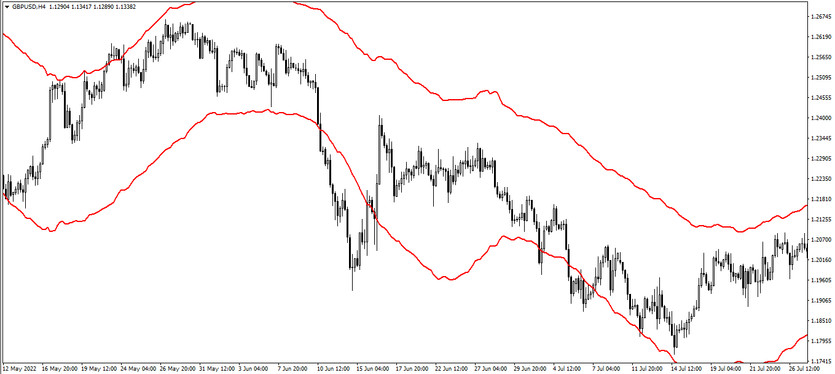

The Keltner ATR Band is a specially developed trading algorithm for finding the optimal moment to enter the market, which is based on the calculations of two indicators included in the standard Forex set. Thus, an indicator that can be considered a small trading strategy is presented directly on the price chart and is a channel of parallel moving averages, thanks to which the possibility of opening a trade is determined. By the concept of operation and visualization, the indicator does not differ much from its standard version, that is, the Keltner Channel indicator, however, the modification version is considered more accurate.

The Keltner ATR Band indicator is suitable for any time interval and currency pair, as its effectiveness does not depend on these factors.

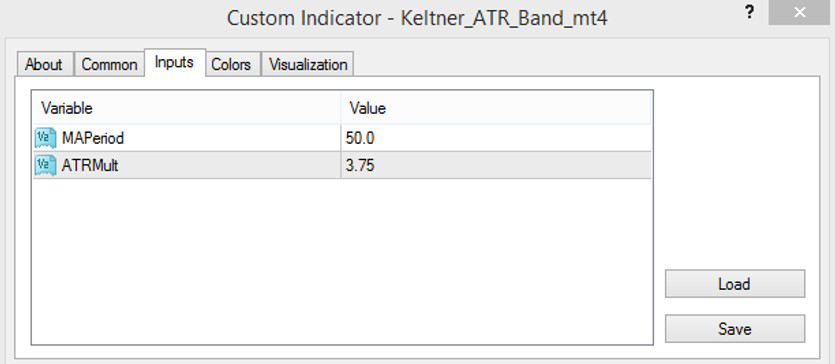

Input parameters

Unlike the standard version, Keltner ATR Band has a less extensive number of input parameters, but this does not make the indicator less effective or inaccurate. The indicator settings have a Colors section, thanks to which it can be changed the color scheme, thickness and visualization of its lines.

- MAPeriod - parameter responsible for the value of the period of moving averages of the indicator. The default value is 50.0.

- ATRMult - ATR indicator value multiplier. The default value is 3.75.

Indicator signals

The principle of trading the Keltner ATR Band indicator is practically the same as using the Keltner Channel indicator. Thus, trading is carried out taking into account the location of a certain candle relative to the upper or lower border of the channel formed by the two moving averages of the indicator. And if the candle closes crossing one of the channel borders, then the tone is considered signal and the point of opening a trade is set on it.

Signal for Buy trades:

- The current candle should be bullish and close above the lower border of the indicator channel.

After a certain candle closes in this way, a long position can be opened. Such a position should be closed immediately as soon as a certain candle reaches the upper border of the channel, since in this case one should prepare for a reversal of the current market movement, when one can consider opening new positions.

Signal for Sell trades:

- The bearish candle should close below the upper boundary of the channel created by the two moving averages.

When the signal candle closes below the upper limit, a sell trade may be opened, which should be closed after the next candle reaches the lower limit of the channel. In this case, a reversal of the market movement should be expected, which will make it possible to open new positions.

Conclusion

Keltner ATR Band is often used in trading, as it is an improved version of the time-tested effective Forex indicator. Moreover, it can be used with any currency pairs on any timeframe without any restrictions. In order to gain certain skills in trading and get used to for the perception of indicator signals, it is recommended to use a demo account.