uptrend.

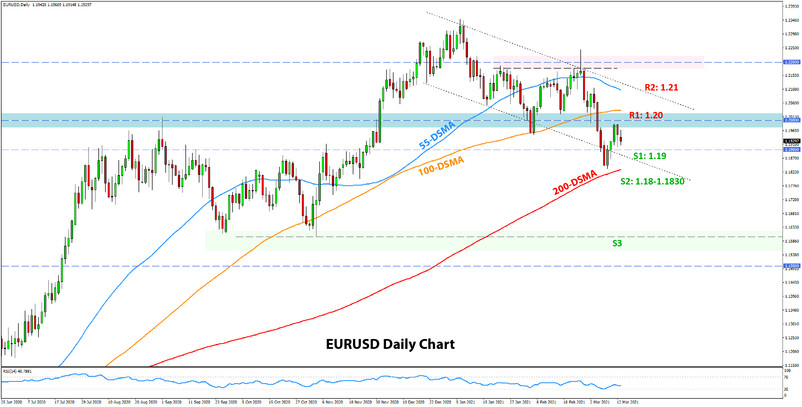

GBPUSD Technical Outlook:

While GBPUSD bulls reclaimed 1.40 last week, they didn’t manage to hold it. The weekly candle closed in the green, but only halfway into the shadow after being rejected at 1.40. Thus, the technical picture here doesn’t denote much strength, especially considering that tall bearish candle at the February top.

If the GBPUSD technical outlook is not overly bullish, then what support levels could open the floodgates to a further selloff?

The 1.3750 – 1.38 area should remain the key support. Note that it may extend as low as 1.3700 before being considered broken. Below it, the focus will be on the 1.35 level, but it will also be important how all this relates to that weekly ascending trendline, which is likely the most important support we should watch in the current context.

Japanese Yen Fundamental Outlook: Traders Watching the BOJ Policy Review

Perhaps, unlike what we are used to in recent years for Bank of Japan meetings, this one on Friday may prove more significant. The BOJ is expected to publish their monetary policy review, where they may decide to make changes to their stance on QE and yield curve control. Still, this will probably not be in the direction of tightening policy, so no big impact is expected on markets and the JPY.

With USDJPY being mainly pulled higher by rising US Treasury yields and general optimism amid speedy vaccine rollouts, it looks unlikely that the weakening JPY trend will stop soon. Broad risk appetite and rising bond yields in developed economies (especially US Treasuries for USDJPY) will continue to be the primary drivers for the Japanese yen.

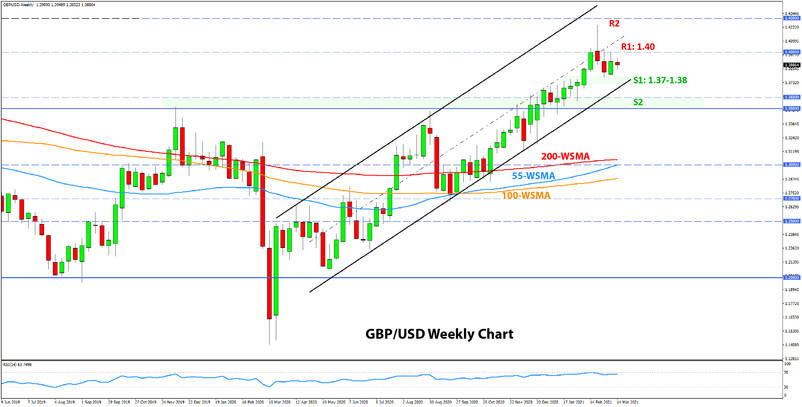

USDJPY Technical Outlook:

USDJPY conquered 109.00 last week and is currently sitting above the 200-day moving average at (red line). There is no serious obstacle to stop the bulls from taking 110.00 too. Whether that happens remains to be seen, but some traders may start to worry about overbought levels here. That may become a bigger concern, particularly if 110.00 is reached soon.

The straight-up move doesn’t provide us too many support levels when looking at the downside. The round numbers like 108.00 and 107.00 are likely to be where some support lies, just as they were moderate resistance on the way up.