One of the most unpleasant trading moments when applying technical indicator analysis is the balance between smoothing and lagging. It is necessary to increase the smoothing period to filter out sharp noises, but then, when the trend changes, the signal will be delayed. The less smoothing is, the more false signals will be received.

The Laquerre indicator is designed to deal with this dilemma.

The indicator had become quite widely known since the early 2000s when John Ehlers talked about an exciting price smoothing algorithm in his book Cybernetic Analysis of the Stock and Futures Markets. Ehlers is an engineer by training, and in the 70s of the last century, he worked on the creation of equipment for processing aerospace signals. It was these developments of his that served as the basis for the creation of the Laguerre indicator.

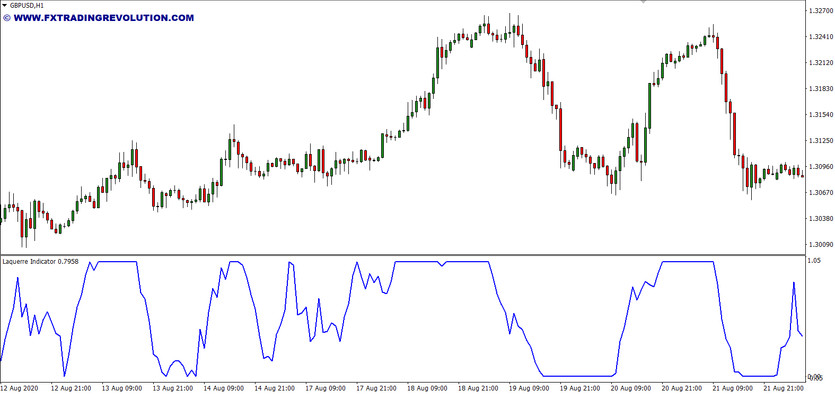

The Laguerre tool is a great indicator to use in trend trading. Traders like it because it shows market cycles on the selected chart period better than most of the standard indicators from the MT4 platform set. This indicator perfectly shows the beginning and end of microtrends, which means that the indicator will be primarily of interest to swing traders and scalpers.

Due to Laquerre formulas' application, the delays in its signals are minimal compared to other trending algorithms.

Indicator settings

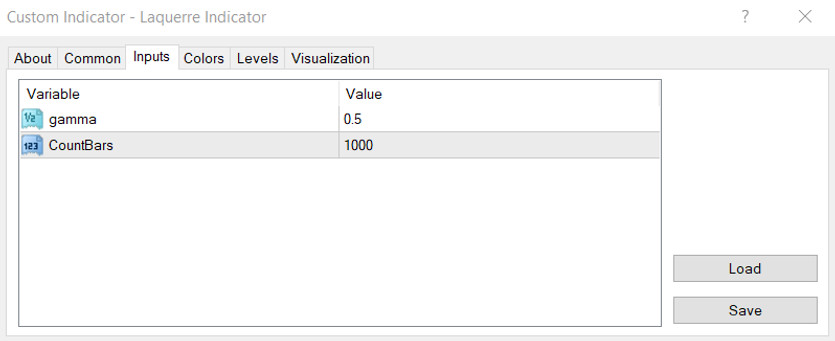

The following settings are available on the Inputs tab:

gamma - the coefficient for calculating indicator levels. The higher the gamma, the smoother the output line will be;

CountBars - the maximum number of chart bars on which the indicator will be calculated.

Indicator signals

Despite the fact that the Laguerre indicator is considered a trend indicator, it is built on the principle of an oscillator, where the total values are within certain limits.

The simplest use case is to buy when the 0.2 line is crossed from bottom to top and sell when the 0.8 line is crossed from top to bottom. You can also use the line of the smoothed indicator 0.5 to filter trades by the system: if Laguerre is below 0.5, we consider only sells, if higher, only buy. Consider the possibility of exiting purchases if the Laguerre indicator crossed the 0.5 or 0.8 line from top to bottom and exiting from sales when crossing the 0.2 or 0.5 line from bottom to top.

In addition, interesting signals are obtained when working with trend lines and divergences of the Laguerre indicator. Usually, the indicator forms a divergence with the price shortly before the existing trend line breakout and the trend reversal.

Conclusion

The Laguerre indicator is a trend indicator that displays a trend line in a separate window. It can be used as a confirmation signal for entering the market, as well as a separate trading system with the addition of graphical analysis filters. This indicator is straightforward to use. It can be used equally successfully both to exit a trade and as a signal to enter.

This tool gives signals more often and more accurately than most standard oscillators, while the number of false signals is noticeably lower than that of other indicators of this type.