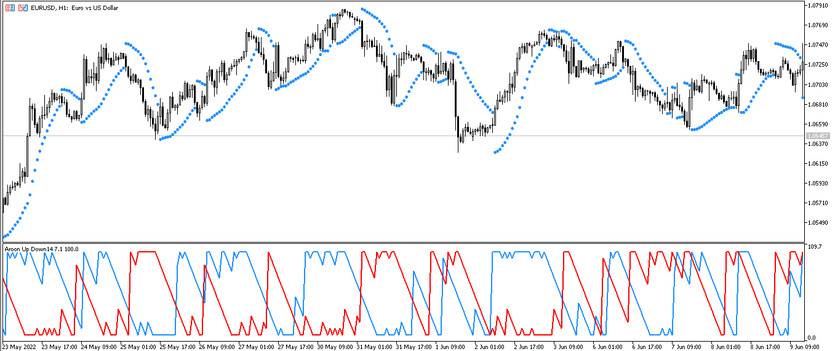

The Aroon Parabolic SAR strategy is a trading algorithm based on the calculations of two effective indicators Aroon and Parabolic SAR. Both indicators are trending, and therefore the strategy will be traded in accordance with the current trend, that is, the direction of the trade will be determined by the current trend. Strategy works on confirmation of signals, but at the same time, the Aroon indicator is considered the main one in the strategy, and Parabolic SAR, in turn, serves as a signal filter. That is, as soon as Aroon determines the current trend, and Parabolic SAR confirms it, thereby filtering the signal of the first one, it can open certain trade.

The strategy can be used with any currency pairs, while it is not recommended to use timeframes below H1.

Strategy indicators

The Aroon Parabolic SAR trading strategy consists of only two indicators, which, when interacting with each other, create a very efficient and accurate trading algorithm. The strategy uses standard indicator values, however, when changing them, it is recommended to take into account all trading values.

- Aroon - trend trading indicator. The settings remain set by default, that is, its period is 14, while the signal level 50 should also be added to the indicator window

- Parabolic SAR - technical trading indicator whose values remain unchanged: 0.02 and 0.2.

Trading with the Aroon Parabolic SAR strategy

In order to open a certain trade using the Aroon Parabolic SAR strategy, no special efforts are required, since the indicators included in its composition are used according to the standard application, that is, the use of the strategy can facilitate the preliminary use of these indicators. To open a certain trade, the current trend should be determined. For this, the intersection and direction of the Aroon lines are taken into account, and only then the position of the Parabolic SAR relative to the candles. And as soon as the desired combination of conditions appears on the signal candle, a trade can be opened.

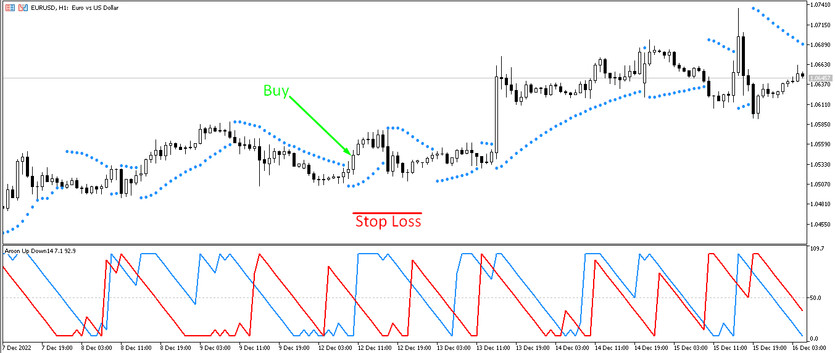

Signal for Buy trades:

- Aroon indicator lines cross above level 50, while the Aroon Up line is above Aroon Down.

- The Parabolic SAR indicator is below the candles.

Upon receipt of such a combination of conditions characterizing an uptrend, a long position is opened on the signal bullish candle. Stop loss is set below the Parabolic SAR indicator or in the amount of 50 points. The position should be closed after the Aroon lines cross again. Since at this moment it should be expected a change in the current trend, which will allow considering the opening new trades.

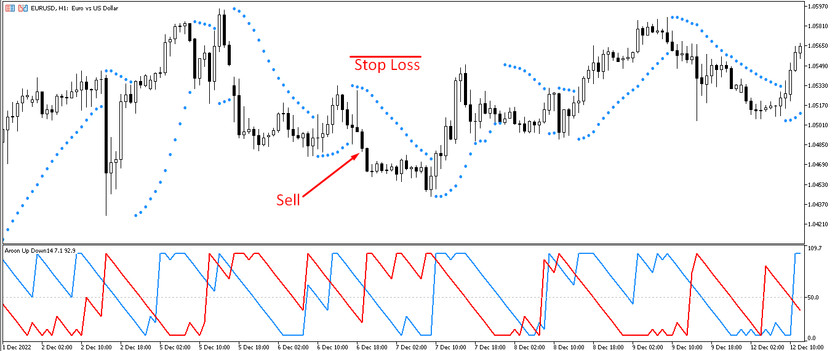

Signal for Sell trades:

- Aroon indicator lines are located above level 50, while the Aroon Down line is above the Aroon Up line.

- Parabolic SAR above the candles.

A short position can be opened immediately after receiving such conditions on a signal bearish candle. A stop loss order is placed above the Parabolic SAR indicator or in the amount of 50 points. Such a trade should be closed after the next intersection of the Aroon lines. This may indicate a change in the current downward trend, which in turn will allow considering the opening of new trades.

Conclusion

The Aroon Parabolic SAR strategy is a very effective trading algorithm, as it is based on the functioning of time-tested trend indicators. Its use is not difficult, especially with preliminary practice on a demo account, or at least with the ability to use the indicators included in its composition.

You may also be interested The BB Momentum Keltner Channel Trading Strategy