The Rollback trading strategy is a specially developed algorithm, the calculations of which are made using several indicators included in the standard Forex set. Interacting with each other, the indicators confirm each other's signals, and thus determine the current market trend and designate the right moment to open a position in its direction. The strategy is mainly used for short-term trading, so several trades can be made on one trading day, but at the same time, it is important to take into account that the market will have to be carefully and continuously monitored in order not to miss certain signals.

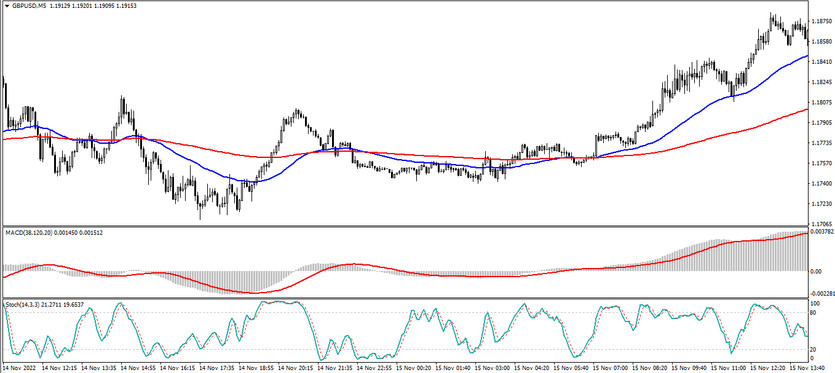

The Rollback strategy is only suitable for the EURUSD and GPBUSD pairs, which, in turn, can only be used in this strategy on the M5 time interval.

Strategy indicators

The Rollback strategy consists of four indicators, which in turn are included in the standard Forex set, which makes it more accurate and verified. All indicators included in the strategy are used for technical analysis of the market, and therefore the strategy is based on confirming each other's signals.

- MACD - indicator used for technical assessment of price fluctuations in the current market. Its parameters are set to 38,120,20,and the price is set to Close.

- Stochastic Oscillator - indicator used to compare the average price value with the current one. Its parameters are 14,3,3,calculations are applied to the Low/High price, and the moving type is Simple.

- EMA (50) - fast exponential moving average. Its period is 50.

- EMA (200) - slow exponential moving average with a period of 200.

Making trades using the strategy

The work and application of the trading strategy Rollback in practice is very simple. To open a certain position, it is only needed to receive the same signals about the current trend from all indicators. That is, as soon as all indicators confirm the current trend, a trade can be opened. If the value of at least one indicator does not match, it is better not to open a trade. If, nevertheless, the indicators indicate the presence of an upward trend, a buy trade is opened, and if the trend is down, then a sell trade.

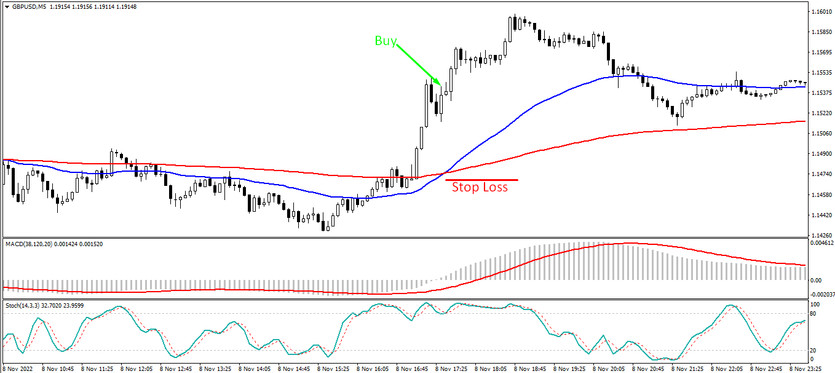

Conditions for Buy trades:

- MACD histogram and its signal line rise above the 0 level.

- The main line of the Stochastic Oscillator intersects with the signal line and is located above it, while both lines are above the level of 50.

- The signal candle should close above the fast moving average.

- The fast and slow moving averages intersect so that the EMA(50) is higher than the EMA(200). It is important that the lines move parallel after that.

After receiving a combination of such conditions, on a candle, a long position can be opened after the signal one. The most suitable moment for its opening will be considered the simultaneous intersection of the moving averages and the breakout of the MACD level 0. Stop loss should be set at the point of a recent local minimum. Such a position should be closed immediately after at least one of the indicators gives a reverse signal.

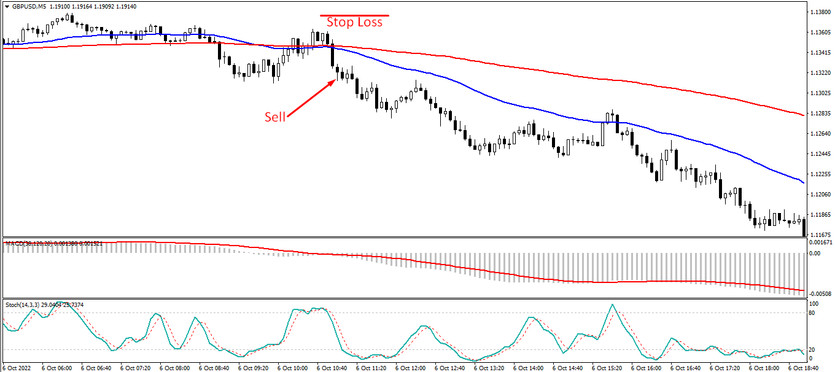

Conditions for Sell trades:

- The MACD indicator falls below its 0 level.

- Stochastic Oscillator falls below its level of 50, while its signal line is above the main one.

- The price is below the moving averages.

- Moving averages cross so that EMA(200) is higher than EMA(50), while after that they move parallel to each other.

After receiving such conditions, a sell trade can be opened on the candle after the signal one, due to the presence of a downtrend in the market. It is best to open a trade if there are simultaneous conditions from the moving averages and the MACD indicator. Stop loss is set at the local maximum point. The trade is closed after receiving at least one contradictory signal from one of the indicators.

Conclusion

The Rollback strategy is not only effective, but also quite easy to use. However, it should be borne in mind that the strategy is designed for short-term trading, that is, its signals appear very quickly and in large numbers, and in order not to miss the opportunity to make a trade, it is recommended to continuously monitor the current market .In order to quickly adapt to the use of the strategy, preliminary practice on a demo account is recommended.

You may also be interested The BB Heiken Ashi trend trading strategy