There is such an idea that Frankfurt, which is located at the closest to the Greenwich meridian than London, can start a third line, to start Both Frankfurt and London have their own stocks. And the fact that the traders will conduct their policy on each of them is beyond doubt. And the policy of one stock exchange on a certain day may differ from the policy of another stock exchange.

There is also such a presupposition that you can get better results than all the trading if you trade according to oversold and overbought. In order to work on the Quantum London system, an indicator was written from the hypothesis, with the help of which it is possible to determine these states. The oversold is marked in red squares, while the overbought are marked in blue.

The beginning of each trading session leads to the activity of the corresponding groups of traders whose trading activities are focused on certain goals. Therefore, the dynamics of assets change in accordance with these goals, and it is quite predictable, which makes it possible to use this property for earning. For example, quotes of many currency pairs at the beginning of the European session often make multidirectional impulse movements, which can be identified by the Quantum indicator.

Indicator settings

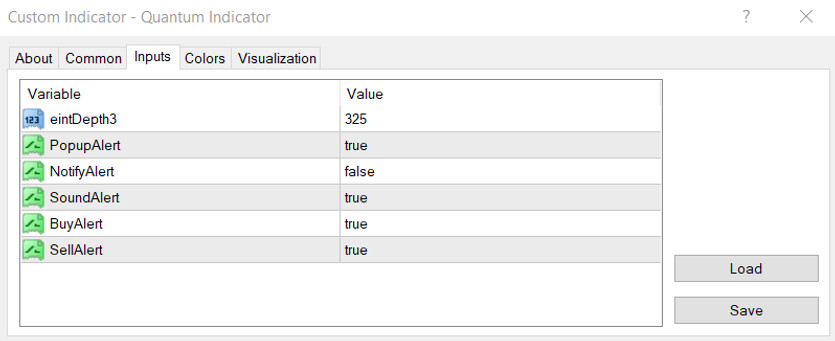

For the algorithm's best operation, it is necessary to select the most optimal value of the input parameter eintDepth3. The higher its value, the fewer signals appear.

The rest of the parameters are responsible for setting up notifications when a signal arrives.

Indicator signals

It is best to start searching for trading signals for this indicator 1 hour before the opening of the European session and finish three hours after the opening. The search for signals is performed on a 1-minute timeframe, so many trading signals can be received during these three hours. After the closure of each signal candle, you should open a position: short - if the signal is a red square; long - if the signal is a blue square.

Thus, in the Quantum London strategy and in the signals of this indicator, in particular, a modification of the Martingale method is used, which provides averaging of profits and losses.

Conclusion

It should also be noted that an important advantage of the Quantum indicator is that it does not redraw its values.

To successfully use this indicator in trading and build a strategy like the London Explosion system, you must strictly follow the rules of risk control, taking into account the possibly large number of averaging. The indicator can demonstrate the best trading performance if used in conjunction with other filters in the system.