Renko Gold is a trading strategy to apply to a gold asset in the Forex market. This strategy is based on the Renko Candles indicator, which you can Download For FREE in the Indicators section of our website. It is easy to use and does not require significant trading skills. Nevertheless, this strategy has solid statistics.

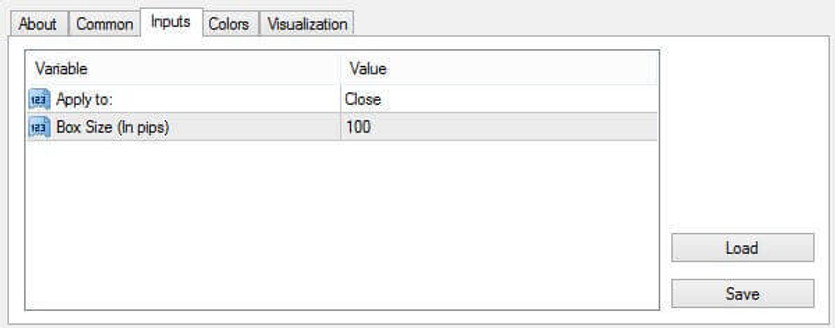

Indicator settings

Apply the Renko Candles indicator to the XAUUSD asset on the H1 timeframe. Set the value to 100 for the Box Size parameter. Set "Apply to" as Close.

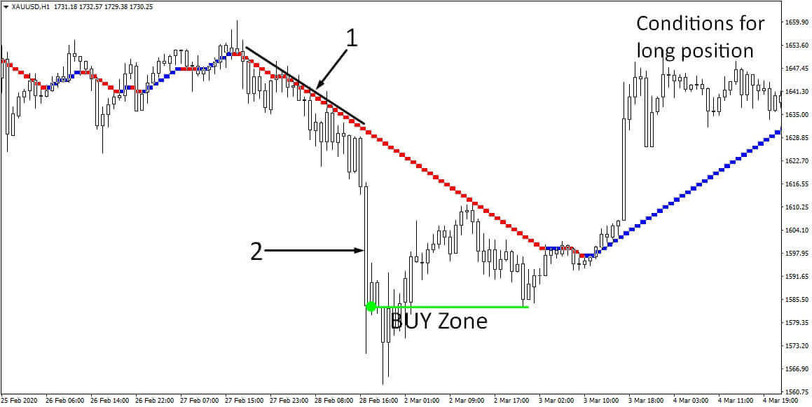

This indicator visualizes Renko candles directly on the asset chart. Read more about the indicator and the principles of Renko charting on our website.

Renko chart in this system serves as a kind of a moving average. The objective of the Renko Gold strategy is to search for possible trend reversals using this indicator.

Conditions for opening long positions

A BUY deal is made at the opening of a new hour.

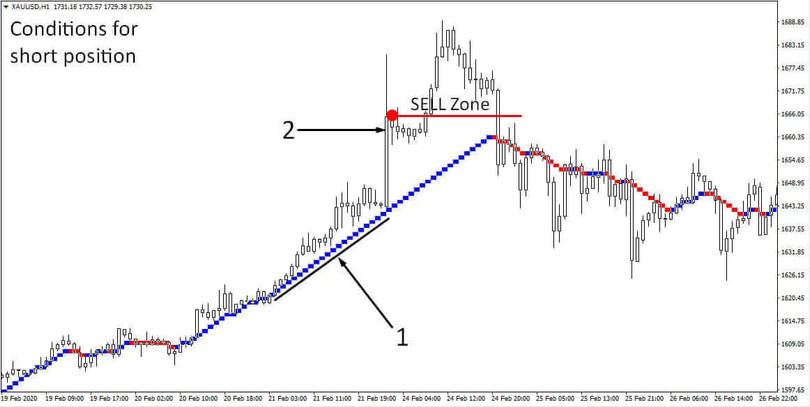

Conditions for opening short positions

The same conditions as for opening long positions, but with the opposite values:

Stoploss and TakeProfit

Stoploss in this trading strategy is set as the size of the H1-candlestick, based on which the deal was opened. Take Profit is not installed. The strategy involves the use of a trailing stop when closing a deal in the positive zone. The size of the trailing stop is also set depending on the size of the candle and is equal to the size of the stop loss.

Conclusion

The statistics of this trading strategy shows that the number of profitable and loss-making trades is approximately equal. On certain historical periods, the number of losing trades is slightly larger than the number of profitable ones. Nevertheless, based on the fact that the system uses a trailing stop for profit-taking, the result of which is sometimes several times higher than the stop loss, the strategy over the long term period shows a steady increase in profitability.