Generally speaking, the term market sentiment refers to the state of mind of the market during the current trading session. We can compare the sentiment in the market with the mood of the people. It can change quickly for different reasons, as well as various thoughts, feelings and actions.

The sentiment to a certain degree determines the demand and supply for a particular currency, stock, or commodity. If the market is favourable on the current outlook, then people start buying more, increasing demand, and therefore pushing the price to new highs. We can call it a bull market.

Alternatively, if the market is pessimistic, the price can drop. In this case, the sentiment is bearish.

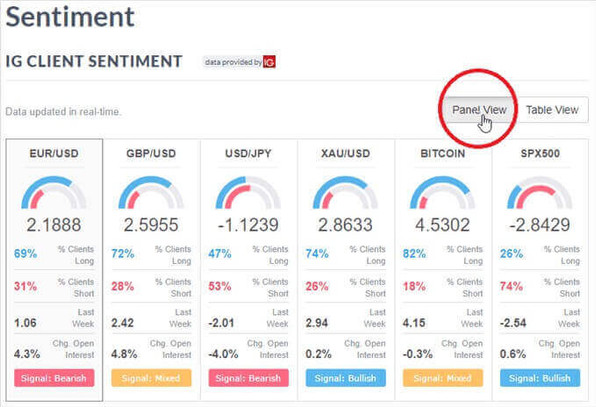

Therefore, there are trading methods based on sentiment analysis. We can measure market sentiment using several tools, such as sentiment indicators (which we are going to explain later) or by simply observing the movement of the markets. One such tool that many retail Forex traders are using is the IG client sentiment data.

Analyzing Process

For a beginning trader, understanding the analysis process, and how it can help predict market trends, can be challenging and daunting. This analysis is the study of price movements in a market, in which operators make use of technical patterns and indicators to predict future market trends. It is a visual representation of the past and present performance of a market. It allows the trader to analyze this information through price action, indicators and patterns to guide and report on future trends before entering a trade.

Client sentiment analysis can be directly applied in the Forex market. However, this tool is not exclusive to the Forex market. Contrarian investors will seek for the crowd to have a market outlook, either to buy and sell, which would be reflected in the IG client sentiment tool.

Sentiment indicator

As we already know, before opening a trade, you must analyze the current sentiment of the market. A clear example would be to estimate how many traders are bulls (holding long positions) and how many are bears (holding short positions). With this information, you can avoid trading against the probable direction of the market.

Another aspect that you need to keep in mind is that many traders do not trade using IG Client Sentiment only, but they combine sentiment with technical analyzing to ensure that they are going to use the appropriated trade size.

Contrarian indicator

When new traders learn about the speculative sentiment index and learn to use it as a contrarian indicator, many think that they should always be trading in the opposite direction of retail traders.

If a trader observes a long position in the USD/CAD, he can see it as a sign that the short positions may be optimal. But the reason for this is not necessarily solely because the traders who are long on the pair are wrong - but if it means anything, it is also to think about what these traders will need to do at a certain point later.

For example, the traders who hold long positions in the USD/CAD, at some point, will have to close their trades. And to do this - they will have to sell. This alone can often times push the price strongly in the opposite direction of their positions. It can create more selling pressure than buying pressure and traders looking to take advantage of this selling pressure may seek to open short positions in line with the signal of the indicator.

Of course, traders who are short will have to do the opposite; to close their short positions, they will have to buy. If such a trade is overcrowded according to the sentiment indicator, it can create the same kind effects in the upside direction, or also known as a short squeeze.