The CAW strategy is an algorithm created by combining the calculations of effective indicators included in the standard Forex set. Its main goal is to identify the optimal moment to enter the current market, in which the dominant movement has already been determined at that time. That is, the indicators included in its composition, they give a signal to open positions simultaneously on a certain candle, which in turn is a signal one, and thus, taking into account the values of all indicators, a position can be opened in a certain direction already on a new formed candle.

To use the CAW strategy, any currency pairs can be selected, however, the indicator shows more success on pairs with good volatility, the choice of timeframe does not play a huge role in the functioning of the indicator, but it is still recommended to use a timeframe from M5 to H1.

Strategy indicators

Thanks to the indicators that are part of the CAW strategy, any trade can lead to maximum profit, which is also affected by the correct use of the strategy and the study of these indicators in practice. The CAW strategy consists of four indicators.

- Smoothed Moving Average - smoothed moving average, the period of which is set to 90.

- CCI - technical trend strength indicator with period 12 and Typical price.

- ATR - indicator of the volatility of the current asset. Its period is set to 14 and the level 0.002 is added.

- Williams Percent Range - indicator that determines whether the market is overbought or oversold, and also provides an opportunity to learn about current trend reversals. Its period is 11, but additional signal levels -15, -40, -60, -85 have been added.

Trading with the CAW strategy

Using the CAW strategy in practice does not make much effort. The main task before trading is to study the indicators included in it separately, so it can be easily and quickly determined the signal of one of them, and then the rest, and opened the trade. To begin with, it should pay attention to the location of the moving average relative to the current price, and only then, by checking the values of other indicators, a certain position can be opened.

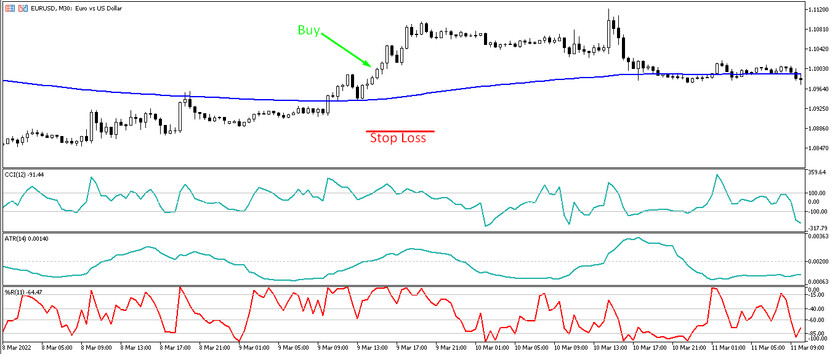

Conditions for Buy trades:

- The price is above the moving average.

- The CCI indicator is moving up above its 100 level.

- The ATR indicator line is moving up and crosses its level of 0.002.

- The Williams Percent Range indicator moves up to level 15, crossing the rest of the levels.

After all these conditions match on the candle after the signal, a long position can be opened. It should be closed with the stop loss at the local minimum, after receiving the opposite conditions from the moving average.

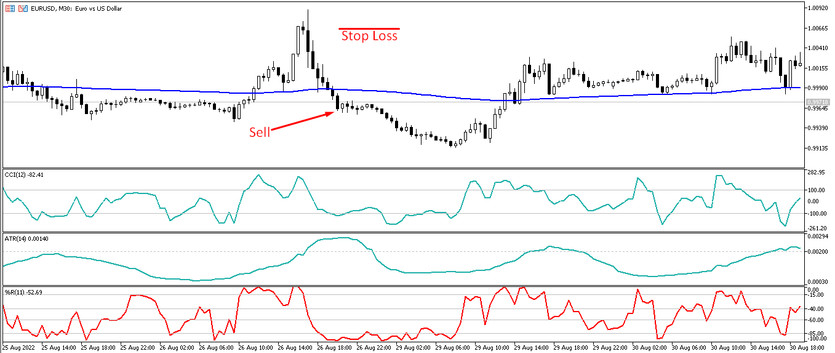

Conditions for Sell trades:

- The current price is lower than the Smoothed Moving Average indicator.

- The CCI indicator is below the 100 level.

- The ATR indicator line, as in the case of buy trades, should remain above its level of 0.002.

- Williams Percent Range indicator line should move down to its level -85.

After these conditions match on a certain candle, a sell trade can be opened on the candle formed after it. Stop loss should be set at the local maximum point, in the amount of at least 100 points. The trade should be closed if the Moving Average will begin to show opposite signs.

Conclusion

The CAW trading strategy provides a good opportunity to accurately and very quickly determine the current trend, and thereby indicate a trade that should be made during a particular movement. In order to achieve maximum profit using a strategy, it is needed not only to study the indicators included in its composition, but also a long practice on a demo account and correct money management.