The Band Reverse trading system can be used on any currency pair and on any timeframe. It is a versatile strategy that effectively chooses the most optimal entry points.

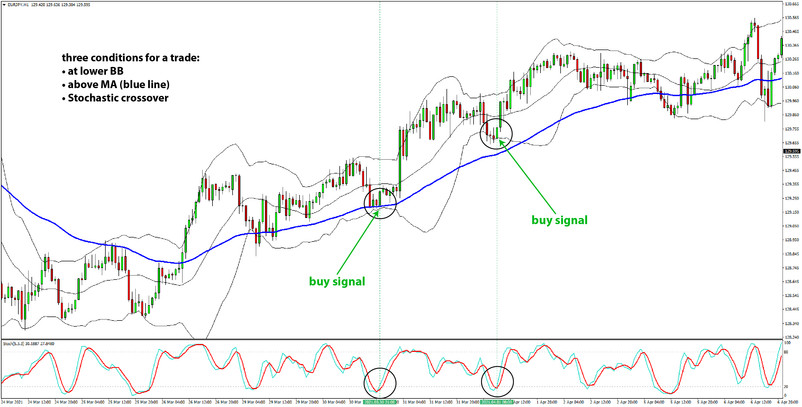

With the Band Reverse system, you are looking for reversals at one of the extremes of the Bollinger Bands. The Stochastic is used to scan for and confirm oversold or overbought areas. The Stochastic is also the trigger that generates the actual buy and sell signals. We also use a longer-term moving average to filter low-quality signals and significantly reduce the number of fakes.

Indicators used:

- Bollinger Bands - standard settings (period 20)

- Stochastic - standard settings (5,3,3)

- Longer-term moving average (34 or 55 period works well); The smoothed calculation also tends to work the best, though you may want to play with this and tweak the settings as best fit for your case.

Strategy Rules:

Look to fade the moves at extremes. That is reverse trading at the upper or lower Bollinger Band that co-occurs with a sell or buy signal on the Stochastic. The 34-period moving average should also confirm the trade, for which the price needs to be above the moving average (for a buy trade) or below the moving average (for a sell trade).

The signal is triggered by a Stochastic crossover in the overbought or oversold areas. The stop-loss order is placed behind the Bollinger Band line (on a closing basis). Exit when the Stochastic reaches the opposite end (overbought for long trades and oversold for short trades).

The specific rules for long and short entries are listed below.

Buy Entries:

- The stop loss is placed behind the lower band

- Exit when the Stochastic reaches overbought (80 or more)

Sell Entries:

- The stop loss is placed behind the upper band

- Exit when the Stochastic reaches oversold (20 or lower)