The BeeJay strategy is a trading algorithm consisting of standard Forex indicators, time-tested. The strategy includes very effective indicators that, together with each other, quickly and accurately determine the current trend and signal the possibility of opening a certain position during the current market movement. Despite the number of indicators used, the strategy remains very easy to use and does not require special trading skills, which makes it possible for traders with different levels of experience to use the strategy.

The BeeJay strategy is suitable for use on any currency chart and time interval. However, it should be borne in mind that the selected timeframe fits well with the selected pair, so the H1 and H4 timeframes are most suitable for the EUR/USD and GBP/USD pairs, and with M15 it is better use pairs AUD/USD and EUR/USD.

Strategy indicators

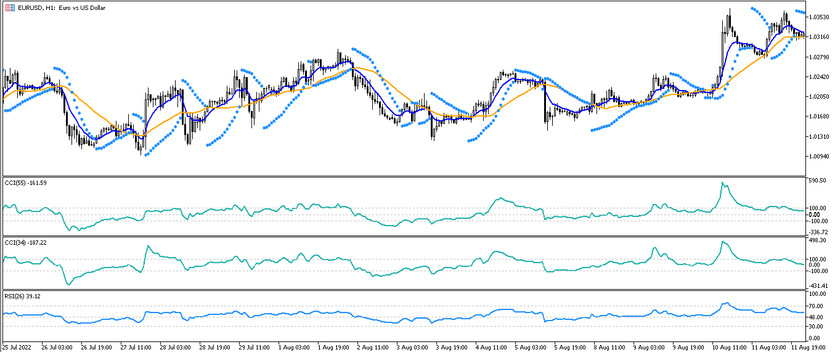

The BeeJay strategy in total consists of the interaction of three indicators, some of which are used in the strategy with different periods. The indicators are included in the standard forex set, and therefore, before using the strategy, it should be first practiced using these indicators separately in order to better understand their signals in the most strategies.

- EMA (8) - fast exponential moving average, the period of which is 8, and the calculations are applied to the Close price.

- SMA (26) - simple moving average with a period of 26, its calculations are also applied to the Close price.

- CCI - technical analysis indicator with a period of 55 and an added signal level of 0.

- CCI - indicator of technical analysis, the period of which is equal to 34, and the signal level is 0.

- RSI - indicator that determines the trend and its strength. Its period is 26, and the signal level is 48. Calculations are applied to the Close price.

- Parabolic SAR - indicator of market reversal points, but in this strategy it will only be used to set Stop Loss.

Trading with the BeeJay strategy

The BeeJay strategy is used in trading to find the best moment to enter the market by identifying a trend using special indicators. The strategy is based on moving averages, which will be the main ones in generating a signal for opening trades. That is, first of all, it should be monitored the intersection of moving averages and their location relative to each other. And only then, taking into account the values of all other indicators, a certain trade can be opened on the candle after the signal one.

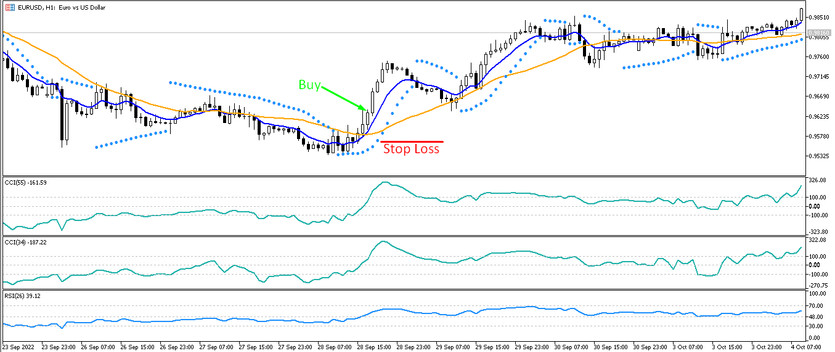

Conditions for Buy trades:

- Moving averages cross so that the fast moving average is higher than the slow moving average.

- CCI with a period of 55, like CCI with a period of 34, rises above the 0 level and moves up.

- RSI rises above its 48 level and continues to move higher.

After receiving such conditions, a long position can be opened on the candle after the signal one. Stop loss is set using the Parabolic SAR indicator, at the closest point to the position opening candle. Take profit, depending on the selected timeframe, is set in the amount of 20-30 points for M15, 100 for H1, H4 - 200-500 points. Such a trade should be closed after the moving averages cross in the opposite direction.

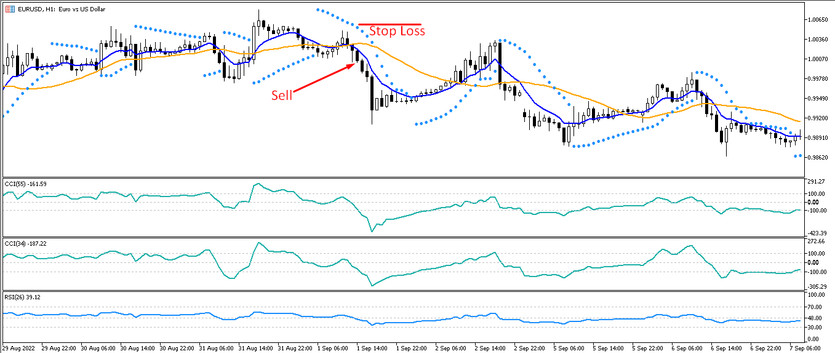

Conditions for Sell trades:

- SMA (26) crosses EMA (8) and is located above it.

- CCI indicators move down and drop below level 0.

- The RSI is also moving lower, dropping below the 48 level.

After receiving all these conditions, a short position can be opened on the candle after the signal one. It should be closed with a Stop Loss at the nearest Parabolic SAR point to the candle, as well as a take profit in the amount of 20 to 500 points, depending on the selected time frame, which is identical to buy trades. The trade is closed immediately after the moving averages begin to cross in the opposite direction.

Conclusion

The BeeJay trading strategy is not only simple and easy to use, but also very effective and shows excellent results with all currency pairs, especially with EUR/USD and GBP/USD on hourly timeframes and AUD/USD and EUR/USD on minute timeframes. In addition, the strategy allows making several trades in one trading day, the main thing is the ability to correctly recognize the signals of the indicators included in its composition. This will require a preliminary study of these indicators and practice on a demo account.