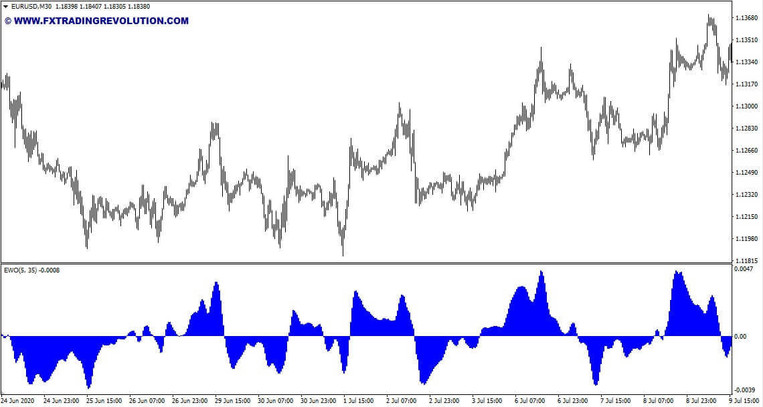

One of the main postulates of the Ralph Elliott wave theory suggests that divergence should form between the third and fifth waves. Since it is almost impossible to recognize this signal by eye, the Elliot Wave Oscillator is designed for this very purpose.

From the name of the Expert Advisor, it immediately becomes clear that it was originally created for the analysis of wave structures, therefore, for a clearer presentation of its work, you first have to master the basic provisions of Elliott's theory.

As for the reasons for the formation of divergence, they can be divided into two groups - technical and fundamental.

In particular, from the point of view of technical analysis, divergence on the Elliott Wave Oscillator is formed due to the fact that the fast SMA slows down the movement while the average prices are formed over a long time interval continue to rise or fall steadily. In other words, the crowd is no longer as confident as in the third wave.

If divergences are explained by fundamental reasons, then in the fifth wave, inherently opposite factors are often combined. For example, all media outlets directly or indirectly recommend investing in some kind of currency, and large banks and funds at the same time, build up a short position in the corresponding futures.

Indicator settings

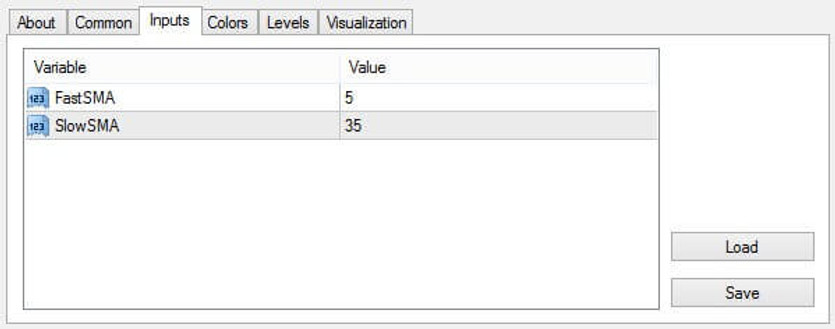

Since the Elliott Wave Oscillator shows the distance between fast and slow SMA, you can change the periods of these parameters in its settings.

Indicator signals

In addition to the situations already described with the occurrence of divergences, the Elliot Wave Oscillator can be used to solve simpler problems. For example, in large timeframes, it does a good job of identifying the prevailing trend. In this case, the signals should be interpreted as follows:

If the histogram is above zero, the trend is upward;

If the oscillator is below the zero marks, the trend is bearish.

On lower timeframes, similar signals are often used to search for specific entry points to a position, so some traders use several Elliott Wave Oscillators at once on different timeframes at the same time.

Conclusion

The considered oscillator was created and optimized for the analysis of Elliott waves; therefore, for its correct use, the first thing to do is to understand the algorithm for finding and marking them. We also recommend using this indicator in conjunction with other filters to form more accurate entry points.

Tip: Can’t open the downloaded archive file (ZIP or RAR)?

Try WinRAR for Windows or The Unarchiver for Mac .

Do you need help with installing this indicator into MT4 for Windows or Mac OS? Our guide HERE will help you.