The Antiflat strategy is based on effective forex indicators that provide the possibility of break-even trades. By using the strategy, the desired results can be achieved in a short period of time, since trading is made only on the H1 chart, and only with the EURUSD pair. One of the advantages of this strategy is the possibility of making several trades in one trading day, however, it should be borne in mind that before opening a new trade, all previous ones should be closed.

Strategy indicators

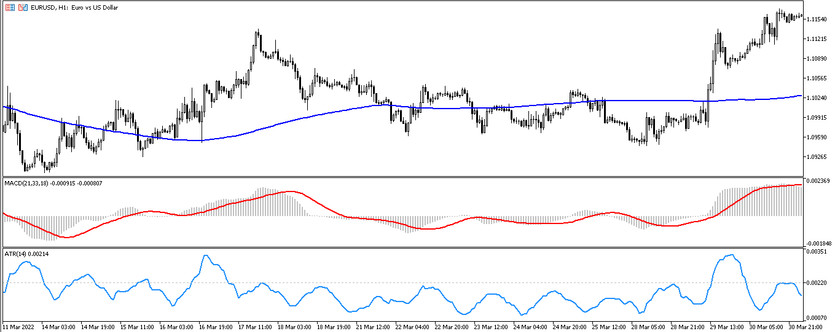

The Antiflat strategy is based on three time-tested standard forex indicators. Their effectiveness is proven in practice, and in combination with each other they create a fairly profitable strategy.

- -SMA (200) - simple moving average, the period of which is 200.

- -MACD-indicator of the direction and strength of the trend, the parameters of which are equal to 21.33 and 18.

- -ATR-indicator for measuring volatility with a period of 14. In the indicator settings, add a level of 0.0022.

Trading with the Antiflat strategy

Due to the presence of only basic forex indicators in the Antiflat strategy, any trade will be as simple as possible, especially after familiarizing with the trading conditions for these indicators. After installing all the indicators on the hourly chart, it should be waited for the combination of trading conditions on a certain candle. But it should be borne in mind that the indicator signals will be valid for four candles, only after passing through such a number of candles, the trade should be closed or opened a new one, regardless of the length of the trading day.

Conditions for Buy trades:

- -A certain candle must close above the simple moving average.

- -The histogram of the MACD indicator, together with the signal line, cross the level 0 and are above it.

- - ATR breaks through its level of 0.0022 from the bottom up and is above it.

After these conditions appear on a certain candle, a long position can be opened. Stop loss should be set at 100 points below the moving average, and take profit at 120 points. If the same conditions form after the first trade, another trade can be opened, however, in this case, the take profit should be set at 250 points. Buy trades should be closed after the ATR line breaks through the 0.0022 level or the MACD histogram goes below the 0 level.

Conditions for Sell trades:

- -The signal candle should close below the SMA (200) indicator line.

- -The MACD indicator, including the signal line, is below the 0 level.

- - ATR closes above its 0.0022 level, as in buy trades.

When the above conditions are formed on a certain candle, a short position can be opened, which should be closed after the MACD histogram crosses the 0 level upwards or the ATR line breaks down the 0.0022 level. When opening a sell trade, stop loss should be set at 100 points, and take profit, when opening the first deal - 120 points, when opening the second - 250 points.

Conclusion

The Antiflat strategy is a fairly simple and convenient strategy created for the EURUSD currency pair. Due to its stability, the strategy may differ in the practical absence of false signals. However, to fully master the nuances of the strategy, practice on a demo account is recommended.