In the past, we have presented some algorithmic trading systems that, while, on the one hand, can generate regular profits, it is not unusual that many also require a significant amount of funds, which can be a particular obstacle, especially in the early days.

In contrast, today, we present another algorithmic system that can also deliver regular returns over time while at the same time not being as capital intensive as its predecessors often are.

Strategy input rules

Entering long positions

- the market falls by a set range

Entry into short positions

- the market will rise by the specified range

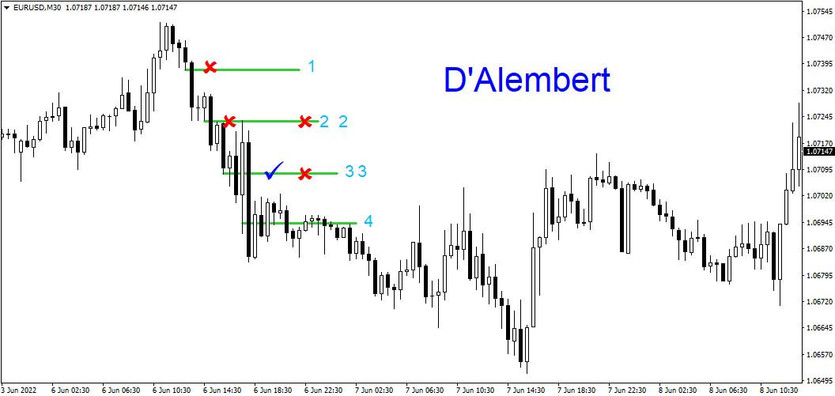

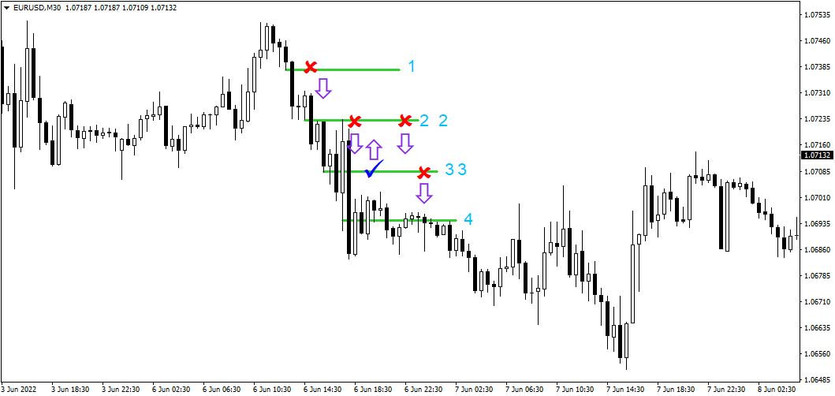

How to trade with the system

D'Alembert is in principle a very simple system that works in such a way that each position always has a fixed SL and TP range (the sizes are the same) and the only thing that happens over time is the increase/decrease of the trading volume. This means that after each loss, the system increases the volume by the value of the base volume (the volume used for the first entry), conversely, if there is a profit, the volume is decreased by the same value.

The above table shows how the profit/loss will change and also the volume per position, and as can be seen, due to the lose less, gain more factor, the profits accumulate over a longer horizon, so in the end the system only needs to record far fewer individual profits than losses to achieve overall profitability (see table: four losses/three gains -> result = -1-2-3-4+5+4+3=+2)

Since the system uses the "gain more, lose less" principle over time, it can usually achieve a long-term success rate in the range of 45-55%, which on the one hand is not very high, but due to the volume change that occurs regularly, it is more than sufficient to achieve regular profitability in the long term.