Increasing volumes in trading is one of the most divisive trading strategies, which divides traders into two camps. On the one hand there are those who do not give up on it in any case and on the other hand those who claim that it is only a gamble in the long term.

Each side is certainly right in some respects, and it is also true that today there are many different investment funds that are defacto based on the principle of increasing volumes over time. So it really cannot be said that they are mere gambling, since the level of risk here, as with other strategies, is again determined by proper money-management.

How today's strategy works

The principle is very simple, at the beginning the trader sets a range after which he intends to increase the trading volume when the markets go against his positions and in case the price really moves in the given range against the open position, then he so called overbids with a slightly higher volume (the number depends on the trader). To give you a better idea, everything is explained further in the practical examples below.

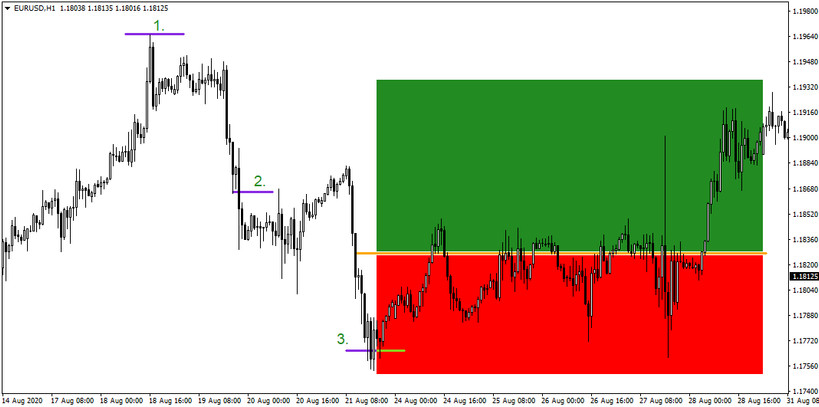

The chart, which can be seen below, shows a situation where there are long entries with a range of 1000 points and an increase of one basic unit each time. This means, for example, that the first position is opened with a volume of 1lot, the second two lots, then three and so on. As can also be seen below, after the third trading position has been opened, a zero boundary (located between the green and red rectangles) has been created between the second and third positions, marking the point where the sum of all three positions reaches zero profit. And now it is hopefully obvious that the market may not travel the same distance to the upside in the case of such a strategy as it did to the downside, which is of course the resulting Alpha & Omega of all such strategies.

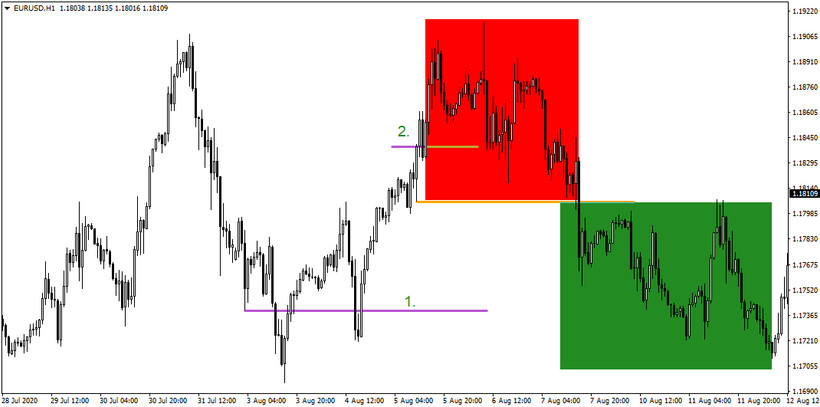

In the chart below, we can see a completely opposite situation, where an increase of "two" additional Sell units occurs when the market rises by 1000 points, which in this case means that the first position is burdened with a loss of 1000 points. Although the market continued to rise, the next position opening did not occur (it did not rise another 1000 points), as later the trend finally reversed and soon the price was already below the zero line (located between the green and red rectangle) after breaking which the sum of the two positions started to take profit.

By definition, strategies with increasing volumes achieve success rates in the range of 50 - 80%, because it all depends on how many levels usually need to be opened before the zero threshold is crossed and therefore the resulting profit.