Triple Confirmation is a strategy formed from standard indicators to identify the most accurate market entry points. The strategy includes three standard indicators, which is clear from the name of the strategy. Forming a small system, the indicators confirm each other's signals, which can add confidence during the execution trades.

The Triple Confirmation strategy is suitable for trading with any currency pairs, however, it should be chosen the timeframe more carefully, it should be borne in mind that the strategy will not be so effective on too small or too large timeframes, timeframes from M15 and higher will be the most optimal.

Strategy indicators

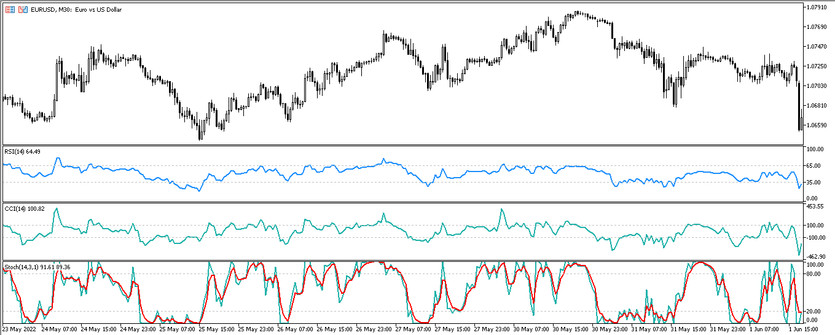

The Triple Confirmation strategy starts functioning after two indicators and an oscillator are installed on the price chart, with pre-configured parameters.

- -RSI-indicator of relative strength, with a period of 14 and with added levels of 35 and 65.

- -CCI price deviation indicator, the period value of which is equal to 14. Also, the indicator window should contain levels 100 and -100.

- -Stochastic Oscillator is an indicator of technical analysis, the values of which are equal to 14,3,1. Its levels are 20 and 80.

Trading with the Triple Confirmation strategy

Since the indicators that make up the Triple Confirmation strategy are somewhat similar, trading using the strategy will not be difficult. Each of the three indicators has levels that indicate the price moving into the overbought and oversold zone. Periodically, the lines of these indicators will cross them, this will be a signal to open certain positions.

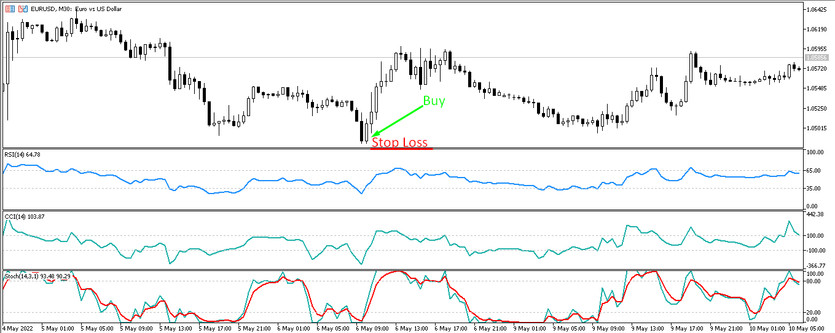

Conditions for Buy trades:

- -The RSI indicator line crosses the level 35 and moves upwards.

- -Stochastic Oscillator also crosses the oversold zone from the bottom up. In this case, the main line should be above the signal line.

- -The CCI indicator after the transition of its level -100 moves up to the level of 100.

After the appearance of these conditions on a certain candle, a long position may be opened on the next one, while it should be borne in mind that one of the indicators may be late, in which case a trade may also be opened. A buy trade should be closed if at least one of the indicators crosses the oversold zone .Stop loss is set at a rate of 3 points from the local extremum.

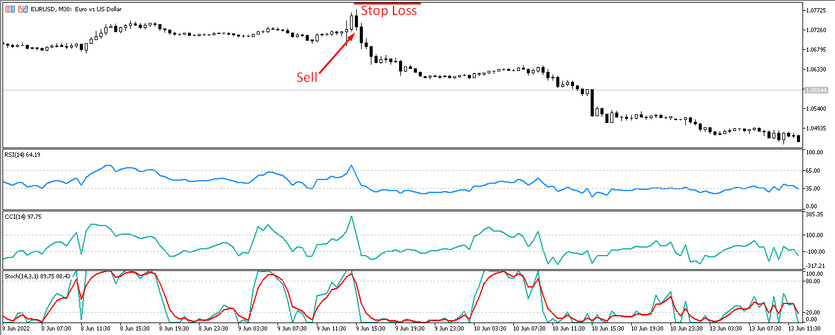

Conditions for Sell trades:

- - The RSI indicator, after crossing the overbought zone, is moving downwards.

- -Both Stochastic Oscillator lines are leaving level 80 and moving towards level 20. The signal line is above the main one.

- -The CCI indicator leaves the overbought zone and moves from top to bottom.

After the appearance of such conditions on a certain candle, a short position is opened on the next one. In this case, one of the indicators may be late. A short position should be closed if the indicators cross their oversold levels. A stop loss order is set at a rate of 3 points from the local extremum.

Conclusion

The Triple Confirmation strategy is very easy to use. It brings a good profit for one trade. It is great for beginners, as it does not cause difficulties to use. However, like in any other strategy, experience is required before using it, which is earned through practice on a demo account .