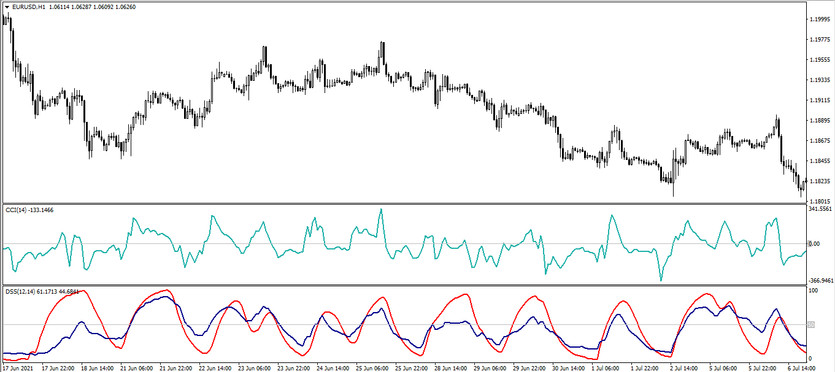

The DSS CCI trading strategy is a special algorithm based on the operation of two forex indicators: Double Smoothed Stochastic and Commodity Channel Index. This strategy is designed for trend trading, that is, trades are opened during a certain trend, and the indicators included in it help to do this more accurately and easily. The strategy works on confirmation of signals, that is, a trade is opened only if both indicators confirm it. And if only one indicator gives a signal, it should be waited for the second signal, and only then opened a trade taking into account the current market movement.

The DSS CCI trading strategy is suitable for trading on any timeframes, however, the choice of pairs is limited to pairs with USD.

Strategy indicators

The DSS CCI strategy consists of two indicators, their interaction creates an effective algorithm, thanks to which trading with the trend is made. It should be borne in mind that their input parameters should be changed in accordance with the selected currency pair and timeframe.

- DSS - trading indicator, which is a modification of the standard Stochastic indicator with double smoothing. Its parameters are 12 and 14. In this case, it should be also added a signal level of 50.

- CCI - indicator of the technical analysis of the market. Its period is 14, and its signal level is -0.

Trading with the DSS CCI strategy

Using the DSS CCI strategy is not particularly difficult, as it includes very easy to use, but at the same time effective indicators. Before opening a certain trade, the current trend is determined first. As soon as both indicators indicate an uptrend at the same time, long positions are opened, and if the indicators determine a downward trend, short positions are opened. At the same time, if one of the indicators gives a signal earlier than the second, it should be waited for simultaneous signals.

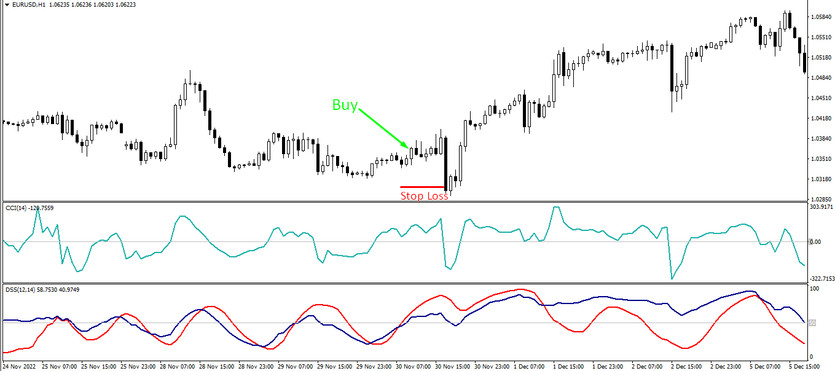

Conditions for Buy trades:

- The lines of the DSS indicator intersect so that the line with the increase value is higher than the line with the decrease value, while both lines are above the level of 50.

- CCI rises above level 0.

Upon receipt of such a combination of conditions, a long position may be opened on the signal candle due to the presence of an uptrend. Stop loss should be set at 30 points or at the point of a recent local extremum. The trade should be closed when the opposite conditions from at least one of the indicators are received. At this moment, it should be prepared for a trend change and opening new trades.

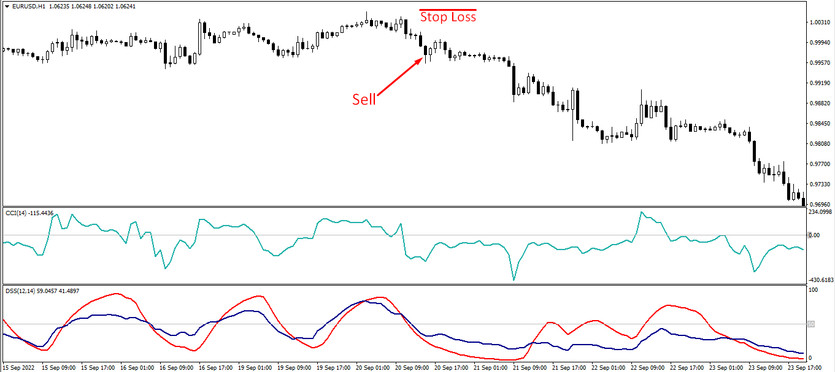

Conditions for Sell trades:

- The DSS line with a falling value is above the line with a rising value, while both lines are below the level of 50.

- The CCI indicator line should be below the 0 level.

A sell trade can be opened immediately after receiving a full combination of indicator conditions. Stop loss is set at the point of a recent local extreme, at a level of about 30 points. Such a trade should be closed after receiving the opposite conditions from the indicators, this will characterize a change in the current downward trend, which will allow considering the opening of new trades.

Conclusion

The DSS CCI strategy is a very profitable and effective trading strategy that allows facilitating trading during certain market movements. It is very easy to use and therefore suitable even for beginners, however, practice on a demo account is still recommended, which will not only strengthen trading skills, but also to learn how to correctly apply this algorithm.

You may also be interested The Serpentine Trading Strategy for major Currency Pairs